U.S. WTI Crude Oil Prices Retreat Below $86.60 Per Barrel Amid A Modest (DXY) Rebound, Vienna Meeting On Sight

- US WTI retreated on Wednesday and was down 0.37%/32 cents at $86.33 per barrel as of 04:33 (UTC+3)

- The Organization of the Petroleum Exporting Countries and its allies, known as OPEC+ look set to cut Oil output by more than one million barrels per day when they meet today in Vienna

- The US WTI crude oil's latest bullish appeal could be attributed to the U.S. dollar weakness

- Recovering Chinese demand, OPEC+ further supply cut, and the end of the U.S. Strategic Petroleum Reserve (SPR) release is set to continue to uphold Oil Prices

Crude oil prices retreated on Wednesday after a strong upside rally on Tuesday, buoyed by a weakened U.S. Dollar and OPEC's + latest move to cut output. As such, U.S. West Texas Intermediate(WTI) Crude oil futures were down 0.37%/32 cents at $86.33 per barrel as of 04:33(UTC+3), while its counterpart Brent Crude Futures was trading at $90.838 per barrel, down 0.53%/ 0.48 cents. Today's downtick could be solely attributed to a modest demand for the greenback. The Organization of the Petroleum Exporting Countries and its allies, known as OPEC+ look set to cut Oil output by more than one million barrels per day when they meet today in Vienna. The meeting would be against declining oil prices and months of severe market volatility, which prompted top OPEC+ producer Saudi Arabia to announce the group could cut production. If implemented today, the group's latest move would squeeze supply in an oil market that energy company executives and analysts say is already tight due to healthy demand, a lack of investment, and supply problems.

OPEC+, which combines OPEC Countries and allies such as Russia, has refused to raise output to lower oil prices despite pressure from major consumers, including the United States, to help the global economy. In fact, a significant cut is poised to anger the U.S., which has been putting pressure on Saudi Arabia to continue pumping more to help OIl Prices soften further and reduce revenues for Russia as the West seeks to punish Moscow for invading Ukraine.

The production target cut being considered is justified by the sharp decline in oil prices from recent highs due to fears about the global economy and a rally in the U.S. Dollar due to FEDs rate hikes, said Goldman Sachs adding that this reinforced its bullish outlook on oil. "The anticipated output reduction is likely discounted by now, judging by how much crude benchmarks have risen since last week, so we may not see a significant reaction to the official decision tomorrow. However, the cartel's actions may act as a floor for the commodity going forward, preventing speculators from triggering another extreme and unwarranted sell-off on weak demand bets," said Diego Colman, a digital strategist at Daily FX.

The US WTI crude oil's latest bullish appeal could be attributed to the U.S. dollar weakness, which in fact, headed for a fifth daily loss on Tuesday against a basket of currencies as investors speculated that the U.S. Federal Reserve might slow its interest rate hikes. The Fed's potentially easing its rate hikes would relieve some worries of a U.S. economic recession that could dampen crude demand. But that would be determined by several U.S. financial data before its next meeting. The Data on Friday would be of great importance, which is expected to show the U.S. economy created about 250,000 jobs last month, below the 315,000 seen in August, with average hourly earnings forecast to remain steady at about 0.3% and the unemployment rate at 3.8%.

Meanwhile, a senior U.S. Treasury official said G7 sanctions on Russia would be implemented in three phases, first targeting Russian oil, then diesel and then lower-value products such as naphtha. Sanctions from the G7 and the European Union, opting for a two-phase ban, are set to begin on Dec. 5. Swiss lender UBS said it sees several factors that could send crude prices higher toward year-end, including "recovering Chinese demand, OPEC+ further supply cut, the end of the U.S. Strategic Petroleum Reserve (SPR) release, and the upcoming E.U. ban on Russian crude exports." According to market sources citing American Petroleum Institute figures, U.S. crude oil and fuel stockpiles fell by about 1.8 million barrels for the week ended Sept. 30. (API). Gasoline inventories fell by about 3.5 million barrels, while distillate stocks fell by about 4 million barrels, according to the sources, who spoke on condition of anonymity. Official inventory data is due on Wednesday. [EIA]

In terms of the near-term outlook, oil's prospects appear to be improving. OPEC's apparent intention is to defend prices to protect producers' revenues and to improve Chinese demand after the Covid-19 lockdowns, the end of the U.S. Strategic Petroleum Reserve's releases. The upcoming E.U. ban on Russian petroleum exports should create a more benign environment for US WTI crude oil and Brent. This means both commodities may have more upside heading into year's end.

