EUR/USD Edges Back Below Early 1.10500s Amid Renewed USD Buying, Focus Remains On US GDP And Core PCE Data

- EUR/USD pair witnessed fresh selling during the mid-Asian session and dropped below the early 1.10500s

- A modest USD rebound helps cap the EUR/USD pair against a further uptick

- A combination of negative Euro macro data undermines the Euro and helps exert downward pressure on the EUR/USD pair

- A slew of U.S. macro data is set to be released today, but the focus remains on the release of US GDP data and the Fed's preferred inflation gauge, Core PCE, for fresh directional impetus.

EUR/USD cross staged a modest pullback from the late 1.10500s, or a nine-week high touched earlier this Tuesday, and for now, seems to have snapped a three-day winning streak. The pair built on its steady pullback through the mid-Asian session and dropped below the early 1.10500s level in the last hour.

A modest USD rebound on Tuesday during the Tokyo session helped cap the EUR/USD pair against a further uptick. The U.S. Dollar Index (DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, has been under intense selling pressure the last three days as coming data could show slower U.S. growth and lower inflation, outcomes that would cement the case for a mid-year rate pause. As a result, treasury bond yields have declined massively, with the Fed-sensitive 2-year Treasury bond seeing 99 basis points down at 4.081% this week.

That said, the current price action suggests that, following overbought conditions in the previous trading sessions, traders decided to take some profits off the table following the recent strong EUR/USD bullish run. Nevertheless, the backdrop still seems tilted in favor of the EUR/USD bears. The markets are convinced that the FED will hike interest rates next week by 25 bps to 5.00%, according to CME's Fedwatch Tool, which shows Fed fund futures traders are pricing in an 86.3% chance that the Fed will hike rates by 25 basis points in May, up from 84.1% last week.

On Tuesday, a fresh round of negative Euro macro data undermined the single currency and contributed to its relative underperformance. An Ifo Institute for Economic Research report on Monday showed the current conditions indicator for Germany had declined by 0.4 points from a month earlier to 95.0 in April 2023, missing market expectations of 96.0. Furthermore, the business climate indicator for Germany had risen by 0.4 points from a month earlier to 93.6 in April 2023. Still, it came in slightly below market expectations of 94.0, suggesting businesses' worries were abating, but Europe's largest economy lacked momentum. To a greater extent, the current account and business climate indicator figures overshadowed positive business expectations in Germany.

That said, easing inflation in the Eurozone area supports the case for smaller rate hikes shortly and suggests the path with the least resistance is to the downside. Uncertainty about the size of the European Central Bank's (ECB) interest rate increase also casts a dark cloud on any meaningful uptick for the euro for the time being. A host of top ECB officials have insisted the size of rate hikes will depend on incoming data.

As we advance, investors look forward to the U.S. docket featuring the release of the U.S. Building Permits Report data, seen lower at 1.413 M, down 1.550 M. Investors will look further for cues from the release of the U.S. New Home Sales Report data for March, which was lower than 630K, down from 640K the previous month. Additionally, investors will look for cues from the release of the U.S. CB Consumer Confidence Report data for April, seen lower at 104.0, down from 104.2 the previous month. However, the focus remains on US GDP data and the Fed's preferred inflation gauge, Core PCE, all set for release on Thursday and Friday, respectively.

