USD/CNH Rises Modestly On Mixed Chinese PMI Data, Focus Shifts Toward Fed's Decision

Key Takeaways:

- USD/CNH rose on Wednesday during the Asian session to trade just a few pips below the 7.19000 mark

- A combination of factors extends support to the buck and helps cap the downside for the pair

- Mixed Chinese macro data undermines the Chinese Yuan and helps exert upward pressure on the USD/CNH pair

- The market's focus shifts toward the Fed's interest rate decision

USD/CNH pair built on its earlier bounce from the sub-7.18000 levels and gained positive traction for the fifth successive day on Wednesday. As of press time, the cross is placed just below the 7.1900 mark, posting a 0.04% daily gain, and looks set for further gains heading into the European session amid the prevalent tone surrounding the buck.

A modest resurgence in U.S. dollar demand earlier today was a key factor helping cap the downside for the USD/CNH cross. The cautious mood ahead of today's Fed decision continues to temper investors' appetites for risk-perceived assets. This was evident from a weaker tone around the equity markets, which could help drive further flows towards the USD/CNH cross.

Additionally, a mixed batch of Chinese PMI data released earlier today further undermines the Chinese Yuan (CNH) and helps exert upward pressure on the USD/CNH pair. A National Bureau of Statistics (NBS) report released earlier today showed Chinese factory activity shrank for the fourth straight month in January. The official Manufacturing PMI in China was at 49.2 in January 2024, matching forecasts and edging higher from December's 6-month low of 49.0. Additionally, China's official NBS Non-Manufacturing PMI increased to 50.7 in January 2024 from 50.4 in December, slightly above market forecasts of 50.6.

The upbeat job data released on Tuesday further extend support to the buck. A U.S. Bureau of Labor Statistics (BLS) report showed that job openings surged by 101,000 from the previous month to 9.026 million in December 2023, the highest in three months and above the market consensus of 8.75 million.

During today's January Monetary Policy Meeting announcement, the buck continued to be supported by firm market expectations that the Fed will leave its benchmark rates unchanged at 5% - 5.25%. This comes after inflation in the U.S. continued to be sticky. In contrast, the labor market continued to be tight, suggesting that the Federal Reserve might prolong its hawkish stance into the second quarter, thus helping push back the idea of early rate cuts.

CME's Fed watch tool also shows fed fund futures traders have priced in a 97.9% chance that the Fed will keep the Fed funds rates unchanged at a 22-year high for a fourth consecutive meeting in January.

As we advance, investors look forward to the U.S. docket featuring the release of the Fed interest rate decision during the mid-North American session. Investors will look for cues in the FOMC statement that will accompany the Fed Interest Rate Decision and watch keenly the question-and-answer segment with Powell, the chair, during the FOMC press conference to see how hawkish/dovish the language is around inflation and future monetary policies.

