U.S. WTI Crude Oil Prices Rebound Amid Renewed Oil Demand

- U.S. WTI Oil prices gained 1.74% on Wednesday to trade at $91.984 a barrel

- Unrest in Iraq failed to dent the OPEC nation's crude exports

- Crude oil demand picks up following Wednesday's crucial pipeline maintenance

Oil prices rebounded on Wednesday after falling to nearly $6 a barrel on fears that fuel demand could soften as global central banks hike rates to fight surging inflation and as unrest in Iraq failed to dent the OPEC nation's crude exports.

U.S. West Texas Intermediate(WTI) settled up $1.74, or 1.74%, at $91.984 a barrel on Wednesday after dropping by $5.37, or 5.5%, to $91.64 the previous day as crude oil demand picked up following Wednesday's scheduled Nord 1 stream pipeline maintenance that will last for three days.

"Oil prices are inching higher on hopes of a production cut from OPEC and its allies to restore market balance in response to the revival of Iran's nuclear deal," said Sugandha Sachdeva, vice president of commodity research at Religare Broking.

Saudi Arabia is a top producer in the Organization of the Petroleum Exporting Countries (OPEC). Last week raised the possibility of production cuts, an idea which drew support from fellow member states, which sources said could coincide with a boost in supply from Iran should it clinch a nuclear deal with the West. Separately, loading from an export terminal for Kazakhstan crude has seen supply interruption already.

Prices tumbled on Tuesday after comments from Iraq's state-owned marketer SOMO that the country's oil exports had been unaffected by the clashes in Libya over the weekend, said UBS analyst Giovanni Staunovo.

Baghdad's worst clashes in years between rival Shi'ite Muslim groups continued for a second day before subsiding when influential cleric Moqtada al-Sadr ordered his supporters to go home. SOMO said it could redirect more oil to Europe if required. The clashes had sparked fear of further upheaval in the OPEC Nation that could put oil shipments at risk.

Prices felt more pressure when Russia's fastest-growing oil producer, Gazprom Neft, said it plans to double oil output at its Zhagrin field in Western Siberia to more than 110,000 barrels per day. In another possible supply boost, Venezuela's oil minister said the country was ready to move ahead with business with the oil major Chevron Corp, adding that progress to relaunch the operations depends on licenses from Washington.

Inflation is near double-digit territory in many of the world's biggest economies. This could prompt central banks in the United States and Europe to resort to more aggressive interest rate increases, which could slow economic growth and weigh on fuel demand.

Receding Bets on another oversized Fed rate hike also pushed down the dollar despite the hawkish remarks by the U.S. Fed chairman on Friday. A weaker greenback is generally bullish, making it less expensive for buyers with other currencies in the dollar-denominated oil market. This, in turn, was seen as another factor that underpinned oil prices, exerting upward pressure on the precious black liquid.

That said, WTI crude oil continues to see an upside as supply-side issues keep sentiment bullish. With oil being viewed as the commodity of last resort during a time of severe energy shortages - as seen in Europe, demand should increase as winter approaches. Soaring gas prices will likely result in gas-to-oil switching, which remains positive for prices moving forward.

U.S. Crude stockpiles rose, while fuel stocks fell in the latest week, according to market sources citing American Petroleum Institute figures on Tuesday.

According to the data, crude stocks rose by about 593,000 barrels for the week ended Aug. 26. U.S. crude oil stockpiles are likely to have fallen in the week to Aug. 26; a preliminary Reuters poll showed on Monday.

Going forward, in a bullish note on commodities, Goldman Sachs Group Inc said that crude oil had scope to push higher, especially amid shortages of other raw materials, including natural gas.

