AUS 200 Index Rebounds On Tech Strength Around Wall Street As Debt Ceiling Negotiators Get Close To A Deal

- Aus 200 Index rebounded on Friday, supported by a combination of factors

- Debt Ceiling talks enter crunch time as negotiators get closer to a deal

- Worsening US-China Jitters remain a headwind to the Australian main index

- The S&P/AUS 200 Index was boosted by solid gains from Nuix Ltd. (Sydney: NXL) and Mesoblast Ltd. (Sydney: MSB) while weighed down by Fisher & Paykel Healthcare Ltd. (Sydney: FPH) and CSR Ltd. (Sydney: CSR)

The S&P/AUS 200 Index edged higher on Friday during the Asian session, rebounding from a six-week low buoyed by a rally in Chip stocks on Wall Street as Debt Ceiling negotiators get close to a deal following a heavy round of overnight talks. As per press time, Australia's Main Index (Aus200) rose over 0.2%/14 points for the day to trade at $7144.98 but remains under heavy bearish pressure in a week in which the primary index is set to close in heavy losses amid U.S. debt ceiling uncertainty and worsening US-Sino tensions.

Today's move follows a mixed day on Wall Street that saw most stocks in Asia fall as fears of a U.S. debt ceiling default persisted as a deal to raise the U.S. debt ceiling has yet to be struck before the June 1st deadline. However, Asian stocks found some reprieve after tracking chip stocks, led by the NVIDIA tech rally. Following the mixed outlook around wall street and the Asian stock markets, the Aus 200 Index slumped over 0.6%/43 points to close at $7136.3 on Thursday.

The two parties negotiating the U.S. Debt ceiling talks have yet to strike a deal on how far the U.S. government could raise its debt ceiling with just a week to go. However, news this morning shows that the two parties at the negotiation table appeared to have moved closer to a deal overnight. Noteworthy, if an agreement can't be struck on time, the U.S. government could risk defaulting on its debt, which could plunge the world's largest economy into a recession and have further dire consequences for the global economy.

Elsewhere, the main index faces heavy headwinds stemming from the worsening US-Sino tensions, which dampen sentiment toward the region. Recently, China banned using U.S.-based Micron Technology's (NASDAQ: MU) chips in select sectors over security concerns, drawing ire from U.S. lawmakers. This also came as Beijing criticized the Group of Seven's stance towards the country and a recent trade agreement between the U.S. and Taiwan during the G7 meeting held last week in Hiroshima, Japan.

Further weighing down on the main index was the slew of softer Chinese macroeconomic readings earlier this month that showed the world's second-largest economy's post-Covid rebound had stalled, adding to worries about a global economic downturn.

On the economic data front, an Australian Retail Sales data report on Friday showed retail sales in Australia were unchanged from the prior month at AUD 35.3 billion in April 2023, after a 0.4% rise in March, according to a report by the Australian Bureau of Statistics. The latest result followed growth in the previous three months, as an increase in spending on winter clothing in response to more relaxed and wetter weather offset less expenditure on discretionary goods in response to cost-of-living pressures and rising interest rates.

AUS200 Index Movers

The S&P/AUS 200 Index is boosted by solid gains from stocks in the Information Technology, Health Care, and Material sectors, with Nuix Ltd. (Sydney: NXL), Mesoblast Ltd. (Sydney: MSB), and Adbri Ltd. (Sydney: ABC) stocks being the biggest gainers in their respective sectors, having risen 5.29%/0.05 points, 5.29%/0.055 points, and 4.87%/0.095 points, respectively, to trade at $0.99, $1.095 and $2.045 per share, respectively.

The Main index is also weighed down by stocks in the Health Care, Materials, and Consumer Discretionary sectors, with Fisher & Paykel Healthcare Ltd. (Sydney: FPH), CSR Ltd. (Sydney: CSR), and Pointsbet Holdings Ltd. (Sydney: PBH) stocks being the biggest losers in their respective sectors, having lost 6.13%/1.47 points, 5.05%/0.270 points, and 2.51%/0.08 points, respectively, to trade at $22.57, $5.070 and $3.11 per share, respectively.

