EUR/USD Lacks Firm Intraday Direction Remains Capped Below mid-1.09500s As Euro Inflation Drops Further

- EUR/USD lacks any firm intraday direction on Thursday; Further southside move remains possible

- A goodish pickup in the U.S. Treasury bond yields sees a modest USD rebound, in turn, caps EUR/USD against the further uptick

- Bets for smaller ECB rate hikes increase as Eurozone inflation drops to over a one-year low

- Markets look forward to a slew of U.S. macro data for directional impetus

The EUR/USD cross struggles to capitalize on the previous session's bounce from mid-1.09500s levels and seesaws between tepid gains/minor losses through the mid-Asian session. The pair is placed just below the 50-day Exponential Moving Average and draws support from various factors.

A combination of factors assisted the U.S. Dollar to rebound swiftly during the mid-hours of the Asian session and moved back above the $101.990s level, which is acting as a headwind to the EUR/USD Pair. Increased market expectations that the Federal Reserve (Fed) will continue to raise interest rates remained supportive of rising treasury bond yields, which underpinned the greenback and helped limit further EUR/USD gains.

Apart from this, hawkish messages from the top (Fed) officials recently supported prospects for further policy tightening by the U.S. Central Bank. Fed Governor Christopher Waller, in a speech last week on Friday at the Graybar National Training Conference, San Antonio, Texas, said, "I would welcome signs of moderating demand (referring to the housing sector, personal income, and surveys that provide managers' views of economic conditions in April), but until they appear and I see inflation moving meaningfully and persistently down toward our 2 percent target, I believe there is still work to do".

In an interview with Reuters on Tuesday, St Louis Fed President said, "The U.S. central bank should continue raising interest rates on the back of recent data showing inflation remains persistent while the broader economy seems poised to continue growing, even if slowly".

The series of hawkish comments come on the backdrop of strong corporate earnings from top banks in the U.S., which confirmed the recent banking crisis didn't have much of an adverse effect on the U.S. banking sector. Additionally, the hawkish comments lately come on the back of a round of positive U.S. macro data, cemented market expectations that the Fed will continue to hike interest rates and further disposed-off the Fed pivot narrative.

Fed Funds futures traders are now pricing in an 84.1% chance that the Fed will hike rates by 25 basis points in May, up from 72.2% last week. Markets are also positioning for a 22.6% chance that the Fed will hike again in June, although most expectations are still skewed towards a pause.

Shifting to the euro docket, the euro continues to be weighed down by the decision by European Central Bank (ECB) officials to leave the door open for a further downshift in the pace of interest rate hikes. In a news report by Bloomberg on Monday, ECB member Martin Kazaks said it's possible officials will opt for a smaller 25 basis-point interest-rate hike in May. However, according to Latvian news service Leta, a half-point move can't be excluded. This, in turn, contributes to the softer tone surrounding the EUR/USD pair and paves the way for further depreciating moves shortly.

Additionally, easing inflation pressures in the Eurozone area cement market bets for small rate hikes by the ECB and further contributes to the eurozone shared currency's softer tone. A Eurostat inflation report on Wednesday showed the annual inflation rate in the Euro Area had decreased to 6.9 percent in March 2023, marking a fifth consecutive month of decline from last October's record high of 10.6 percent and marking the lowest level since February 2022. The core index hit a fresh record high of 5.7 percent, putting pressure on policymakers to push on with further rate hikes.

The inflation data report will be a critical determinant of the ECB's action in its next monetary policy decision. ECB Member Philip Lane, in a speech on Wednesday at the Enterprise Ireland Summit 2023, said, "In the March monetary policy meeting, we announced that future policy rate decisions would be determined by an assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

As we advance, investors look forward to the U.S. docket featuring the release of the Initial Jobless Claims data, Existing Home Sales data (Mar) and the Philadelphia Fed Manufacturing Index (Apr). Investors will also look for cues from second-tier Europe macro data featuring the release of the European Trade Balance data (Feb) and the ECB Account of Monetary Policy Meeting report.

