EUR/GBP Stick To Modest Gains Above 0.85400s Level

- EUR/GBP gained positive traction on Tuesday to lift spot prices to near a five-week high

- The growing risk of European interest rate hikes caused European stocks to slump and push bond yields higher, exerting upward pressure on the pair

- A combination of factors undermines the British Pound and offers support to the major

EUR/GBP pair prolonged its recent strong move over the past six days and gained traction for the fourth successive day on Tuesday. The momentum lifted spot prices to a five-week high, around the 0.85423 - 0.85502 level region during the first half of the Asian Session.

On the European economic data front, European Central Bank Board Member Isabel warned on Saturday that the central banks risk losing public trust and must act forcefully to curb inflation, even if that drags their economies into a recession. Most investors interpreted this as a hawkish tone and, in turn, was seen as a key factor that underpinned the Euro and exerted upward pressure on the pair. Her remarks came a day after FED chairman Jerome Powell made it crystal clear in his speech at the Jackson Hole symposium. The Job-fighting inflation remains unfinished, and they intend to push interest rates higher and keep them there longer than markets had expected.

Following Isabel's and Powell's remarks, European government bond yields jumped across the board, and as such, The 10-year Treasury yield traded at 13.64%, up more than 13bps. European stocks, however, were lower on Tuesday as all sectors and major bourses continued to slip into negative territory during morning deals in London on Monday. Tech stocks led the losses, down over 2%. Germany's DAX index fell more than 1.3%, France's CAC 40 index dipped around 1.6%, while Italy's FTSE MIB fell 1%.

However, Isabel's remarks were not welcomed by many market analysts, "I struggle to understand the sense of sharp (ECB) interest rate hikes. The big problem is the energy supply, and right now it doesn't look like we can get out any time soon", said Carlo Franchini, head of Institutional Clients at Banca Ifigest in Milan.

Energy supply fears across Europe resumed on Tuesday, pushing natural gas futures higher as energy supplies to Germany from Nord Stream 1 pipeline by Russia under the Baltic Sea will remain shut for three days due to unscheduled maintenance from Wednesday, adding further fuel to the inflation bonfire across Europe. This contributes directly to pushing up energy bills across the eurozone, further denting the market sentiment. It is worth noting that gas is a major source of electricity generation; a surge in gas prices leads to an increase in electricity prices.

The Bank of England expects consumer price inflation to top 13.3% in October. The country's average energy bills (set via a price cap) are expected to rise sharply in the fourth quarter to eventually exceed an annual £4,266 ($5,170) in early 2023. This came after new data showed that U.K. inflation jumped to a 40-year-high of 10% in July. It is also worth remembering earlier this month, The Bank of England issued a dire outlook for economic growth against the backdrop of its largest interest rate hike announcement by 50bps since 1995. Going forward, due to the high inflation rate in the U.K. and the ongoing energy crisis, Consumer purchasing power has significantly gone down as wage increases have also failed to keep pace with the surging cost of living. A recent survey also showed consumer confidence had fallen to its lowest level since records began in 1974.

Rail strikes recently in the U.K. have already brought the country to a halt on multiple days throughout the summer and look set to continue. In contrast, postal workers, telecoms engineers, and dock workers have all voted to strike as inflation erodes real wages. That said, the ongoing political turmoil in the U.K. was another contributing factor behind the British Pound's relative underperformance and is seen as lending some support to the major.

As we advance, the market focus now shifts toward the Eurozone HICP data report scheduled for Wednesday. The HICP data is expected to land higher at 9% than the prior release of 8.9%. Additionally, investors will look for cues from Eurostat out of the European CPI.

