EUR/USD Extends Intraday Pullback From YTD Low, Rises Above 1.08400 Level on Sustained U.S. Dollar Selling

Key Takeaways:

- EUR/USD witnessed buying on Thursday and extended the intraday pullback for a third consecutive day

- Uncertainty about the timing of the Fed rate cuts continues to weigh on the greenback, which in turn helps exert upward pressure on the EUR/USD pair

- Subdued U.S. dollar action lends support to the euro despite increased market expectations of a June rate cut

- A slew of U.S. macro data is set to be released today, but the focus remains on the release of the March NFP data

The EUR/USD pair extended its recent sharp pullback from the 1.07313 - 1.07252 region or two-month low and witnessed buying for the third successive day on Thursday. This also marked the third day of a positive move in the previous four and uplifted spot prices to a fresh one-month high, just above the 1.08400 level during the mid-Asian session.

The modest decline in U.S. Treasury bond yields amid increased bets for Fed rate cuts saw the U.S. Dollar Index (DXY), which measures the greenback against a basket of currencies, slide for a third consecutive day on Thursday to trade below the $104.200 mark. It was crucial in exerting upward pressure on the EUR/USD pair.

This comes amid the dovish comments by Federal Reserve Bank Chair Jerome Powell, who, while speaking during the Stanford Business, Government, and Society Forum at Stanford University on Wednesday, said that the central bank needs more evidence of easing inflation before lowering the cost of borrowing money but confirmed it would take a while for policymakers to evaluate the current state of inflation, keeping the timing of potential interest rate cuts uncertain.

That said, the uncertainty about the timing of the rate cuts and rising geopolitical risks tempers investors' appetite for risk-perceived assets and further benefits the euro.

Despite this, markets still feel convinced that the Fed will leave rates unchanged during the May meeting and start cutting rates during the third quarter of 2024, presumably during the June meeting.

In fact, the bets were further raised after an ADP jobs report released on Wednesday showed Private businesses in the U.S. hired 184K workers in March 2024, following an upwardly revised 155K in February and beating forecasts of 148K cementing market expectations that the Fed could be forced to leave rates higher for longer in its fight against stubborn inflation in the U.S.

The Upbeat Jobs report follows hawkish Fed officials' comments over the past few days, which further reinforce the hawkish Fed narrative. Notably, Atlanta Fed President Raphael Bostic said on Wednesday that he only sees one rate cut this year, occurring in the fourth quarter.

Additionally, Cleveland Federal Reserve President Loretta Mester said Tuesday that she still expects interest rate cuts this year but ruled out implementing them at the next policy meeting in May.

Shifting to the Euro docket, increased market expectations of a June rate cut continue to weigh heavily on the euro. The bets were further raised after a Eurostat report released on Wednesday showed the consumer price inflation rate in the Euro Area declined to 2.4% year-on-year in March 2024, matching November's 28-month low and falling short of market expectations of 2.6%. The core rate, excluding volatile food and energy prices, also cooled to 2.9%, its lowest point since February 2022 and below forecasts of 3.0%.

In a separate report, the unemployment rate in the Euro Area stood at a record low of 6.5% in February 2024, matching January's revised figure and compared with market forecasts of 6.4%. The number of unemployed individuals increased by 17 thousand from the prior month to 11.102 million.

As we advance, investors look forward to the U.S. docket featuring the release of the Initial Jobless Claims data report. Investors will look further for cues from the U.S. Trade Balance (Feb) release and Eurozone Services PMI (Mar) data reports. The main focus, however, remains on Friday, the release of the U.S. monthly jobs report, popularly known as non-farm payrolls (NFP) data.