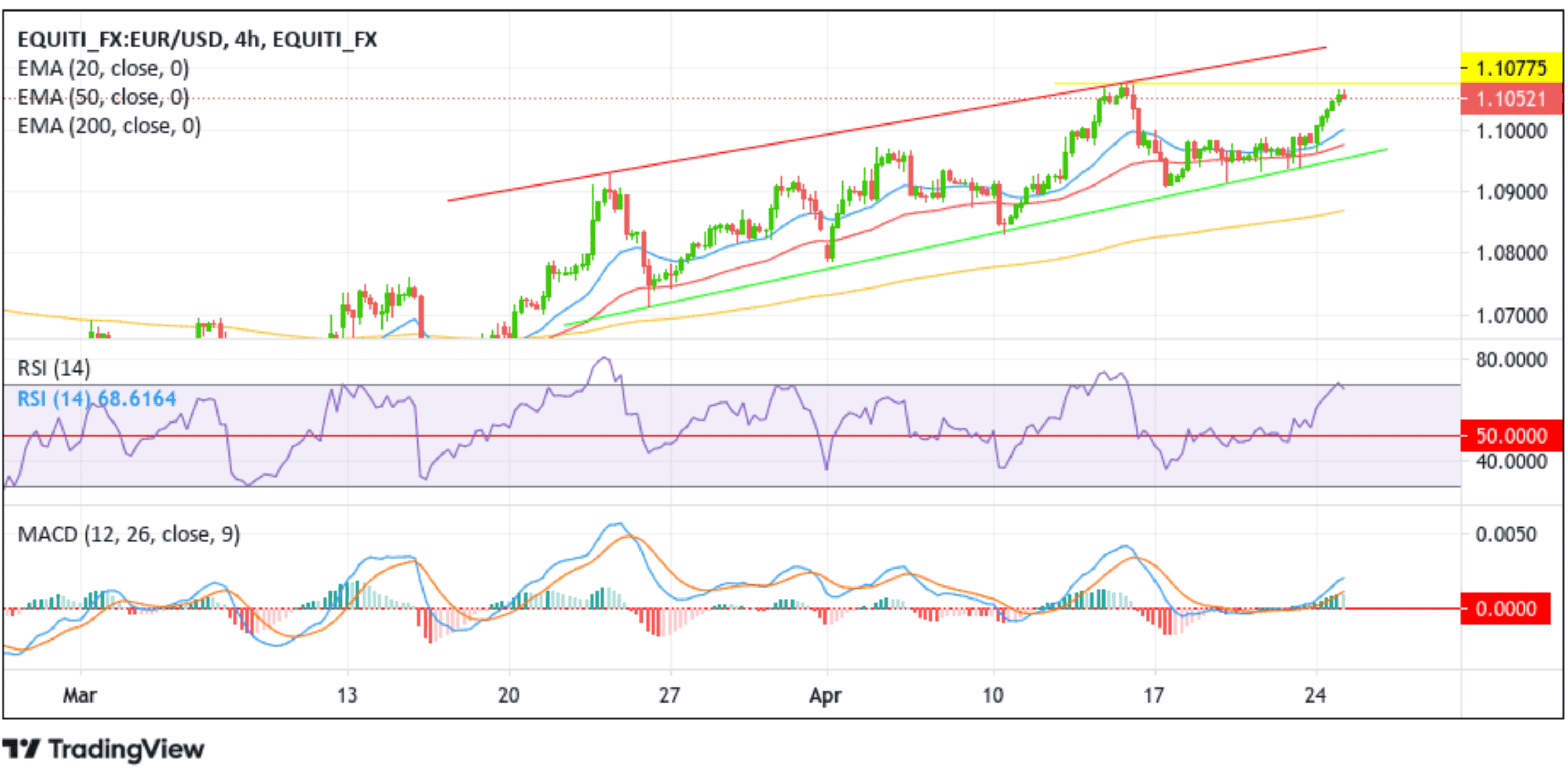

Technical Outlook: Four-Hours EUR/USD Price Chart

From a technical standpoint, an increase in selling pressure could cause the shared currency to drop further toward the February 2023 swing high now turned support level. A decisive flip of this support level into a resistance level could pave the way for a further corrective move toward confronting the buyer congestion zone due to the 20-day (blue) and 50-day (red) EMA levels at 1.110037 and 1.09786 levels, respectively. In the worst scenario, the bearish trend could be extended toward tagging the key support level plotted by an ascending trendline extending from the late March 2023 swing low.

On the flip side, if technical traders and dip-buyers jump back in and heed the call to BUY the EUR/USD pair, initial resistance will appear at the 1.10750 level. Buying interest could gain momentum if the price pierces this barrier, creating the right conditions for a break above the key resistance level plotted by an ascending trendline extending from the late-March 2023 swing high. The bullish trajectory could then be extended toward the 1.11853 resistance level.