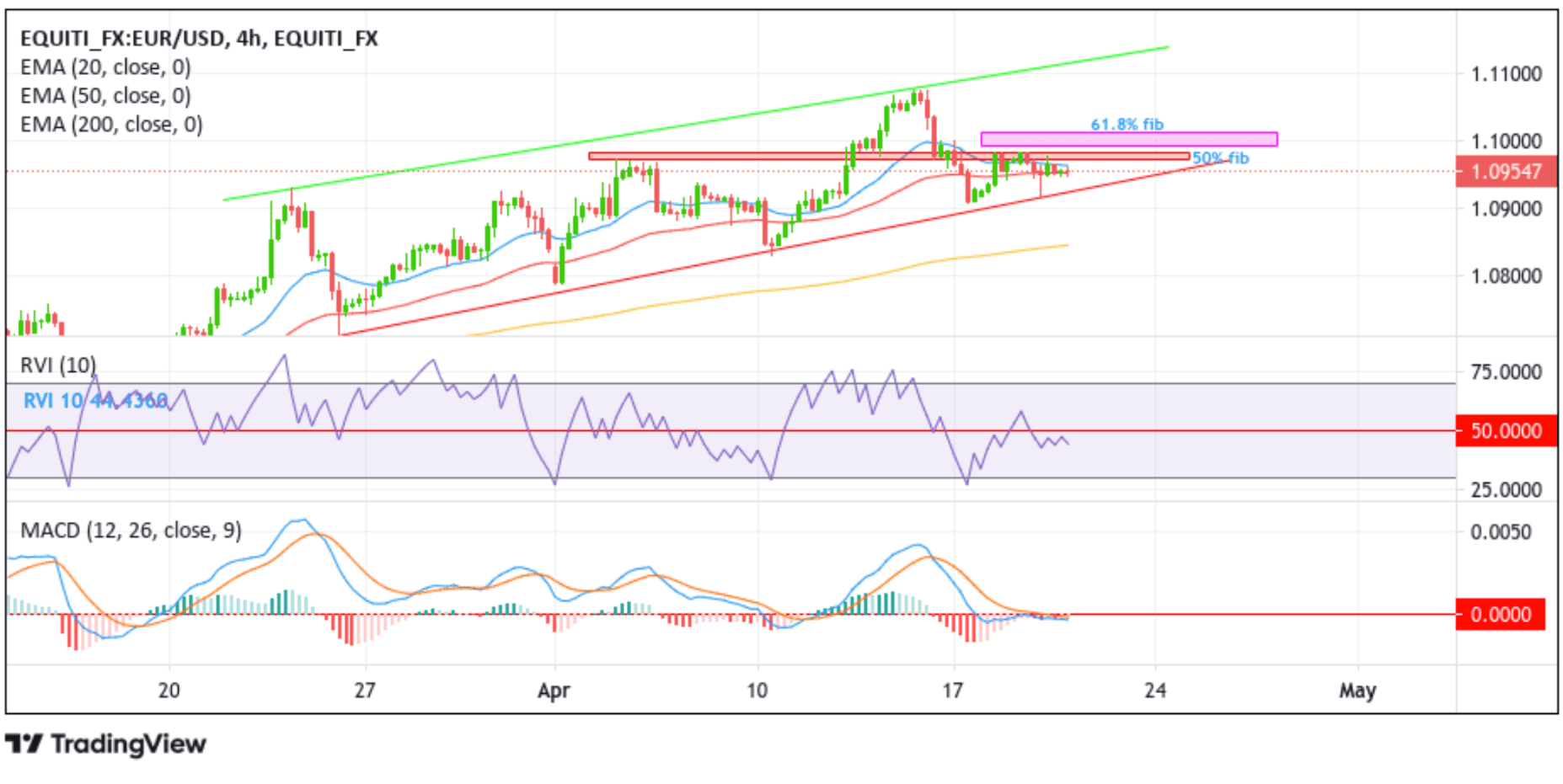

Technical Outlook: Four-Hours EUR/USD Price Chart

From a technical standpoint, the price's inability to break above the 20-day EMA (blue) at 1.09633 level paved the way for a short covering mood. The current price action suggests sellers heeded the call to SHORT the EUR/USD pair upon sensing heavy overhead resistance above current levels. This proved strong enough in the previous trading session to cap further upside moves. Furthermore, the RVI 10 at 44.4368 (volatility indicator) and the MACD Crossover (momentum indicator) triggered SELL signals when they descended into bearish territory (below signal level), indicating a bearish sign of price action this week.

A further increase in selling pressure beyond current levels will drag spot prices to tag the 50-day EMA (red) at the 1.09530 level. A decisive flip of this support level into a resistance level will pave the way for a drop toward retesting the key support level plotted by an ascending trendline extending from the late-March 2023 swing low. A break below this support level (bearish price breakout) will pave the way for further southside move around the EUR/USD Pair. The bearish trajectory could then be extended toward confronting the technically strong 200-day EMA (yellow) at the 1.08473 level. A four-hour candlestick close below the aforementioned EMA level could negate any near-term bullish outlook and pave the way for aggressive technical selling around the EUR/USD pair.

On the flip side, if buyers resurface and spark a bullish turnaround, initial resistance comes in at the 20-day EMA support level en route to the key supply zone ranging from 1.09730 - 1.09833 levels. Sustained strength above these levels would pave the way for an ascend towards confronting the 50% and 61.8% Fibonacci retracement levels at 1.09918 and 1.10124 levels, respectively. A convincing move above this zone resistance zone would negate any near-term bearish outlook and pave the way for additional gains around the EUR/USD pair. The Bullish uptick could then accelerate toward the key resistance level plotted by an ascending trendline extending from the late-March 2023 swing high. A break below this support level (bullish price breakout) will pave the way for aggressive technical selling around the EUR/USD Pair.