US WTI Crude Oil Rebounds Supported By A Modest U.S. Dollar Weakness, Edges Slightly Above $74.40 Per Barrel

- US WTI, crude oil prices, rebounded on Thursday, supported by a modest U.S. dollar weakness, edges slightly above $74.40 per barrel

- Recession fears and positive sentiment around the U.S. dollar, to a greater extent on Tuesday, overshadowed a large crude oil draw and a drop in gasoline inventories

- A modest U.S. rebound plus investors' decision to close their sell positions caps crude oil prices against further downside moves

US WTI, crude oil prices, rebounded on Thursday during the Asian session after dropping significantly the past two days, buoyed by banking fears revival and recession fears, even after a report on Wednesday showed U.S. crude inventories fell more than expected. As per press time, US WTI crude oil prices were up 0.14% to trade at $74.42 per barrel, while its counterpart, Brent crude oil, was up 0.17% to trade at $77.88 per barrel.

Lingering signs of an economic slowdown in the world's top economy and expectations of further rate hikes by the Federal Reserve that could curtail fuel demand growth acted as a headwind to crude oil prices and capped any meaningful upside for crude oil prices; hence, the path with the least resistance was to the downside. A softer-than-expected U.S. consumer confidence data report on Tuesday showed U.S. consumer confidence in the economy had fallen to a nine-month low, raising fears that the U.S. economy, the major global growth driver, is heading towards recession in the second half of the year. The softer U.S. CB confidence figures came before another report last week signalled a potentially greater-than-expected economic slowdown in the U.S.

Further dragging down crude oil prices were renewed concerns about the U.S. banking sector after California-based lender First Republic spooked the financial markets on Tuesday, saying it had lost 40% of its deposits in the first quarter. As a result, the bank's shares plunged 49% on Tuesday, reigniting fears of another banking sector crisis after the collapse of SVB and Signature Bank, followed by a downturn in Credit Suisse.

A stronger U.S. dollar, supported by a combination of positive factors, weighed down on Tuesday's crude oil prices. Apart from this, the risk-off mood continued to underpin the greenback and further exert downward pressure on crude oil prices. Oil prices have erased all their gains since the Organization of the Petroleum Exporting Countries (OPEC) and producer allies such as Russia, known collectively as OPEC+, announced an additional output reduction until early April.

That said, recession fears and positive sentiment around the U.S. dollar, to a greater extent on Tuesday, overshadowed a large crude oil draw and a drop in gasoline inventories. On Wednesday, a U.S. Energy Information Administration (EIA) report showed U.S. crude oil inventories fell by 5.054 million barrels in the week ending April 21st, 2023, the largest decline in a month and compared with market consensus of a 1.486 million drop. Distillate stockpiles, which include diesel and heating oil, were also down by 0.576 million barrels, compared with forecasts for a 0.839 million drop. However, a modest USD rebound on Thursday helped limit further crude oil price weakness and helped crude oil prices rebound and edge slightly up. The current price action also suggests oil traders have closed their sell positions and taken away some of their profits amid oversold conditions.

As we advance, oil traders look forward to the release of the US GDP data later today that will reveal the strength of the U.S. economy. The key data will impact the U.S. dollar strength and crude oil prices. Additionally, Oil traders will look for cues from the release of the Fed's preferred inflation gauge, Core PCE, set for release on Friday.

