UK FTSE 100 Index Extends Recovery Momentum Above Late 7400.00 Mark As BoE Holds Rates Unchanged At 5.25%

Key Takeaways:

- U.K.'s blue-chip FTSE 100 futures index extends BoE-inspired gains above the late-7400.0 mark

- Bank of England (BoE) held its overnight lending rate unchanged at 5.25% during its November meeting and dismissed the prospects of rate cuts anytime soon

- Ocado Group, Plc. (London: OCDO) and Entain, Plc. (London: ENT) led the list of top gainers and losers on Friday before the bell

- Markets await a slew of U.K. macro data for fresh UK FTSE 100 index directional impetus

The U.K.'s blue-chip FTSE 100 futures index prolonged its strong move-up witnessed over the past five days and gained traction for the fourth successive day on Friday, lifting spot prices to a fresh weekly high during the second half of the Asian session. As of press time, futures tied to the UK100 rose over 0.25%/(19.7 points) to settle above the $7474.00 level. The moves follow a winning day in the European markets, as London stocks jumped on Thursday, driven by rate-sensitive homebuilders and real estate stocks reactions to the latest Bank of England (BoE) decision. The exporter-focused FTSE 100 index climbed over 1.4% following the Central Bank's decision to register one of its most significant intraday gains over three weeks.

The Bank of England on Thursday maintained its benchmark interest rate at a 15-year high of 5.25% for the second consecutive time during its November meeting, as policymakers evaluated recent signs of an economic slowdown in the U.K. while simultaneously grappling with the ongoing challenge of stubbornly high inflation. The Monetary Policy Committee voted 6-3 to keep rates unchanged, with three members advocating for a 25 basis points increase. The central bank also emphasized that monetary policy will likely remain restrictive for an extended period to steer inflation back towards the 2% target. Meanwhile, inflation projections were revised slightly higher. At the same time, the GDP growth forecasts suggest that the U.K. economy stagnated in the last quarter and will only experience marginal growth in the final three months of this year.

The immediate market implication of the Bank of England's decision saw the sterling pound rise 0.18% against the dollar before paring gains to close with modest gains above the 1.22000 round mark. Additionally, the benchmark FTSE 100 rose 0.19%

before following through to close with heavy gains above the 7460.00 mark and logging its best day in over three weeks.

That said, investors widely expected Thursday's decision as policymakers assessed recent indications of an economic slowdown in the U.K., contrasting them with the persistent challenge of significantly elevated inflation, which remains well above the 2% target.

On the economic data front, a U.K. Nationwide Building Society report on Wednesday showed nationwide housing prices in the United Kingdom increased to 0.9% (517.52 points) in October from 0.1% (514.30 points) in September 2023, beating market consensus of -0.4% (-254.0 points). Meanwhile, a Markit Economics report revealed the S&P Global/CIPS UK Manufacturing PMI was revised to 44.8 in October 2023, a slight decrease from the preliminary estimate of 45.2 and compared to September's 44.3.

UK FTSE 100 Index Movers

Here are the top UK FTSE 100 index movers today before the bell, a week in which the main index is set to close with heavy gains.

Top Gainers

• Ocado Group, Plc. (London: OCDO) rose 7.00%/33.30 points to trade at £509.20 per share.

• British Land, Co. (London: BLND) added 6.93%/20.60 points to trade at £318.00 per share.

• Just Eat Takeaway.com N.V. (London: JETJ) gained 6.27%/63.00 points to trade at £1068.00 per share.

Top Losers

• Entain, Plc. (London: ENT) lost 5.92%/55.60 points to trade at £884.40 per share.

• Hikma Pharma, Plc. (London: HIK) declined 4.40%/84.50 points to trade at £1835.50 per share.

• GSK Plc. (London: GSK) shed 1.90%/27.00 points to trade at £1396.00 per share.

Market participants now look forward to the U.K. docket featuring the release of the Services PMI (Oct) and the Composite PMI (Oct) data reports. The reports and broader market risk sentiment will influence the Sterling Pound and provide the UK FTSE 100 Index with directional impetus.

