EUR/USD Moves Back Below 1.05500 As Risk Sentiment Remains Fragile Amid Geo-Political Tensions

Key Takeaways:

- EUR/USD cross-eased from the daily high and moved below the 1.05500 mark

- Rising geopolitical risks and market uncertainty boost greenback safe-haven appeal and help limit further EUR/USD gains

- Expectations that the European Central Bank (ECB) will hold rates during the November meeting undermine the euro

The EUR/USD cross attracted some dip-selling from the vicinity of the 1.05734 level/daily high during the mid-Asian session and moved back below the 1.05500 mark hours after kicking off the week with a modest bearish gap, opening. Rising geopolitical risks and market uncertainty in the wake of fresh fighting over the weekend in the Middle East helped boost market demand for safe-haven assets, which favored the greenback and was a key factor that helped limit further gains around the shared currency.

At dawn on Saturday, during a major Jewish holiday, the Palestinian militant group Hamas launched a surprise attack on Israel in the country's deadliest day of violence for 50 years. In response, Israel launched airstrikes on Gaza and declared war against the Palestinian enclave of Gaza on Sunday. At the time of writing, a CNBC publication showed that at least 700 Israelis had reportedly been killed, according to NBC News. The Palestinian Health Ministry, meanwhile, has recorded 313 deaths so far.

Further supporting the greenback was the U.S. monthly jobs data report, popularly known as Nonfarm Payrolls (NFP), released on Friday, which showed the U.S. economy created 336K jobs in September 2023, well above an upwardly revised 227K in August and beating market forecasts of 170K. It is the most substantial job gain in eight months and well above the 70K - 100K needed per month to keep up with the growth in the working-age population, signaling that the labor market is gradually easing but remains resilient despite the Fed's tightening campaign. To a greater extent, the Upbeat Jobs report has cemented market expectations of at least one rate hike before the end of the year, which remains supportive of rising U.S. Treasury yields and suggests the path of least resistance for the EUR/USD pair is to the upside.

In contrast, the European Central Bank (ECB) is expected to leave rates unchanged during its November meeting after signaling during its September meeting that the hike, is the 10th in a 14-month-long fight against inflation, was likely to be its last, which in turn is set to continue to weigh on the Euro (EUR).

As we advance, without any significant economic news data from both dockets, the broader market risk sentiment and U.S. Treasury bond yields will continue to influence the U.S. dollar and provide short-term trading opportunities around the EURS/USD pair. The focus, however, remains on the release of the FOMC Meeting minutes on Wednesday, followed by the Consumer Price Inflation (CPI) data report on Thursday.

