Sterling Pound Rises Slightly Above $1.26500 Mark On Upbeat UK BRC Retail Sales Data, U.S. CPI Data Looms

Key Takeaways:

- GBP strengthened slightly above the $1.26500 mark on Tuesday during the Asian session, supported by fresh, upbeat U.K. macro data

- The stronger-than-expected UK BRC retail sales data underpins the cable and helps cap the downside for the GBP/USD cross

- The U.S. Dollar Index (DXY) oscillates above the 104.180 mark on Tuesday but remains 0.36% down for the week, which helps keep Cable prices elevated

- Markets look forward to the release of the key U.S. inflation data report on Wednesday

The Great British Pound (GBP) rose to around $1.26539 per U.S. dollar on Tuesday during the Asian session on fresh, upbeat U.K. macro data released earlier. The major currency pair, however, lacks clear direction and trades sideways this morning as investors await the release of key U.S. inflation data on Wednesday.

Retail sales in the United Kingdom jumped 3.2% on a like-for-like basis in March 2024 from a year ago, the most robust growth since August last year, largely driven by early Easter, which drove up food sales ahead of the long weekend, a UK British Retail Sales Consortium report released earlier today showed. The March figure also accelerated from a one-year low of 1% logged in February and exceeded forecasts for a 1.8% gain. The rebound in consumption is attributed to an easing cost of living pressures.

The strong U.K. retail sales figures somehow reversed hopes of a June rate cut by the Bank of England (BoE). On Tuesday, investors repriced their bets for early rate cuts, submitting fresh bullish bids, thereby helping the cable appreciate further against the buck.

Furthermore, positive signals from the Bank of England's (BoE) monetary policy indicators released last week further help to reverse hopes of a June rate cut for the time being.

Individuals in the United Kingdom borrowed £1.5 billion of mortgage debt on net in February 2024, compared to £1.1 billion of net repayments in January and market expectations of £0.15 billion of net repayments. This was the highest borrowing since January 2023, as interest rates on newly drawn mortgages fell sharply, a Bank of England report last week showed.

Additionally, net mortgage approvals for house purchases in the United Kingdom, an indicator of future borrowing, rose to 60.4 thousand in February 2024 from a revised 56.1 thousand in the previous month, exceeding market expectations of 56.5 thousand.

Shifting to the U.S. docket, the U.S. Dollar Index (DXY), which measures the greenback against a basket of currencies, has been oscillating above the 104.180 mark on Tuesday during the Asian session, a scenario that explains why the major currency has been trading in a sideways direction for the better part of the Asian session. The U.S. Dollar Index, however, remains 0.36% down for the week, weighed by uncertainty about the timing of the rate cuts and rising geopolitical risks.

A U.S. Bureau of Labor Statistics (BLS) report released on Friday showed the U.S. economy added 303K jobs in March 2024, the most in ten months, compared to a downwardly revised 270K in February and forecasts of 200 K. The data shows that the U.S. labor market continues to be tight despite strong efforts by the Fed to control it.

Numbers this substantial significantly decrease hopes that the Federal Reserve (Fed) will consider cutting rates during the June meeting. CME's Fed Watch tool also shows fed fund futures traders are now at a cross-road of 50-50% of a June rate cut.

That said, incoming U.S. CPI data will further help determine the trajectory of the Fed's policy move and indicate whether the Fed will start cutting rates in June. According to market consensus, the U.S. CPI is expected to have dropped slightly to 0.3% in March from 0.4% in February. Excluding food and energy, the U.S. CPI is expected to have dropped slightly to 0.3% in March from 0.4% in February.

As we advance, without any significant market-moving economic news data, the Treasury bond yields and the general market risk sentiment will continue to influence U.S. dollar dynamics and ultimately provide directional impetus to the GBP/USD cross. The main focus, however, remains on the release of the key U.S. inflation data report on Wednesday.

