Euro Stoxx 50 Index Rises Slightly Higher On Post ECB Interest Rate Decision

- Euro Stoxx 50 index rises opened on Friday slightly higher

- ECB hikes rates by 75 basis points and scales back support for European banks

- Major corporate earnings on Thursday from Big companies in Europe uplifted the Euro Stoxx 50 Index

The Pan-European Stoxx 50 index opened on Friday slightly higher on the back heel of a fresh batch of corporate earnings and ECB interest rate decision. As of 05:00 (UTC+3), the Euro Stoxx 50 index was up 0.2%/ 10 points at 3591.1 while the wider benchmark Euro Stoxx 600 index was down 0.03%/0.12 points at 410.19. The Blue chip index recovered its earlier losses after the European Central Bank announced on Thursday announced a 75 basis points interest rate hike-its third consecutive interest rate hike - while also revealing new conditions for European Banks.

On Thursday, the European Central Bank announced a 75-basis-point interest rate hike — its third consecutive increase this year — while also scaling back support for European banks. Following much speculation by market participants, the ECB said it was now changing the terms and conditions of its targeted longer-term refinancing operations, or TLTROs. These tools provide European banks with attractive borrowing conditions designed to incentivize lending to the real economy. "During the acute phase of the pandemic, this instrument played a key role in countering downside risks to price stability. Today, in view of the unexpected and extraordinary rise in inflation, it needs to be recalibrated," the ECB said. Therefore, it added that the interest rates applicable to the tool, known as TLTRO III, would be adjusted from Nov. 23 to match the deposit facility rate, which is the primary benchmark of the ECB. In addition, banks will also be offered voluntary early repayment dates.

"In order to align the remuneration of minimum reserves held by credit institutions with the Eurosystem more closely with money market conditions, the Governing Council decided to set the remuneration of minimum reserves at the ECB's deposit facility rate." Thursday's rate hike takes the ECB's primary benchmark from 0.75% to 1.5%, a level not seen since 2009, before the sovereign debt crisis. It comes after the central bank raised rates by 50 basis points in July and 75 basis points in September. However, the ECB confirmed that its rating hike cycle is still ongoing.

Several economists have projected another rate increase in December of 50 basis points. The ECB, however, did not indicate the level of future rate rises, saying that they will be data-dependent. Major corporate earnings on Thursday came from Credit Suisse, Shell, Unilever, and Total Energies, with Credit Suisse's shares falling more than 18% after the bank announced a sizeable third-quarter loss. Bank stocks overall were 1.1% higher.

France's Total Energies on Thursday reported that third-quarter net income rose to $6.6 billion despite losses from pulling out of a venture in Russia, with huge oil and gas company profits raising pressure on European governments to shield people from high energy bills. The company posted adjusted net earnings of $9.9 billion but notably took charge of $3.1 billion after it sold a 49% interest in a Siberian natural gas field to Russian energy producer Novatek. Total CEO Patrick Pouyanné acknowledged the effect of Russia's war in Ukraine in raising oil and natural gas prices this year, saying the company "leveraged its integrated model, particularly LNG (liquefied natural gas), to generate results in line with previous quarters." Europe has increasingly turned to LNG as Russia has slashed natural gas flows amid the war. Total's gas and renewable energy sector posted a record operating income of $3.6 billion in the third quarter, a $1.1 billion increase from the previous quarter, Pouyanné said. Total's overall earnings were up 43% from the third quarter of last year. Following total energies better than expected corporate earnings, Total Energies SE Stock is trading at 54.48, up 1.56points/ 2.95% in the last 24 hours.

Another well-performing stock in the Euro-Stoxx 50 Index is Enel SPA Stock. Italy's most significant utility, Enel SpA, said on Thursday it reached a deal to sell 50% of its grid service unit Gridspertise to private equity firm CVC for about 300 million euros ($293.37 million). Enel said that the deal values the whole division at 625 million euros, a value that could increase to 1 billion euros when including potential deferred payments. The transaction is part of Enel's broader strategy aimed at attracting investments from partners to jointly develop businesses in the areas of renewable energy, electrification, or services. The announcement confirms a Reuters story last week quoting two sources with knowledge of the matter. That said, Enel SPA stock index value has risen ever since, with the latest data showing strong gains of 0.137 points/3.12% to trade at 4.522.

