NZD/USD Retreats After A Minor Correction & Drops Below 0.62800, A Slew Of Speeches From FOMC Members Awaited

- NZD/USD pair witnesses selling in mid-Asian session remains confined below 0.62800 mark

- A combination of factors assists the U.S. dollar in rebounding modestly, in turn, caps NZD/USD against the further uptick

- Diminishing odds for an aggressive Reserve Bank of New Zealand (RBNZ) combined with negative China macro data continue to undermine the Kiwi

- Markets now await speeches from influential FOMC members for fresh clues regarding future monetary policies

NZD/USD cross attracted some selling during the mid-Asian session to rebound modestly from the vicinity of the 0.62855 level after seesawing earlier between tepid gains and minor losses. As per press time, the shared currency is still up over 0.15% for the day and is trading with minor losses below the 0.62800 mark.

The modest U.S. dollar rebound on Monday amid the prevalent cautious mood was seen as a key factor that supported the NZD/USD pair and helped cap the pair against further uptick. The U.S. Dollar Index (DXY), which measures the value of USD against a basket of currencies, however, remains under heavy bearish pressure and the current price action risks chances of fizzling out sooner or later amid ongoing decline in treasury bond yields, which continues to undermine the greenback. Apart from this, signs of stability in the U.S. equity markets could further undermine the safe-haven greenback and help cap the NZD/USD pair against further losses for the time being. Additionally, the U.S. Debt Ceiling talks took a different turn over the weekend as negotiations were paused. McCarthy's representative said the "White House is not being responsible with its request". This, in turn, came as a hit to the greenback after ticking higher late last week, supported by the positive progress made that week on Tuesday.

Despite the combination of negative factors, the upside seems limited amid firm market expectations of a hawkish Fed at the next monetary policy meeting. Apart from this, signs of a potential recession in the U.S., sticky inflation, and more robust job growth remain supportive of the greenback, suggesting the downside is the path of least resistance for the shared currency. Additionally, diminishing odds for an aggressive Reserve Bank of New Zealand (RBNZ) amid easing inflation pressures in New Zealand continue to undermine the Kiwi and suggest the path of least resistance is to the downside.

Further limiting the Kiwi are the softer Chinese macroeconomic readings last week, which showed China's post-Covid rebound had stalled, increasing worries about a global economic downturn. The Kiwi is further weighed down by the decision of China's Central Bank to maintain its key lending rates steady for the ninth straight month at the May fixing. The one-year loan prime rate (LPR), which the medium-term lending facility uses for corporate and household loans, was left unchanged at 3.65%; while the five-year rate, a reference for mortgages, was kept at 4.3%. The move came after the central bank held its medium-term policy rate at 2.75% last week.

As we advance, investors look forward to the U.S. docket featuring St. Louis and Atlanta Fed Presidents; James Bullard and Raphael Bostic's speeches during the early North-American session.

