USD/ZAR Sticks To Modest Recovery Gains Above 17.20 Mark As Fed Raises Rates By Half A Point

- USD/ZAR attracted fresh buying on Thursday and lifted spot prices above the 17.20 mark

- Fed Delivers widely expected 50 basis point rate hike

- Fed Chair Powell, in his speech during the FOMC press statement, stated that it was too early to discuss a potential rate cut

- South African Inflation Softened to 7.4% in November, according to data released on Wednesday by Statistics South Africa

USD/ZAR pair witnessed renewed buying from the vicinity of the 17.14287 level during the early Asian session and reversed part of its overnight losses to uplift spot prices above the 17.20 mark. The cross looks set to maintain its offered tone heading into the European session.

A softer risk tone around the U.S. Treasury bond yields offered some support to the greenback after the Federal Reserve delivered a widely expected 50 basis point rate hike and indicated that it would continue raising rates to tame inflation. As such, the 2-year Treasury yield settled at 4.249%. Meanwhile, the yield on the benchmark 10-year Treasury note last dipped about 3 basis points to 3.474%. Yields and prices have an inverted relationship.

The U.S. Dollar index (DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, regained upside momentum on Thursday and was up 0.18% at 103.837 as of 06:04 UTC +3, rebounding from the weekly low after losing ground in the previous session when Fed Chair Jerome Powell took questions during the FOMC Press Conference. This, in turn, was seen as a key factor that drove flows away from the Rand and exerted upward pressure on the pair.

Prior to the Federal Reserve meeting, some investors had hoped that the chairman, Jerome Powell, would indicate a willingness to lower interest rates due to lower-than-expected inflation data. However, Powell stated that it was too early to discuss a potential rate cut and that the Fed's primary focus was on implementing policies that would bring inflation back to its target of 2% in the long term.

"The inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases. But it will take substantially more evidence to give confidence that inflation is on a sustained downward path," Powell wrote.

Commenting on Powell's speech, "This is a more hawkish set of communications than markets expected. Policymakers dashed hopes for a sustained easing in financial conditions by maintaining previous language saying that 'ongoing increases' would be needed to put the policy on a sufficiently restrictive footing," said Karl Schamotta, chief market strategist at Corpay.

"The officials have maintained their stance of expecting higher interest rates for an extended period of time, and have even raised their projections for the terminal rate to 5.1%. This suggests that more clear evidence of reduced inflation pressures would be needed before the Fed considers making any significant changes to its policies," he added.

Shifting to the South African docket, inflation data on Wednesday showed inflation in South Africa slowed down last month. The annual Consumer price inflation moderated slightly in November to 7,4% from 7,6% in October. The monthly change in the consumer price index (CPI) was 0.3% in November, slightly lower than the 0.4% recorded in October. Excluding food and energy, the monthly consumer price inflation declined to 0.1%, up from 0.5% in October and beating the market consensus of 0.2%. The three categories with the highest annual inflation rates in November were transport (15.3%), food & non-alcoholic beverages (NAB) (12.5%), and hotels & restaurants (7.9%). That said, the downbeat south African inflation data was a key factor that undermined the Rand.

As we advance, investors now look forward to the U.S. Docket featuring the release of the Core Retail Sales (Nov) and Retail Sales (Nov) data reports which are expected to show a decline in consumer spending in the retail level by 0.2% and -0.1% down from both 1.3% in October. Traders will look further for cues from the Philadelphia Fed Manufacturing Index (Dec) release and the Initial Jobless Claims data reports, all set to be released during the mid-North American Session. The data reports would influence the near-term USD Price dynamics. This should assist traders in determining the next leg of a directional move for the USD/ZAR Pair.