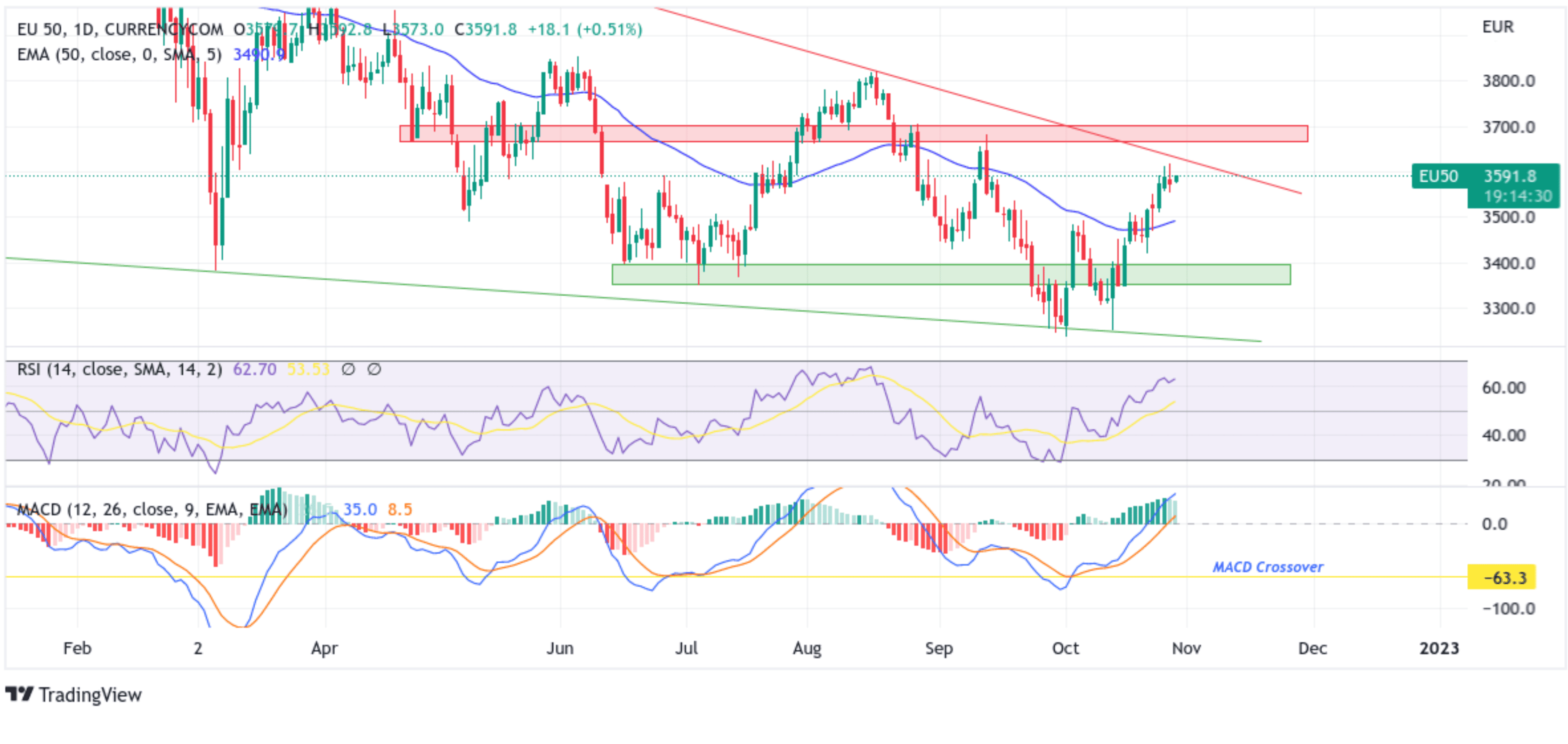

Technical Outlook: One-Day Euro-Stoxx 50 Index Price Chart

From a technical standstill using a One-Day Price Chart, the EU-50 index price rebounded from the vicinity of 3557.8 level after facing resistance breaking below the aforementioned support level(plotted on lower time-frames 4-Hours TF). Some follow-through buying would lift spot prices to the immediate hurdle, the upper trendline of a rising wedge chart pattern plotted from January 2022 swing high. If Price Pierces this barrier(breaking above the aforementioned resistance level), creating the right conditions for an advance toward the key supply zone ranging from 3663.3 - 3702.1 levels.

All the technical oscillators are in positive territory, with the RSI(14) at 62.70 portraying a bullish filter and also on the verge of flashing overbought conditions, while the Moving average convergence divergence(MACD) crossover at 63.3 is above the signal line pointing to a bullish sign for price action this week.

On the flip side, if sellers resurface and spark a bearish turnaround, initial resistance comes in at the 3557.8 support level. If sellers manage to breach this floor, downside pressure could accelerate toward the key Demand zone ranging from 3350.7 - 3396.3 levels. On further weakness, the focus shifts toward the support level; the lower trendline of a rising wedge chart pattern plotted from March 2022 swing low.