U.S. WTI Crude Oil Price Climb On Strong Crude Demand And Weak U.S. Dollar

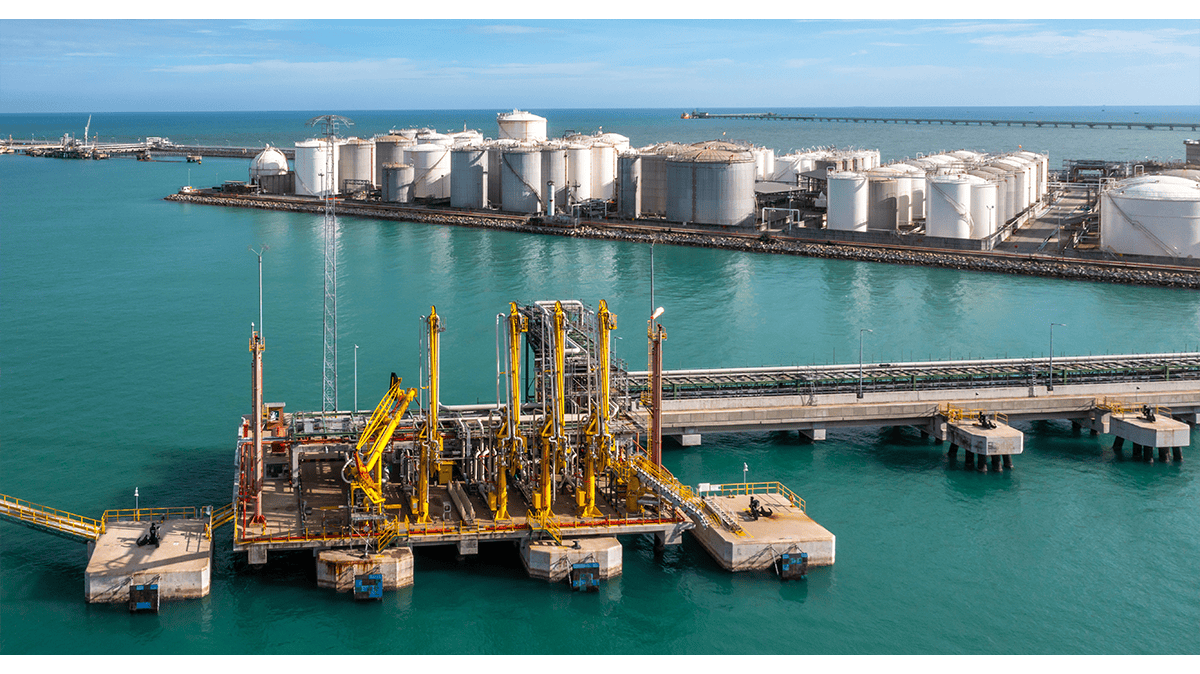

- US WTI crude oil prices surge on Thursday to trade above $88.30 per barrel during the mid-Asian trading session

- Crude Oil Exports increased in the week ended October 26th, according to a report by the Energy Information Administration

- USD Index weakens amongst its peers on news that the FED will slow down its rate hiking cycle

- Despite weaker oil prices during the third quarter, the oil industry is still booking strong financial results

US WTI crude oil prices surged on Thursday on the back heel of strong Oil demand and a weak USD to rise above $88.30 per barrel during the mid-Asian session. US WTI Crude oil prices continued their intraday ascent on Thursday, extending the previous session gains amid record U.S. crude oil export and subdued USD demand. An Official Report released on Wednesday by the Energy Information Administration showed that the number of commercial crude barrels held by U.S. firms had fallen by 2.588 Million, implying more crude oil export for the week ended on October 26th. In turn, this was a critical, crucial factor that underpinned the US WTI crude oil prices. On the other hand, subdued USD demand was also seen as another factor that supported the recent US WTI Crude Oil Prices uptick witnessed in the previous sessions.

The USD Index, which measures the greenback against a basket of other currencies, weakened more than 1% against a basket of peers on Wednesday as weakening economic data firmed views that the Federal Reserve will slow the pace of its rate-hiking cycle. The dollar's decline came as the benchmark 10-year U.S. Treasury yield continued its descent from last week's multi-year high of 4.338% and was last down four basis points at 4.0317%. "Broad dollar weakness and further but milder declines in U.S. Treasury yields than yesterday appear to reflect wishful thinking toward a Fed pivot next week," said Derek Holt, head of capital markets at Scotia Economics.

The aggressive pace of Fed tightening this year, aimed at taming stubbornly high inflation, has turbo-charged the dollar. Traders and economists predict a fourth-straight 75 basis-point interest rate increase next Wednesday, but there is growing speculation that the central bank will slow to half a point in December. The view that the Fed could begin to pivot in December was reinforced by data on Wednesday that showed U.S. home prices sank in August as surging mortgage rates sapped demand. Data released on Wednesday by the U.S. Department of Commerce showed that sales of new U.S. single-family homes dropped in September, and data for the prior month was revised lower, supporting the view that Fed rate increases are already working to tap the breaks on the world's biggest economy.

Elsewhere, the Bank of Canada hiked interest rates by a smaller-than-expected 50 basis points. It said future increases would be influenced by its assessment of how tighter policy was working to slow demand and ease inflation. The Canadian dollar initially fell against the U.S. dollar after the Bank of Canada decision, which was the second consecutive reduction in the rate rises after a 100 basis-point move in July and 75 basis points last month, but then firmed up again. The loonie hit a three-week high of 1.35105 earlier in the day. Investors should be aware that Canada is a leading exporter of oil to the U.S. and a surge in the oil prices impact the loonie significantly by generating more revenue for Canada.