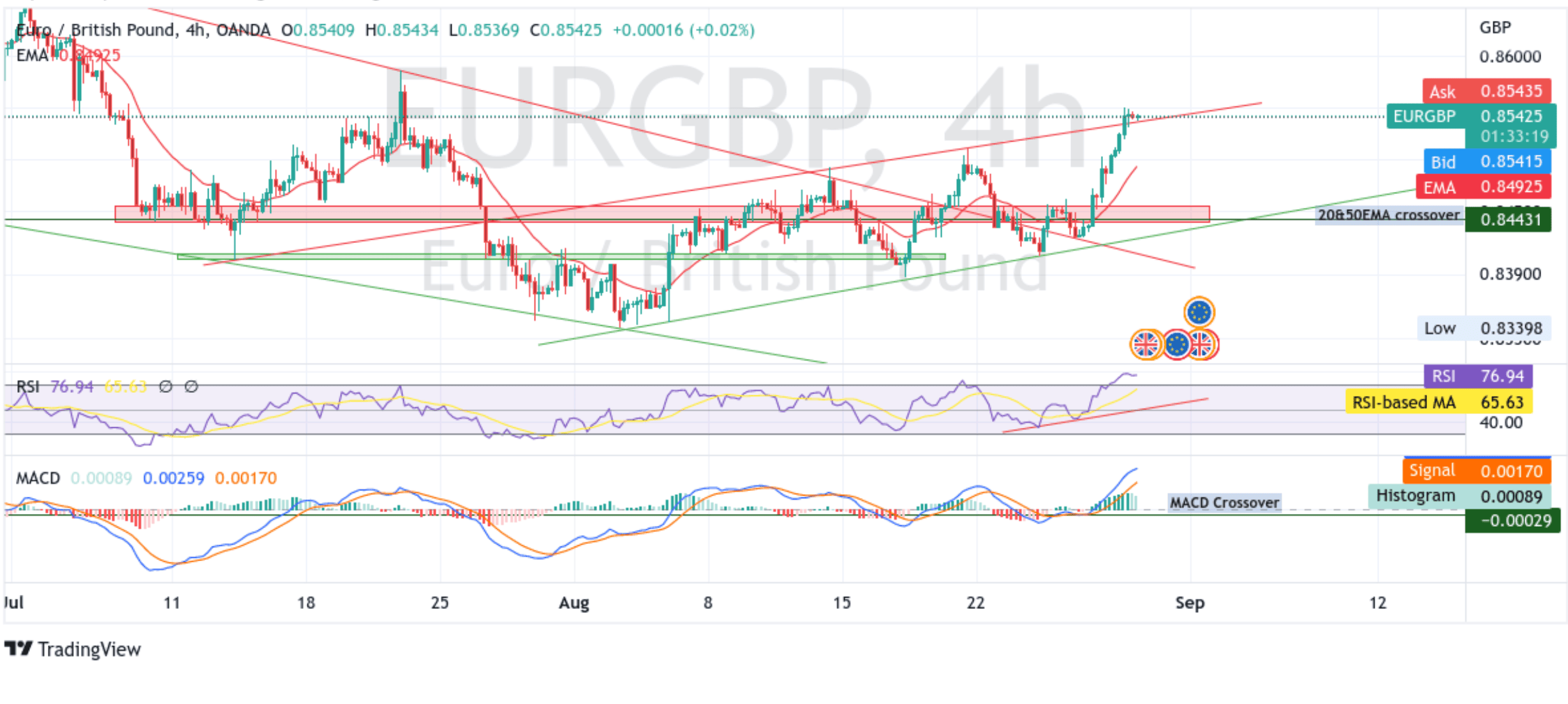

Technical Outlook: Four-hour EUR/GBP Price Chart

From a technical perspective, spot prices are now looking to extend the momentum beyond the upward-sloping trend-line of the ascending channel pattern from the mid-July 2022 swing low. The previous day's mid-day strong move beyond the 0.85347 level confirmed a solid bullish breakout and supported prospects for additional gains. Some follow-through buying would lift spot prices towards an immediate hurdle(supply zone) ranging from 0.85652 - 0.85840 levels. The aforementioned zone would act as a barricade against the pair against any further uptick, however, sustained strength beyond would be seen as a new trigger for bulls to continue pushing the price up and pave the way for additional gains.

The RSI(14) level at 76.94 is flashing extreme overbought conditions and warrants some caution ahead of this week's key events/data risks. The moving average convergence divergence (MACD) crossover at -0.00029 paints a bullish filter. Additionally, The 20 and 50 Exponential Moving Average(EMA) crossover at the 0.84431 level further adds to the upside bias.

On the flip side, any meaningful pullback now seems to find some support near the 0.85340 - 0.85399 level. This is followed by the 0.85300 round-figure mark, which, if broken decisively, will negate the positive outlook and prompt technical selling around the pair. The downward trajectory could then accelerate toward the next relevant support (demand zone), ranging from 0.84394 - 0.84560 levels.