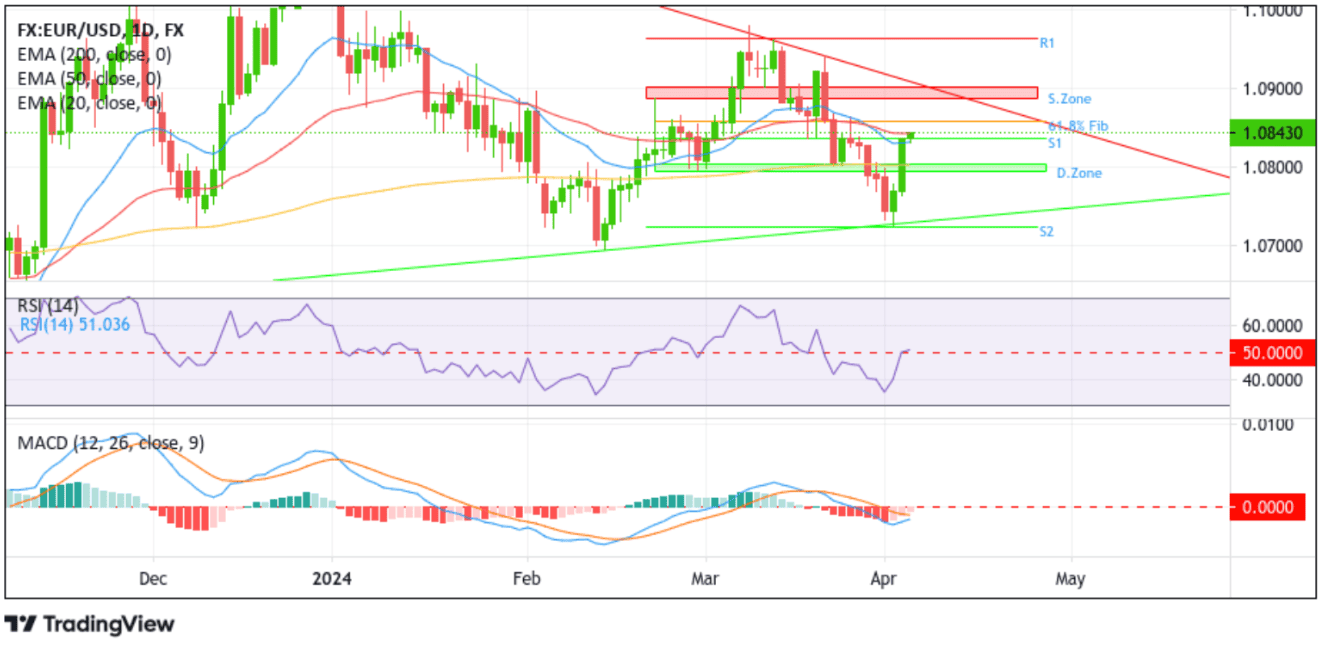

Technical Outlook: One-Day EUR/USD Price Chart

Looking into EUR/USD's one-day price chart, the major currency pair, immediately after rebounding sharply from the lower limit of the bullish symmetrical triangle chart pattern, went ahead and broke above the key demand zone ranging from 1.08038 - 1.07952 levels and rose further to find acceptance later above the 20-day (blue) EMA level at 1.08321 level and thereafter breaking above the 1.08370 resistance level, now turned a support level. As of press time, the EUR/USD cross is trading at the 1.08430 level, and on further buying, the currency pair would rise toward the 61.8% Fibonacci retracement level (golden fib) at 1.08584 of the 21st March to 4th April bullish recovery. A convincing move above this level would reaffirm the bullish thesis and pave the way for a rise toward the supply zone ranging from 1.09020 - 1.08882. Sustained strength above this zone, followed by a bearish price breakout above the upper limit of the bullish symmetrical triangle chart pattern, would act as a fresh trigger for new buyers to jump in, paving the way for more gains around the major currency pair. The currency pair could then rise toward the March 2024 swing high at the 1.09804 level (R1).

On the flip side, if sellers and tactical traders jump back in and force a bearish reversal, initial support comes in at 1.08370. On further weakness, the focus shifts lower to the demand zone ranging from 1.08038 - 1.07952 levels. A convincing move below this zone would negate the bullish outlook and pave the way for an accelerated drop toward the lower limit of the bullish symmetrical triangle chart pattern. Noteworthy, the upper limit of the aforementioned zone coincides with the technically 200-day solid (yellow) EMA level. A subsequent break below this fundamental support level would reaffirm the bearish bias and pave the way for further selling around the EUR/USD pair. The major currency pair could then drop toward the 1.07229 support level (S1), about which, if this level fails to hold, EUR/USD could decline further toward the 1.06940 support level and, in dire cases, extend a leg down toward the 1.06536 support level.