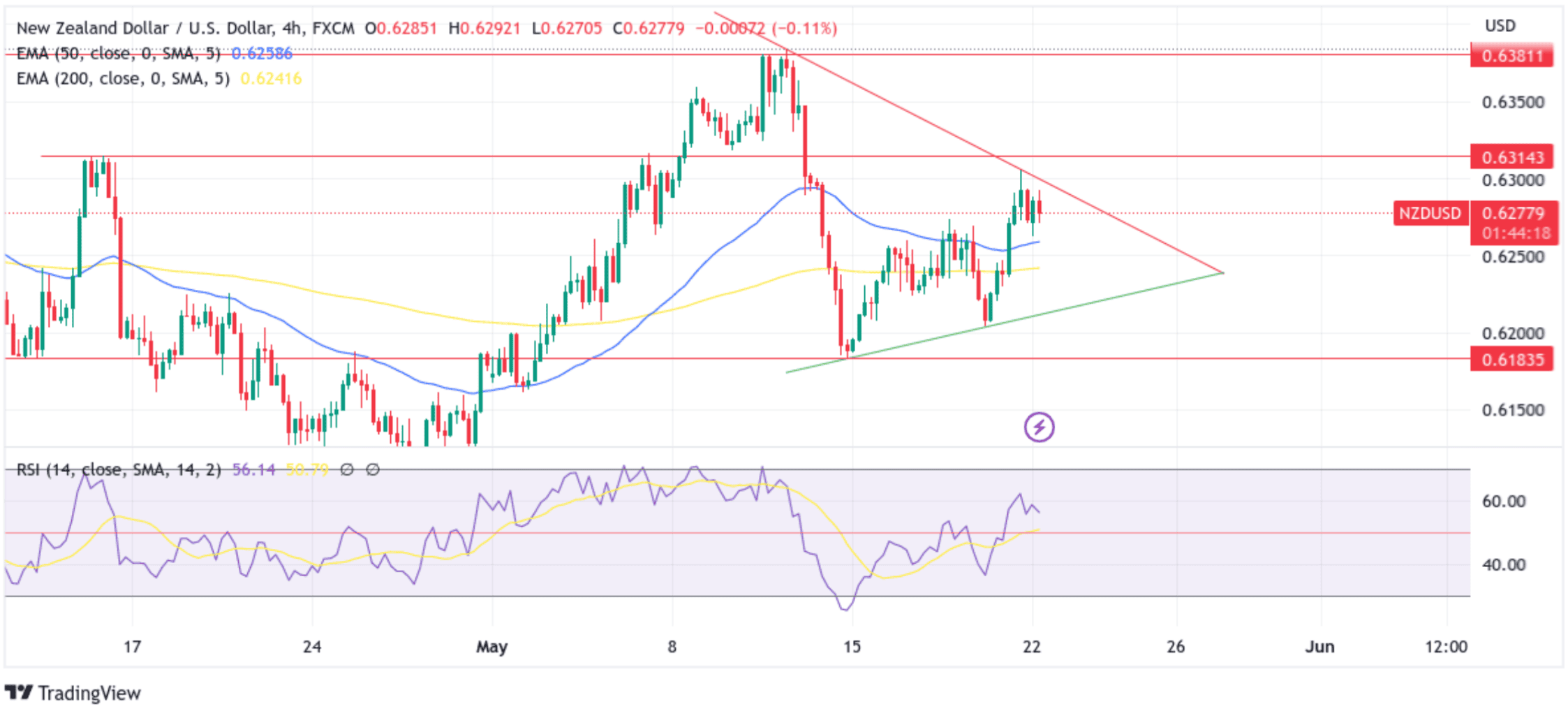

Technical Outlook: Four-Hours NZD/USD Price Chart

From a technical perspective, a further increase in selling pressure could drag spot prices toward tagging the 20 (blue) day Exponential Moving Average at the 0.62597 level before a possible neck down toward confronting the technically strong 200 (yellow) day Exponential Moving Average at the 0.62424 level. Sustained weakness below the latter could negate any near-term bullish outlook and act as a new trigger for sidelined sellers to join, hence rejuvenating the bearish momentum and provoking an extended decline toward the key support level plotted by an ascending trendline extending from the mid-May 2023 swing low. A break below this support trendline (bearish price breakout) could see the shared currency accelerate its decline toward confronting the 0.61835 support level.

On the flip side, suppose dip-buyers and tactical traders jump back in and trigger a bullish reversal. In that case, the price will face initial resistance at the resistance level plotted by a descending trendline extending from the mid-May 2023 swing high. A breach of this resistance level (bullish price breakout) could pave the way for a short rally above the 0.63000 psychological mark toward confronting the 0.63143 resistance level. A subsequent break above this level could pave the way for a northbound rally toward confronting May 2023 swing high at 0.63838. A decisive flip of this resistance level into a support level could pave the way for further gains around the NZD/USD pair.