GBP/JPY Seems Vulnerable After Hot UK Inflation; UK's Retail Sales Data Awaited

- GBP/JPY pair attracts fresh selling on Thursday to extend the previous day's modest pullback

- U.K.'s inflation rate jumps to a record high

- Positive Japan macro data extend some support to the safe-haven Japanese Yen

GBP/JPY Pair declined on Thursday, remaining under bearish pressure, and dropped to a daily low below 162.647 amid the risk-averse. Following minor tepid gains and losses earlier, the asset met fresh supply on Thursday during the early part of the Asian session. It extended Wednesday's modest pullback from 163.367 - 163.583 levels.

U.K. inflation rose to another 40-year high in July as spiralling food and energy prices intensified the country's historic squeeze on households. The consumer price index rose 10.1% annually, according to estimates published by the Office for National Statistics on Wednesday, above a Reuters consensus forecast of 9.8% and up from 9.4% in June. Additionally, Core inflation, which excludes energy, food, alcohol, and tobacco, came in at 6.2% in the year to July 2022, rising from 5.8% in June and ahead of projections of 5.9%.

The office for national statistics said that July's increase in prices –0.6% in the month alone — was unusual because prices generally fall in July at a time of high street sales. In fact, following Wednesday's inflation data U.K.'s inflation rate was more significant than in other G7 countries and highlighted the difficult task the bank of England faces to bring inflation down. That said, market investors now expect the Bank of England (BOE) would look to further hike its interest rate to tackle the surging inflation in its upcoming monetary policy committee minutes report on 15 September.

Short-dated U.K. government Bonds reacted positively to the report, and as such, the yield on the 2-year Gilt was up more than 29 basis points to reach 2.441%, before moderating slightly. The yield on the 10-year Gilt also rose by more than 11 basis points, and the 5-year yield climbed 16 basis points.

However, the market investor's decision to wait on the sidelines against submitting any aggressive bids on the brink of U.K.'s retail sales data was also seen as a key factor that undermined the Cable and exerted downward pressure on the GBP/JPY pair.

On the Japanese docket, positive macro data from Japan offered some support to the safe-haven Japanese yen and drove flows away from the Cable. Japan's Trade Balance (YOY) came at -1.436 Billion Yen against an initial expectation of -1.405.0 Billion Yen and a prior figure of -1.398.5 Billion Yen. The values of exports and imports in Japan increased in July, according to the latest data released by the Japan Ministry of Finance on Wednesday. Exports value was up by 8.72Billion Yen from 7.352 Billion Yen in July 2021 or by 19%, and the Imports Value was up by 10.189 Billion Yen up from 6.92 Billion Yen in July 2021 or by 47.2%. The readings confirmed that the Japanese economy was on the recovery path after facing many headwinds due to the impact of COVID-19 and the rise in commodity prices.

As we advance, in the absence of significant market-moving economic news data from both dockets, the focus now shifts toward the U.K. Core retail sales report scheduled for release on Friday during the early European session. The report would give fresh insight into the economy's health and influence the near-term GBP price dynamics. This, in turn, should assist traders in determining the next leg of a directional move for the GBP/JPY pair.

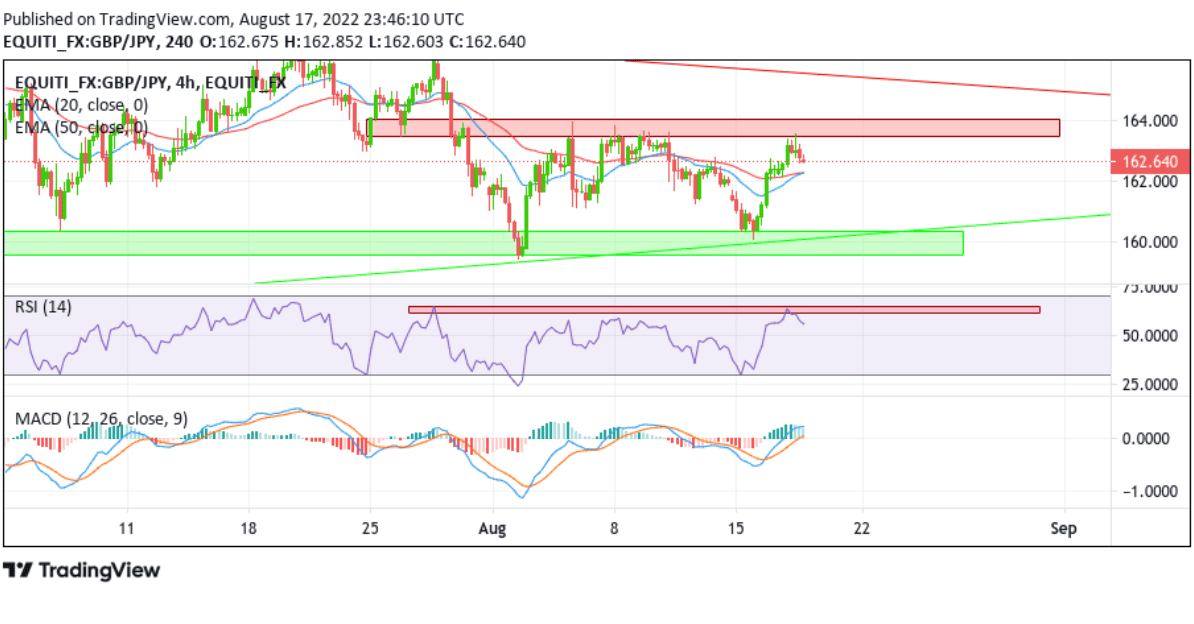

Technical Outlook: GBP/JPY Four-Hour Price Chart

From a technical perspective, using a four-hour price chart, the price has extended Wednesday's modest pullback from 163.367 -163.583 levels. Some follow-through selling has the potential to drag the GBP/JPY pair towards testing the key Demand zone ranging from 159.532 - 160.341 levels. The aforementioned zone coincides with the lower horizontal trendline of the bearish pennant formation plotted from 12 May and would act as a barricade against the pair. Sustained strength below the Demand zone and the trendline would negate any near-term bullish outlook and pave the way for aggressive technical selling.

All technical indicators point to strong bullish momentum, and the recent pullback could be short-lived. That said, the RSI(14) level at 53.61 level is still far away from oversold conditions but displays an extension of the modest pullback from the 63.5429 level. The 20 and 50 Exponential moving average (EMA) points are flat-lined at the 162.258 level (which will act as a barrier toward any meaningful downside). However, a crossover between the aforementioned EMA's will add to the bearish filter. Subsequently, a Moving Average Convergence Divergence (MACD) crossover later today will add to the bearish credence.

On the Flipside, a pullback toward testing the key Supply zone followed by a subsequent break above the zone would negate any near-term bearish bias and pave the way for technical buying.