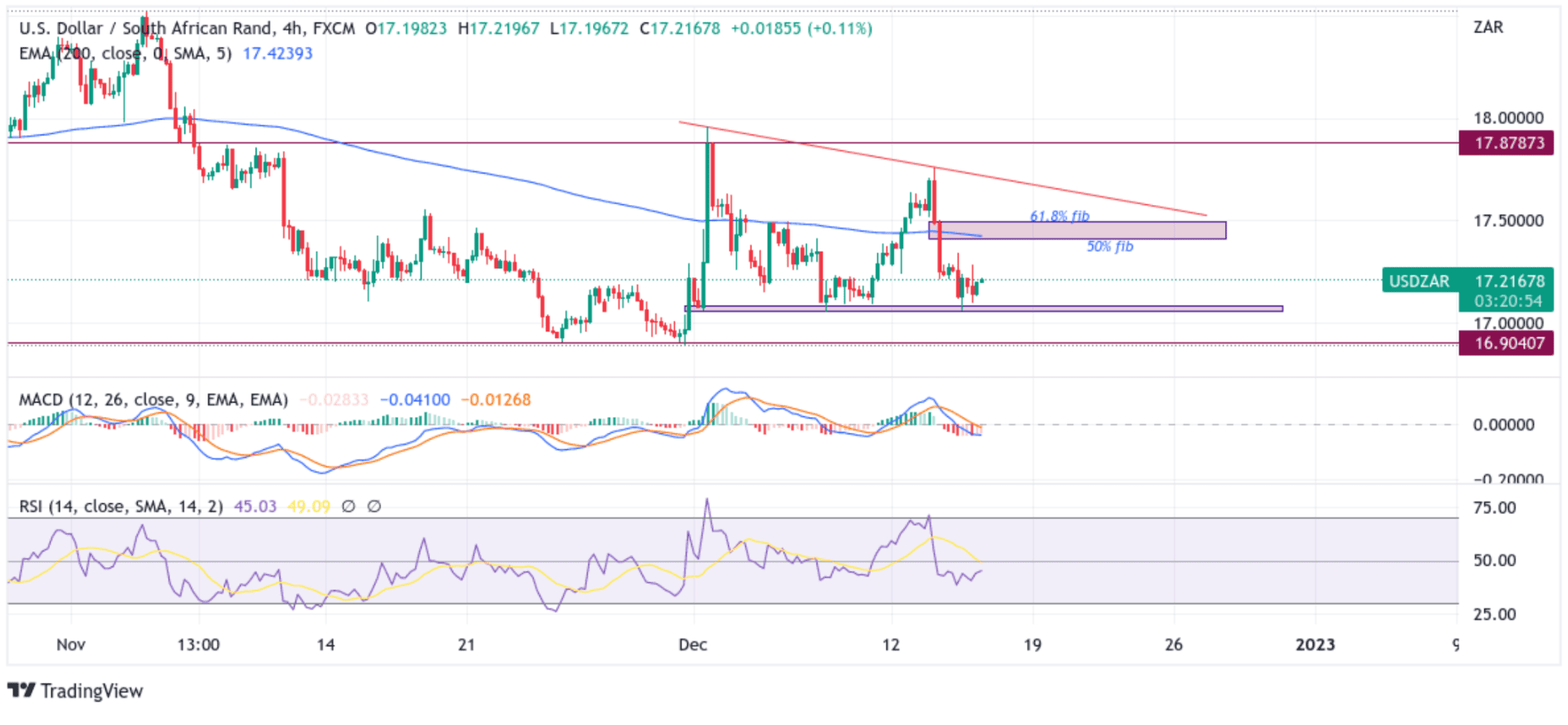

Technical Outlook: Four-Hour USD/ZAR Price Chart

From a technical perspective, spot prices are looking to extend the bullish uptick after rebounding from the vicinity of 17.09869 (the upper limit of the key Demand zone). Subsequent follow-through buying would uplift spot prices to the immediate hurdle plotted by 50% and 61.8% Fibonacci retracement levels at 17.40691 and 17.49312 levels, respectively. Sustained strength above this barricade would confirm a bullish momentum but would need acceptance above the strong 200 Exponential Moving Average (EMA), which coincides with the 50% Fibonacci retracement level. If that happens, the USD/ZAR could appreciate further retesting the key resistance level plotted by a sloping trendline extending from the 1st December swing high.

All the technical oscillators on the four-hour chart are in negative territory, with the RSI (14) at 45.03 below the signal line suggesting that the buying pressure could be increasing. Still, before placing further bullish bets, it will be prudent to wait for a further upside above the 50% and 61.8% Fibonacci retracement levels. The Moving Average Convergence Divergence (MACD) Crossover is below the signal line, pointing to a bearish sign for price action this week, but a move above the signal line would add credence to the bullish filter.

On the Flipside, if dip-sellers and tactical traders jump in and trigger a bearish reversal, the price will first find support at the demand zone ranging from 17.09869 - 17.05590 levels. If sellers manage to breach this floor, the USD/ZAR pair could turn vulnerable and accelerate the downfall toward testing the 16.90407 Key support level. On further weakness, the downside pressure could accelerate toward testing the 16.86062 support level.