EUR/GBP Rebounds Swiftly From Weekly Low, Retakes Late 0.86800s As Markets Await German CPI Data

- EUR/GBP pair rebounds swiftly and moves back above the late 0.86800s

- A combination of factors is a tailwind to the Euro and helps cap the EUR/GBP pair against further downtick

- Firming hawkish BOE expectations continue to work as a tailwind to the Cable

- Markets await the release of German CPI data, which is expected to show easing inflation pressures in Germany

The EUR/GBP cross attracted some dip buying in the vicinity of the 0.86842 level and staged a modest intraday recovery from the four-week low touched earlier this Wednesday. As per press time, the shared currency is up over 0.05%/4.5 pips for the day and looks set to maintain its bid tone heading into the European Session.

The sharp rebound in the EUR/GBP price could be attributed to the hawkish rhetorical comments by top ECB officials lately, who have been very vocal on the issue of inflation and interest rates in the eurozone area. During a panel discussion on Monday at the Forum New Economy, top ECB official Philip Lane explained why it is essential to slow nominal wage increases to restore purchasing power after price shocks. The markets have loosely translated this into more rate hikes are incoming, which has the desired effect of reducing the economic growth rate and, in turn, lower inflation. Overall, this should lead to lower nominal wage growth. Lane's comments came a day after Dutch Central Bank President Klass Knot said that the ECB interest rate hikes are starting to have an effect, but more will be needed to contain inflation. Knot added that he could still support lifting interest rates from the current level (3.25%) or even higher if inflation proves more sticky than he expects.

That said, the current price action also suggests that, following oversold conditions in the previous trading sessions, traders decided to take some profits off the table following the recent strong EUR/GBP bearish run.

However, further EUR/GBP uptick seems elusive amid upcoming German inflation figures, which could show easing inflation figures in the eurozone country, supporting the case for smaller rate hikes shortly and suggesting the path with the least resistance is to the downside. The German Consumer Price Inflation (CPI) data is lower at 0.4% in April, down from 0.8% in March, according to a German Federal Statistics Office preliminary report. On a year-to-year basis, the German CPI is expected to drop to 7.2% in April from 7.4% in March. If the data later today shows easing inflation in the eurozone area, this should act as a headwind to the euro and cap the EUR/GBP pair against further uptick. Additionally, firming market expectations that the Bank of England (BOE) will raise interest rates by 25bps later this week on Thursday continues to offer support to the cable and should limit any meaningful uptick for the EUR/GBP pair in the long run. A better-than-expected retail sales data report on Tuesday cemented markets' bets that the BOE will raise interest rates in its next monetary policy interest rate decision. A British Retail Consortium report on Tuesday showed that retail sales in the United Kingdom rose 5.2% on a like-for-like basis in April 2023 from a year ago, accelerating slightly from a 4.9% growth in March.

As we advance, investors look forward to the German CPI inflation data set for release during the early European session. The data will affect the euro's dynamics and provide directional impetus for the EUR/GBP pair.

