US WTI Crude Oil Futures Extends Rebound On Positive Demand, Economic Concerns Looms

- US WTI Crude futures extended their recovery into a second straight session on Friday

- U.S. oil inventories grew slightly more than expected in the last week of December, according to the latest report by EIA

- China, the world’s largest crude importer, is set to reopen its border in Hong Kong hence boosting crude oil demand

US WTI Crude futures extended the modest recovery from the vicinity of 72.46 level and gained positive traction for the second successive day on Friday after U.S. inventory data and a reopening in the China-Hong Kong border spelled some positive trends for demand. However, fears of a looming recession still kept crude on course for steep weekly losses.

As per press time, US WTI crude oil futures was up 1.08%/80 points, trading at $74.60 per barrel after initially falling the last two days driven by worries about a global recession, especially since short-term economic signs in the world’s two biggest oil consumers, the United States and China, looked weak. Additionally, a warning by the International Monetary Fund (IMF) of a potential recession in several significant economies also contributed to the recent decline in oil prices.

Lifting oil prices was an Energy Information Administration (EIA) crude oil inventories data on Thursday, which showed U.S. oil inventories grew slightly more than expected in the last week of December. U.S. gasoline stocks fell 346,000 barrels last week, the Energy Information Administration said, compared with analysts’ expectations in a Reuters poll for a 486,000-barrel drop.

Distillate stockpiles, including diesel and heating oil, fell 1.4 million in the week, versus expectations for a 396,000-barrel drop. The EIA data showed that crude consumption remained strong through the holiday season.

Still, crude inventories rose more than expected at 1.7 million barrels, compared with analysts’ expectations for a 1.2 million-barrel rise.

Further lifting US WTI crude oil prices was the news from China that it would reopen its border in Hong Kong by January 8, another step away from the country’s strict zero-COVID policy. The move ramped up expectations of an eventual economic recovery in the country, which is expected to spur a sharp bounceback in oil demand.

As we advance, strength in the dollar would limit U.S. crude oil futures, especially as investors await U.S. nonfarm payrolls data that is expected to show some easing in the country’s tight jobs market. However, investors are still wary of any signs of a resilient job market that could give the Federal Reserve more headroom to maintain its hawkish rhetoric.

The minutes of the central bank’s December meeting showed that Federal Reserve officials are committed to fighting inflation and expect higher interest rates to remain in place until more progress is made. A scenario that could weigh further on economic activity and dent crude demand.

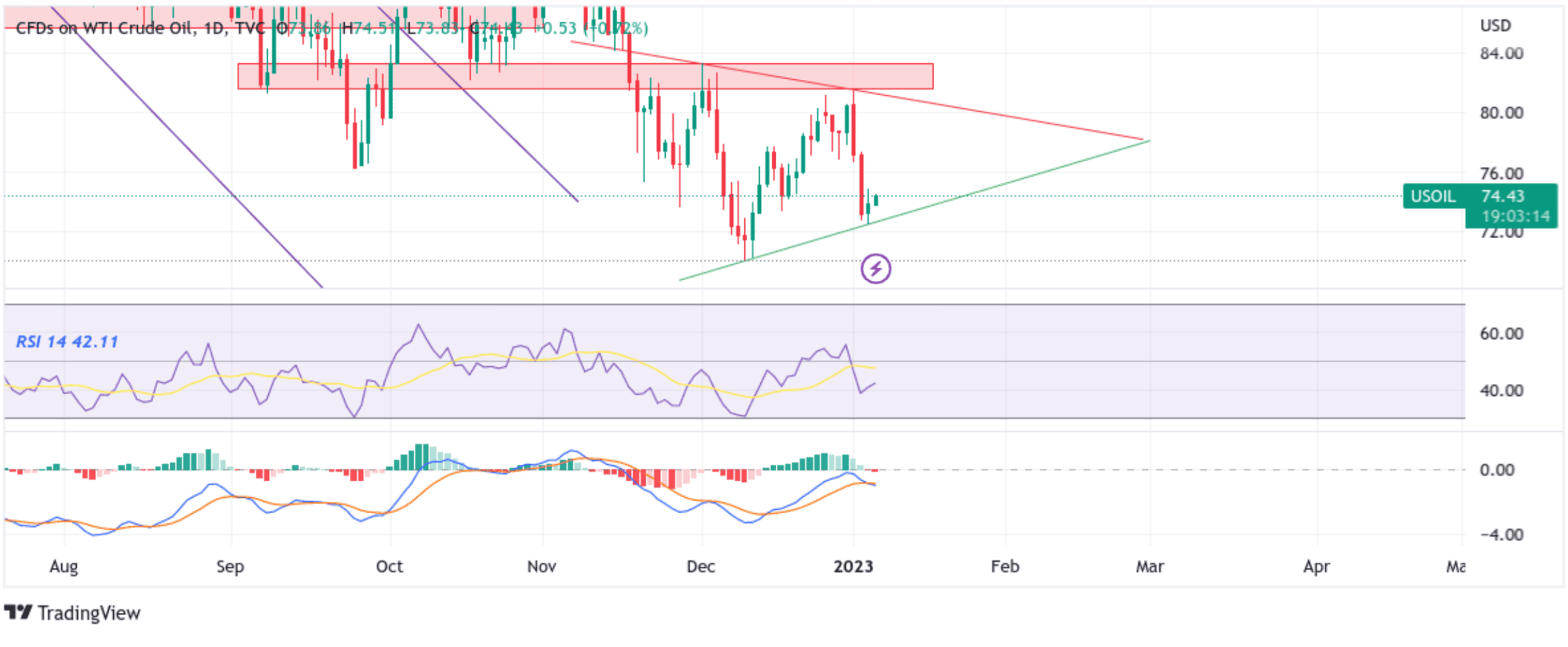

Technical Outlook: One-Day US WTI Crude Oil Futures Price Chart

From a technical standstill using a one-day price chart, US WTI crude oil futures have extended the sharp rebound from the vicinity of the 72.46 level after a firm rejection from the ascending trendline (key support level) of a bearish pennant chart pattern extending from the December 2022 swing low. Some follow-through buying would uplift spot prices toward the key resistance level plotted by a downward-sloping trendline of the bearish pennant chart pattern extending from the December 2022 swing high. A convincing break above the aforementioned resistance level (bullish price breakout) would pave for additional gains around the US WTI Crude oil futures. Still, the bullish trajectory would face an immediate hurdle plotted by a strong supply zone ranging from 81.50 - 83.32 levels. Sustained strength buyers above this barrier would negate any-near term bearish outlook and pave the way for aggressive technical buying around the US WTI Crude oil futures.

All the technical Oscillators on the chart are in negative territory, with the RSI (14) at 42.11 below the signal line and portraying a bearish filter. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is below the signal line, validating the downside bias and pointing to a bearish sign for price action this week.

On the flip side, if dip-sellers and tactical traders jump in and trigger a bearish reversal, the solid support is at the 73.58 support level. If the price breaches this floor, selling interest could gain momentum, creating the right conditions for a drop toward retesting the key support level plotted by an ascending trendline of a bearish pennant chart pattern extending from the December 2022 swing low. Further weakness below the aforementioned support level would pave the way for aggressive technical selling around the US WTI crude oil futures.