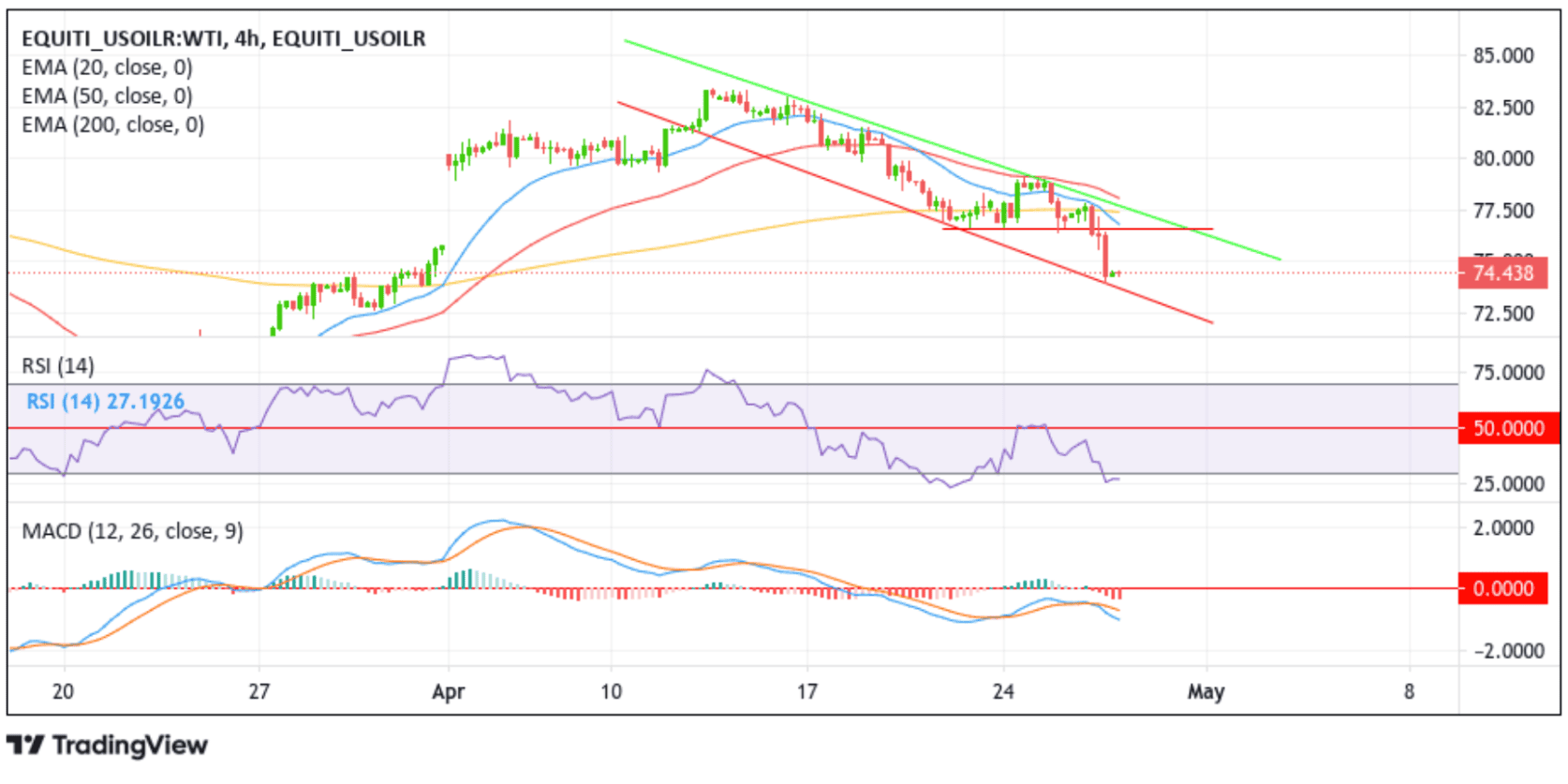

Technical Outlook: Four-Hour US WTI Crude Oil Price Chart

From a technical standstill, oil prices extended a modest rebound from the lower trendline (support level) of the bearish channel pattern. Oil buyers have jumped in and triggered a bullish reversal (correction move) following oversold conditions (RSI 14 at 27.1926), which warranted caution to sellers against submitting aggressive bearish bets.

A further increase in buying pressure from the current price level (corrective move) will encounter initial resistance at the $76.585 level. Fliping this resistance level into a support level will pave the way for more crude oil gains but would face stiff resistance at the seller congestion zone due to the 20-day (blue) and 200-day (yellow) EMA levels at 76.820 and 77.408, respectively. If the price fails to break above this zone, it could negate the bullish outlook and cause crude oil prices to retrace, paving the way for the next impulsive move.

On the flip side, if sellers jump back in again and spark a bearish reversal, crude oil prices will find support at the $76.816 support level en route to the key support level plotted by a descending trendline of the bearish chart pattern formation. A convincing move below these levels could negate any-near term bullish outlook and pave the way for more crude oil price weakness.