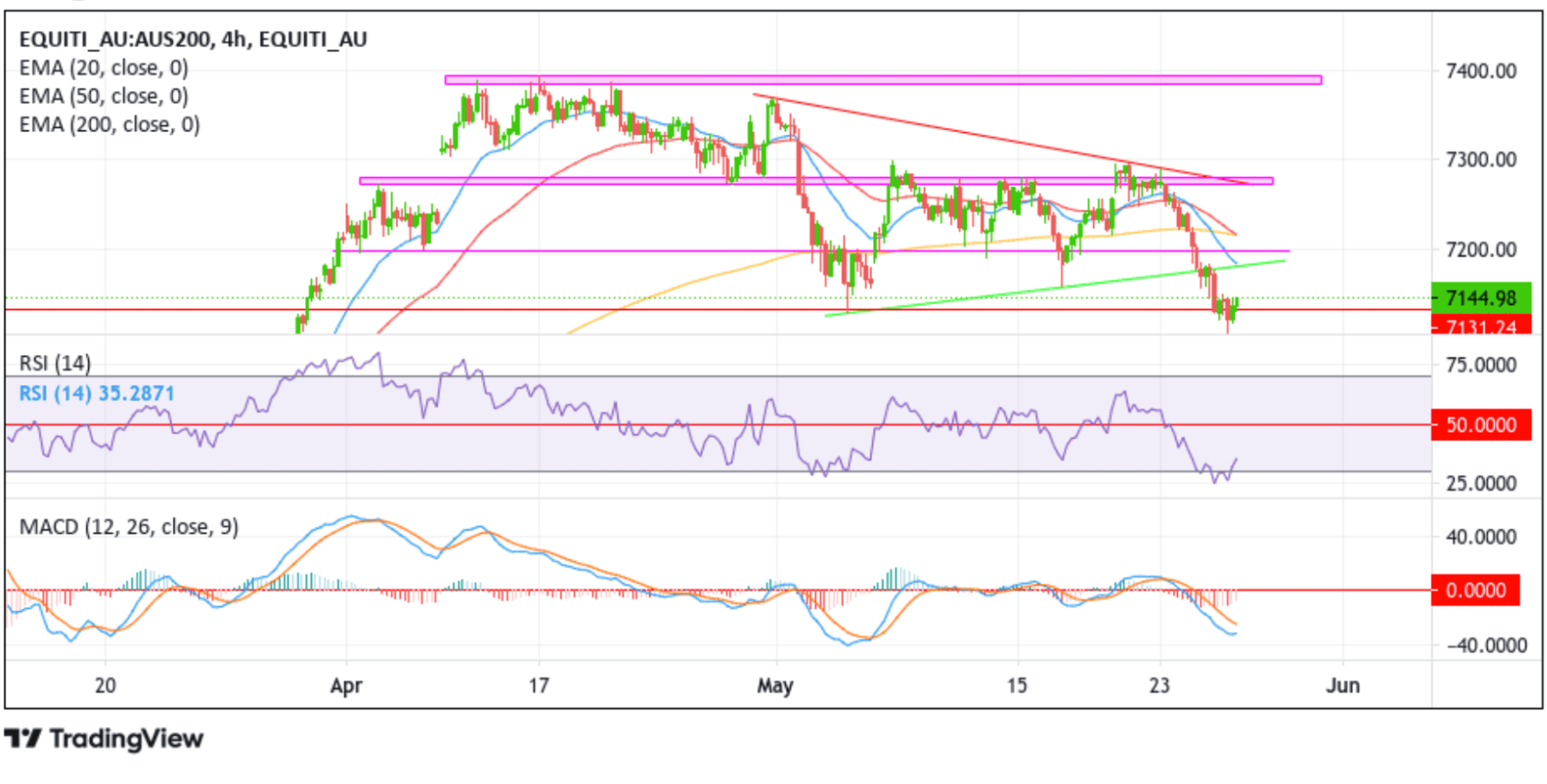

Technical Outlook: Four-Hours AUS 200 Index Price Chart

From a technical standpoint, the price's ability to break below the key trendline support supported the case for further southside moves below the $7200.00 mark. The price, however, has managed to rebound and broke above the $7131.24 resistance level, which the price had initially broken in the previous session. That said, a further increase in buying pressure from the current price level would uplift spot prices toward the trendline support now turned resistance level. If buyers manage to break above this ceiling, it will pave the way for further gains around the Aus 200 Index.

A subsequent move above the 20-day (blue) Exponential Moving Average (EMA) at $7182.99 would pave the way for a short rally toward confronting the $7196.99 resistance level. A decisive flip of this resistance level into a support level could pave the way for an ascent above the $2000.00 psychological mark en route to the 50 (red) and 200 (yellow) days crossover confluence level at the $7215.09 level. Sustained strength above this confluence level would negate any near-term bearish outlook and pave the way for a strong rally toward the 7279.95 - 7271.83 supply zone and, in highly bullish cases, confront the next supply zone ranging from 7394.45 - 7384.85 levels.

On the flip side, profit takers could interrupt the current price action, causing the Aus 200 Index to retrace toward the 7131.24 support level. A breach below this support level could pave the way for a drop toward tagging the 7105.02 support level. A subsequent break below this level could invalidate the bullish thesis and, in dire cases, cause the Aus 200 Index to drop further toward the next relevant support level at $7034.94.