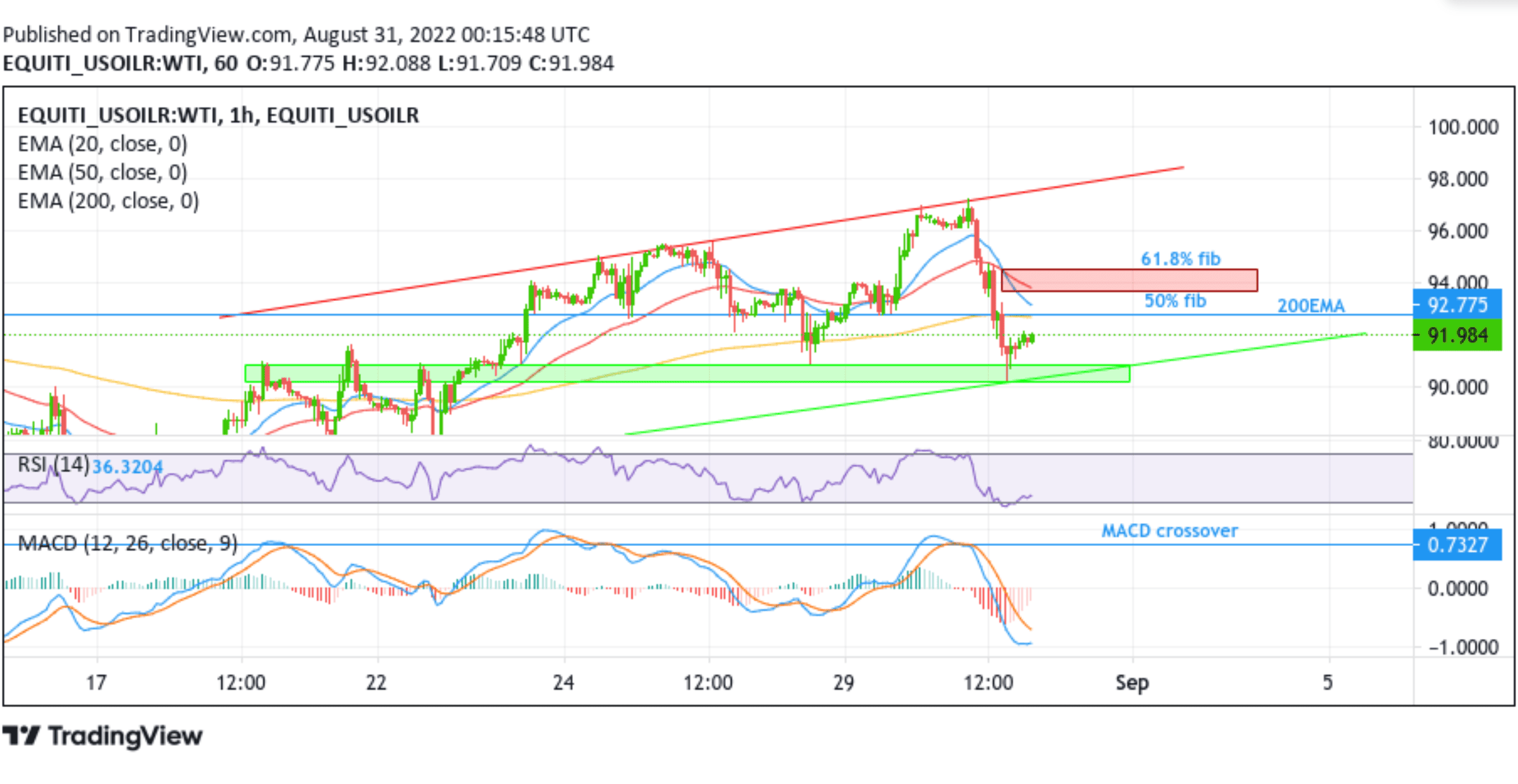

WTI Crude Oil: One-Hour Price Chart

From a technical perspective, using a four-hour price chart, the price has extended the modest pullback from the vicinity of 90.225 level after a firm rejection from the key Demand zone ranging from 90.229 - 90.860 levels. The aforementioned zone coincides with the lower trendline of the ascending channel pattern plotted from the august 2022 swing low. Some follow-through buying would lift off spot prices toward testing the next relevant hurdle: the 50% and 61.8% Fibonacci retracement levels at 93.699 and 94.545 levels, respectively. First, we will need a sustained break above the 200EMA at the 94.483 level before the price pushes further to the aforementioned retracement levels. That said, if broken decisively, the aforementioned barrier(93.699 and 94.545) would be seen as a fresh trigger for bulls to continue pushing up the price and pave the way for additional gains.

All the technical indicators on the one-hour price chart display a bearish scenario. That said, The RSI(14) level at 36.3204 level is in bearish territory and far away from flashing overbought conditions. The MACD crossover at the 0.7237 level paints a bearish filter. Additionally, The 20 and 50 EMA crossover at the 94.483 level adds credence to the bearish bias.

On the Flipside, a pullback towards retesting the key demand zone ranging from 90.229 - 90.860 levels followed by a convincing break below the aforementioned zone would negate any near-term bullish bias and pave the way for aggressive technical selling.