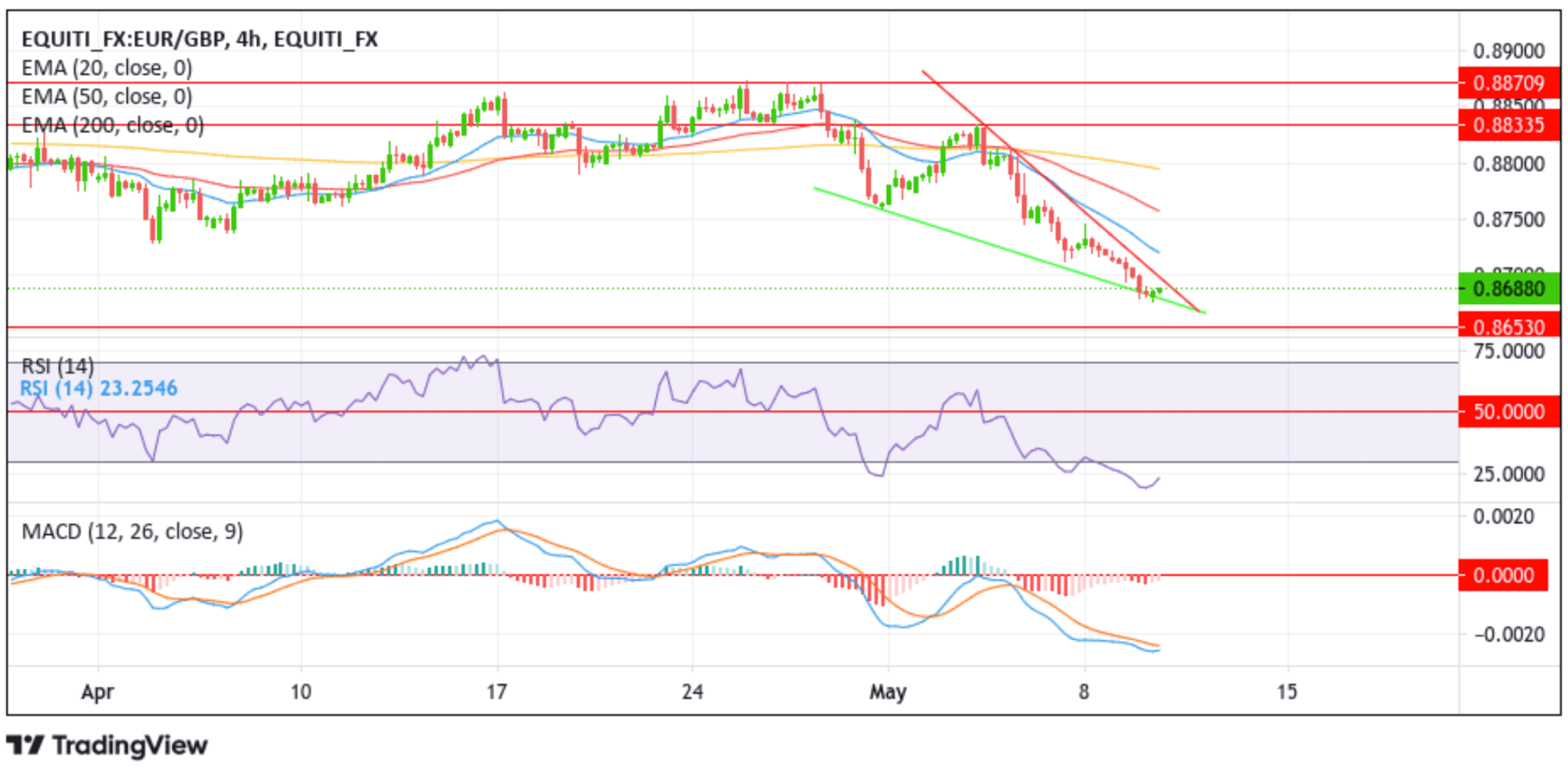

Technical Outlook: Four-Hours EUR/GBP Price Chart

From a technical perspective, the EUR/GBP cross is currently auctioning at the 0.86880 level, denoting a 0.05% gain for the day, and is sitting just a few pips below the key resistance level plotted by a descending trendline extending from May 2023 swing high. Increasing buying pressure beyond the aforementioned key resistance level will uplift the shared currency to tag the 20-day (blue) Exponential Moving Average (EMA) at 0.87203. A four-hour candlestick close above this level would pave the way for an ascent toward the 50-day (red) and 200-day (yellow) Exponential Moving Average (EMA) at 0.87544 and 0.87931 levels, respectively. If sidelined buyers join in from this supplier congestion zone, it will rejuvenate the bullish momentum, provoking an extended rally north toward the 0.88335 resistance level. A decisive flip of this resistance level into a support level would pave the way for a rally toward the 0.88709 resistance level.

On the flip side, if bears overpower the bulls again, EUR/GBP could drop toward the immediate support level plotted by a descending trendline extending from the late-April 2023 swing low. A convincing move below this (bearish price breakout) would invalidate any near-term bullish thesis and pave the way for a decline toward the 0.86530 support level.