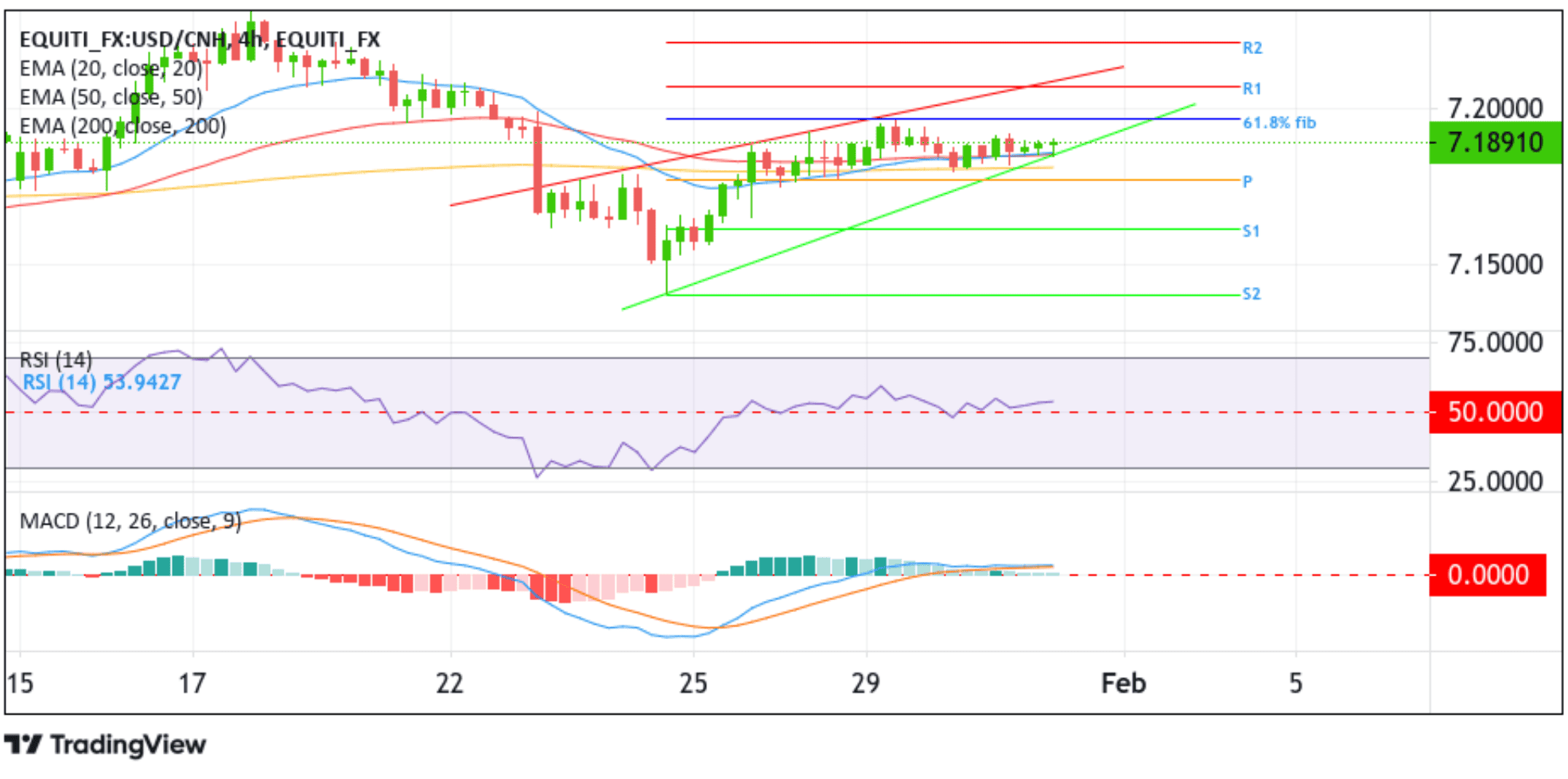

Technical Outlook: Four-Hour USD/CNH Price Chart

From a technical standpoint, the recent bounce from the lower limit of the rising wedge chart pattern extending from the late January 2024 swing lower-lows and the subsequent move-up favors buyers and supports the case for upside moves. Some follow-through buying would uplift spot prices toward the 61.8% Fibonacci retracement level of the January 17 – 24 downfall. A clean move above this level would act as a fresh trigger for buyers to place new bids, paving the way for an ascent toward the 7.2000 round mark en route to the 7.20688 level (R1). If the price pierces above this barrier, USD/CNH could rally further toward the upper limit of the rising wedge chart pattern, extending from the late January 2024 swing to higher highs.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes in at the key support level (lower limit of the rising wedge chart pattern). A subsequent break below this level will pave the way for a move toward tagging the technically strong 200-day (yellow) Exponential Moving Average (EMA) at 7.18227. A convincing move below this level will negate the near-term bullish outlook and pave the way for a drop toward the pivot level (p) at 7.17725, about which, if this level fails to hold, downside pressure could accelerate, paving the way for a fall toward the 7.16119 support level (S1), followed by the 7.14023 horizontal level.