Further uplifting US WTI Crude Oil Prices was a Bloomberg news report that the United States and the European Union are likely to settle for a more loosely policed cap at a higher price than once envisioned, with just the Group of Seven (G7) nations and Australia committed to abiding by it, the report said, citing people familiar with the matter Additionally, as quoted by Reuters, Europe is expected to ban oil imports from Russia next month and restrict Russian shippers from the global shipping insurance industry. Despite weaker oil prices during the third quarter, the oil industry is still booking solid financial results. According to some, this is "awkward" because it happens during economic hardship. Besides being awkward, however, Big Oil's profits will likely draw more political pressure from desperate governments, said Irina Slav, Oil and Gas news writer for oilprice.com. Bloomberg reported this week that, based on data it had compiled, the collective profits of Exxon, Chevron, Shell, BP, and Total Energies for the last quarter would come in at $50.7 billion, Slav added.

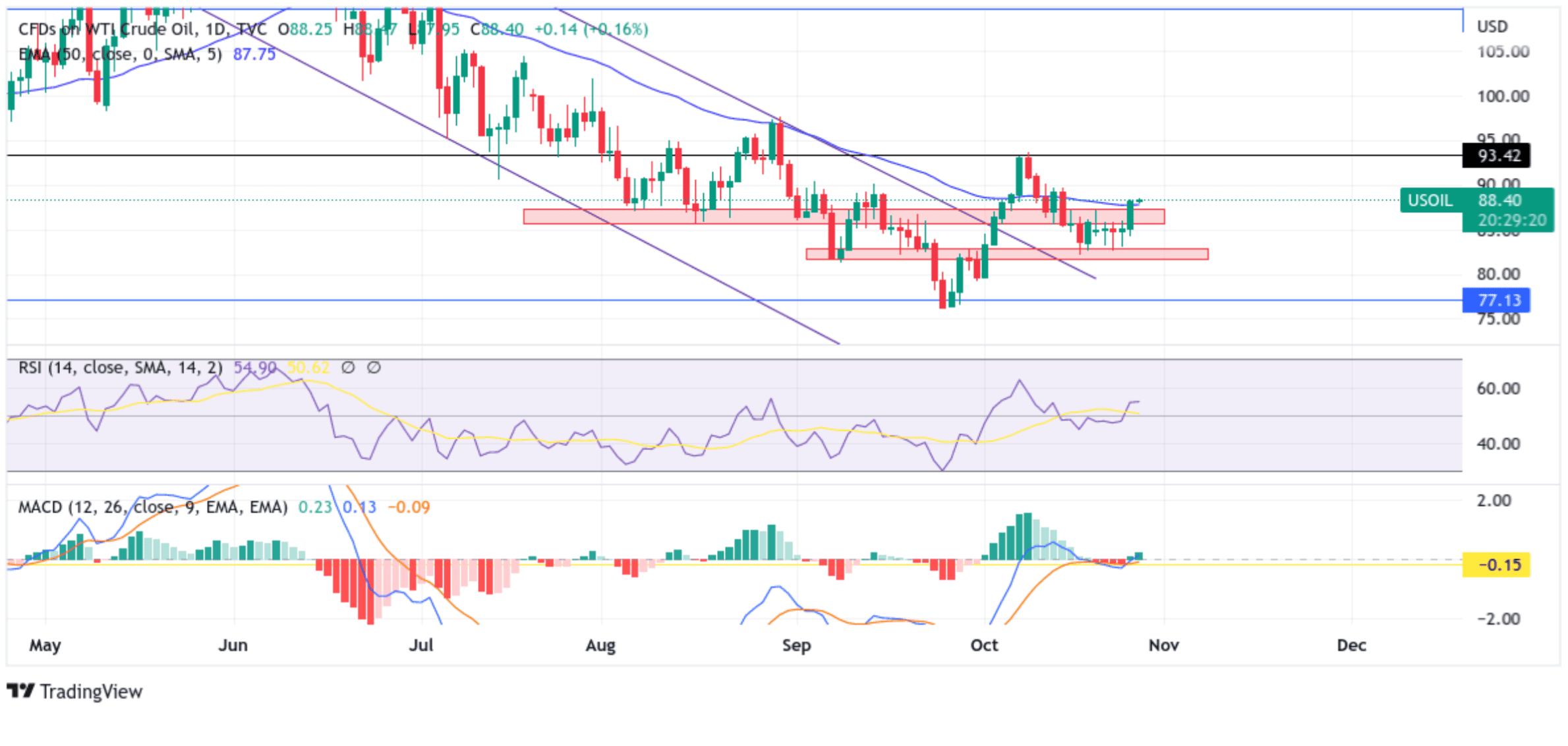

Technical Outlook: One-Day US WTI Crude Oil Price Chart

From a technical standstill using a One-Day Price Chart, US WTI crude oil prices are trading above a key supply zone ranging from $85.59 - $87.25 levels(broke above the supply zone). Some follow-through buying would lift spot prices to the next hurdle at the $93.42 ceiling, of which a convincing break above the aforementioned resistance level would pave the way for more near-term gains for US WTI crude oil prices.

All the technical oscillators are in positive territory, with the RSI(14) at 54.90 portraying a bullish filter, while the Moving average convergence divergence(MACD) crossover at -0.15 is below the signal line. However, a move above the signal line would add credence to the upside bias.

On the flip side, if sellers resurface and spark a bearish turnaround, initial resistance comes at the $85.59 - $87.25 levels. If sellers manage to breach this key floor, downside momentum could pick up pace paving the way for a move towards the upper trendline(turned support level) of a long-term descending channel Pattern plotted from the 14th June swing high. That said, a convincing break below the aforementioned support level would negate any near-term bullish outlook and pave the way for aggressive technical selling around US WTI Crude Oil.