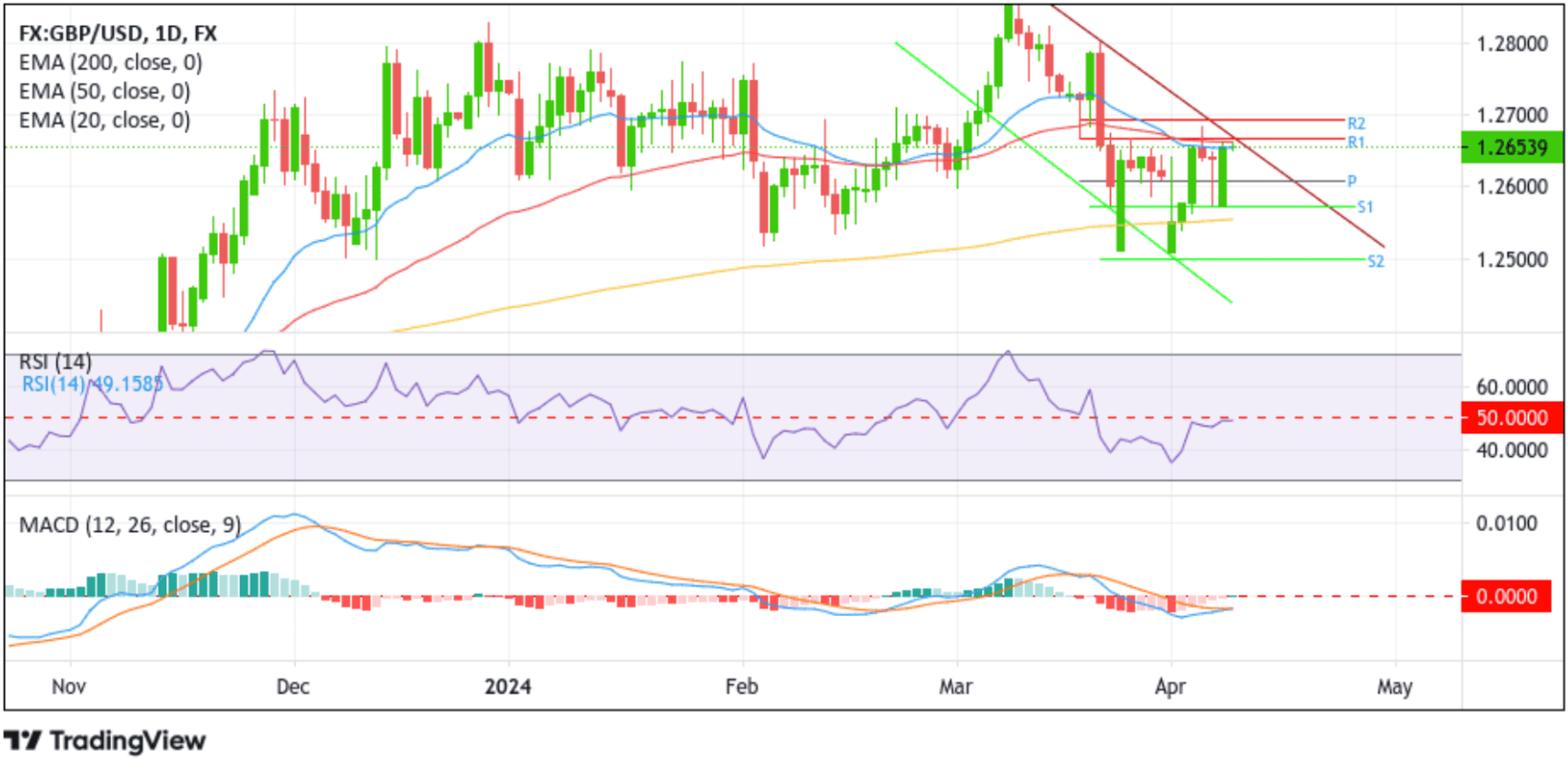

Technical Outlook: One-Day GBP/USD Price Chart

GBP/USD is trading directly above the upper limit of the multi-week-old descending channel pattern following an extension of the modest pullback from the 1.25727 support level touched on Monday. Looking at the broader picture, any further buying seems like a selling opportunity, as above the current price level lies heavy overhead resistance, which the price has failed to break the last two times. Moreover, the technical oscillators on the daily chart (RSI14 & MACD) hold negative territory and support prospects for further selling.

Thus, a bearish price reversal will find initial support at the 1.26073 level (P). A decisive move below this level will pave the way for an accelerated drop toward the 1.25727 support level (S1), about which, if this level fails to hold, the price could drop further to tag the 200-day (yellow) EMA level at 1.25539 level. A subsequent acceptance below this level will act as a fresh trigger for new sellers to jump in, paving the way for an accelerated drop toward the 1.24983 crucial support level (S2). A clean move below this level would turn the major currency pair vulnerable to a decline toward the lower limit of the multi-week-old descending channel pattern.