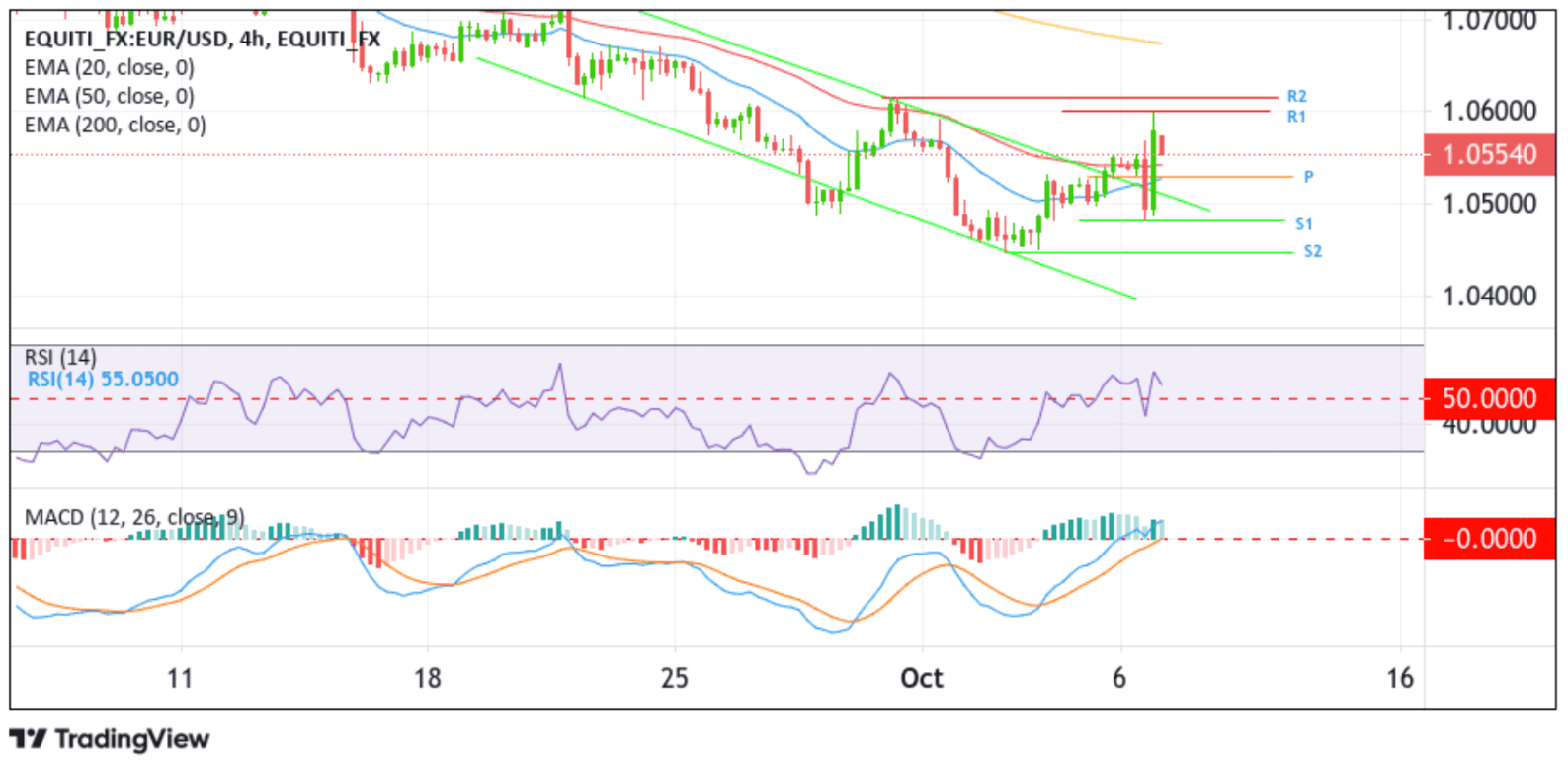

Technical Outlook: Four-Hour EUR/USD Price Chart

From a technical standpoint, a further increase in selling pressure from the current price level would drag spot prices toward tagging the 50-day Exponential Moving Average (EMA) at 1.05415, which sits above the key pivot level (P) at 1.05294. Acceptance below these barriers would act as a fresh trigger for sellers to push down the price toward the key resistance level (now turned support level) plotted by a downward sloping trendline extending from the late-September 2023 swing high. A clean break below this level would pave the way for a drop toward the 1.04822 support level (S1), about which, if sellers manage to breach this floor, downside pressure could accelerate further, paving the way for a slide toward the next relevant support level at 1.04484 (S2). Failure to defend this level would make the EUR/USD pair vulnerable to extending the downward trajectory towards the key support level plotted by a downward-sloping trendline from the late-September 2023 swing low.

On the flip side, if bulls return and catalyze a bullish reversal, initial resistance comes in at 1.06006 (R1), followed by 1.06161 (R2). If the price pierces these barriers, the EUR/USD cross could rally toward tagging the technically 200-day solid (yellow) EMA level at 1.06729. A convincing move above this level would negate any near-term bearish outlook and pave the way for aggressive technical buying around the EUR/USD pair.