Oil Prices Retreat Amid Low Demand Outlook

Oil prices retreated on Wednesday from the vicinity of 92.65 level amid a lower demand outlook as oil futures reversed early gains on indications that Russian crude shipments via the southern leg of a major pipeline to Europe may resume in a few days.

Benchmarks Brent and West Texas Intermediate crude slipped after swinging about 2% in each direction earlier in the session. Russia’s Transneft said Ukraine halted its flows through its druzhba pipeline toward Hungary, the Czech Republic, and Slovakia on Aug 1st. Russia has already blamed international sanctions for curbing natural gas flows to Europe through the Nord Stream Pipeline. Similar disruption to oil flow would deepen the region’s energy crises, adding to pressure on inflation and amplifying the risk of recession.

Mol chairman Zsolt Hernadi has reportedly warned of a potential supply crunch due to the price cap, which is in place until OCT 1st. Mol Nyrt said it had initiated talks to restart the crude flows by paying the transit fee to Ukraine itself.

Retreating oil prices was a relief to large consumer nations like the United States and countries in Europe that have been urging producers to ramp up output to offset tight supplies and combat raging inflation.

Oil had surged to well over $120 a barrel earlier in the year after a sudden rebound in demand from the darkest days of the COVID-19 pandemic combined with supply disruptions stemming from sanctions on significant producer Russia over its invasion of Ukraine.

The demand outlook remains clouded by increasing worries about an economic slump in the United States and Europe, debt distress in emerging market economies, and a strict zero COVID-19 policy in China, the world’s largest oil importer.

Further pressure followed fears that rising interest rates could slow economic activity and limit demand for fuel. The combination of factors was seen as a key factor that undermined oil prices against further uptick.

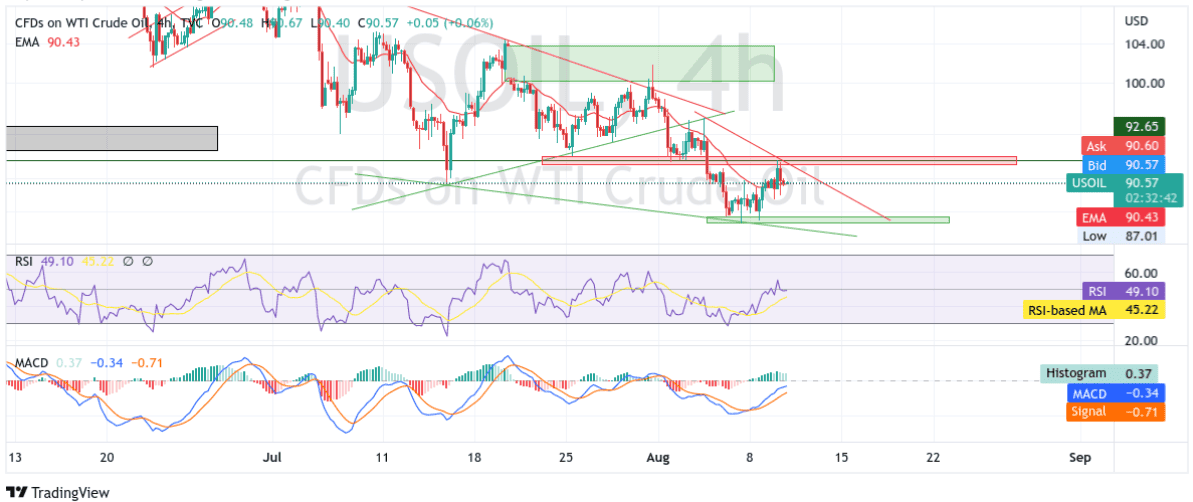

WTI Crude Oil Price Outlook: Four-hours Price Outlook

From a technical perspective, using a four-hour price chart, the price has extended the modest pullback from the vicinity of 92.65 level after attracting new bearish bets in the last hour or so on Tuesday. Some follow-through selling would push the asset towards testing the key demand zone turned support level ranging from 86.95 - 87.59 levels which would act as a barrier against the asset. That said, the barrier, if broken decisively, would be seen as a fresh trigger for bears to continue pushing down the price and pave the way for additional losses.

The RSI(14) level at 49.10 level is in bearish territory and not far away from the oversold condition. Additionally, acceptance below The 20 at 90.46 level adds credence to our bearish filter.

On the Flipside, a pullback toward testing the key supply zone turned resistance level ranging from 92.11- 93.02 level followed by a convincing break above the aforementioned zone would negate any near-term bearish bias and pave the way for technical buying.