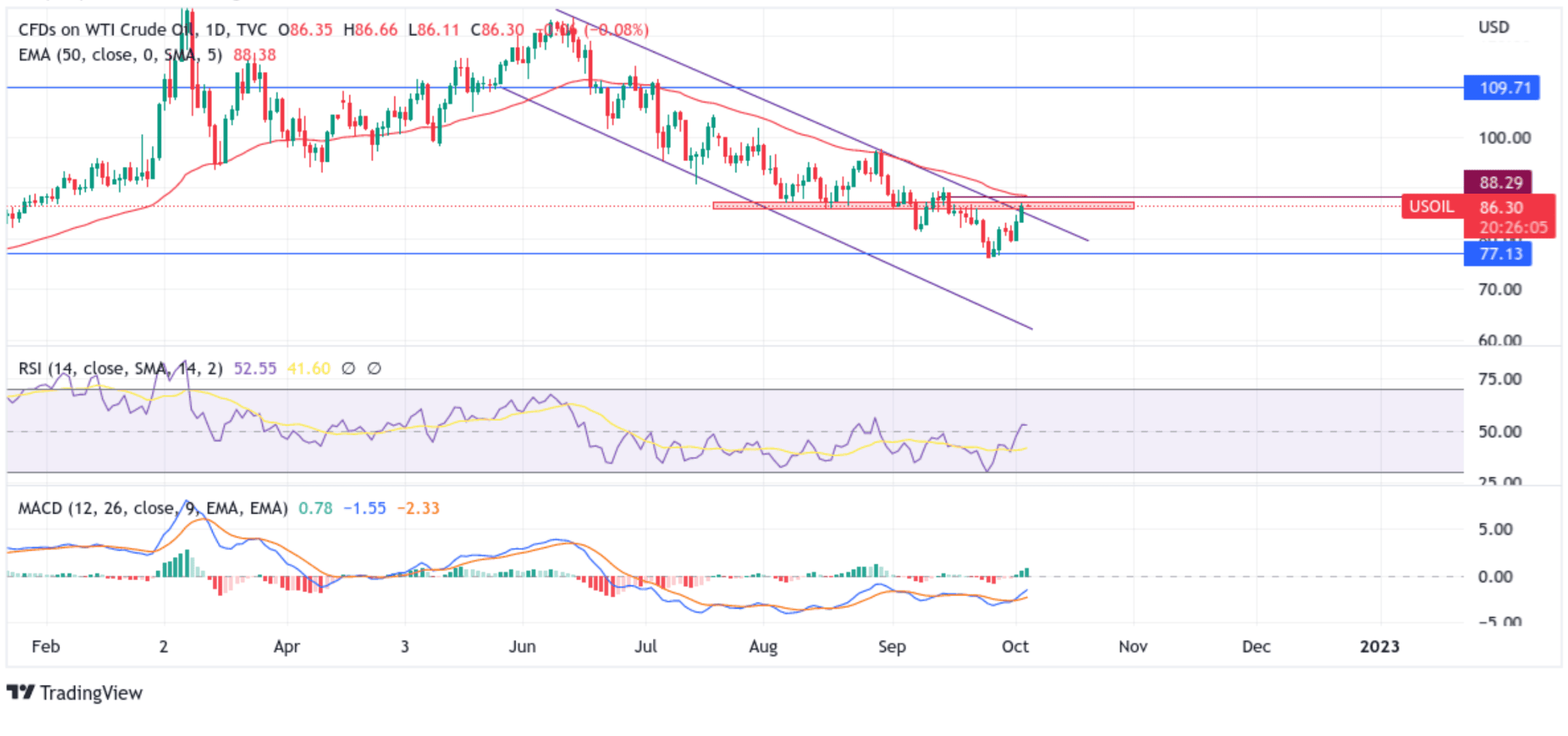

US WTI Crude Oil Technical Outlook: One-day Price Chart

From a technical perspective, using a one-day price chart, spot prices are now looking to extend the momentum beyond the downward-sloping trend line from the June 2022 swing high. Tuesday's move beyond the previous YTD top at around the 84.58 level confirmed a solid bullish breakout and supported prospects for additional gains. However, the bullish momentum faces stiff resistance from the immediate hurdle(supply zone), ranging from 85.59 - 87.25 levels. The aforementioned zone would act as a barricade against the pair against any further uptick; however, a clean break above the mentioned hurdle would be seen as a new trigger for bulls to continue pushing the price up and pave the way for additional gains.

All the technical oscillators point to a continuation of the bullish trajectory. The RSI(14) level at 52.55 is treading up, and from the look of things, the bullish trajectory is set to continue. The moving average convergence divergence (MACD) crossover at -2.52 paints adds to the bullish bias.

On the flip side, any meaningful pullback now seems to find some support at the lower trendline of the descending channel pattern. However, a convincing break below the aforementioned trendline would negate any near-term bullish outlook and pave the way for aggressive technical selling. The downward trajectory could then accelerate toward the demand zone ranging from 81.50 - 82.83 levels.