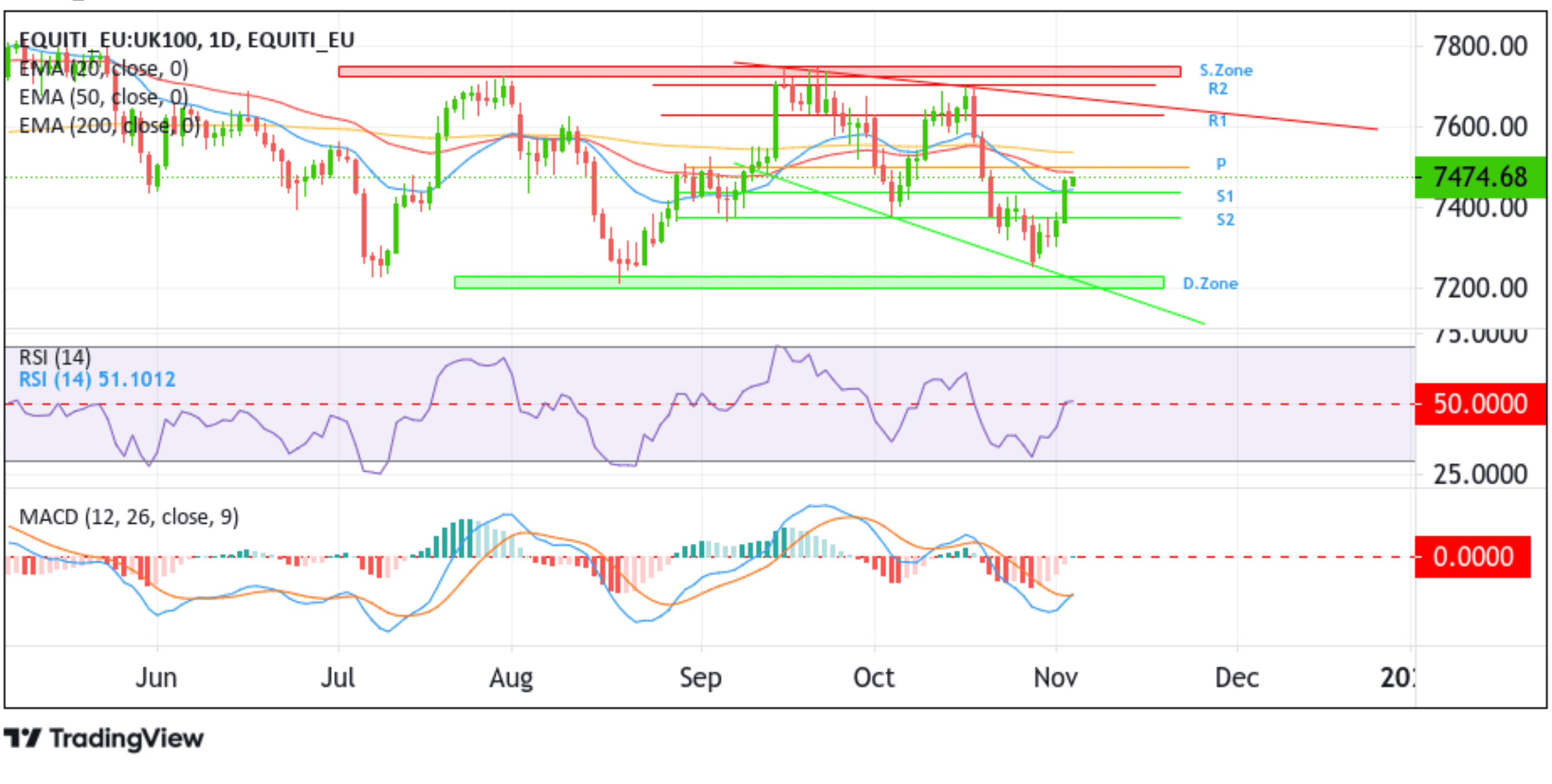

Technical Outlook: One-Day UK FTSE 100 Index Price Chart

From a technical standpoint, the UK 100 Index price extended the modest recovery from the vicinity of the 7255.5 level touched on October 27th and is currently trading with heavily bullish pressure above the $7474.00 level, posting a 2.73% weekly gain. A further increase in buying momentum from the current price level will uplift spot prices toward tagging the 50-day (red) Exponential Moving Average (EMA) at 7488.73 before ascending toward the key pivot level at 7502.40. A subsequent break above this key horizontal level will pave the way for a move toward confronting the technically 200-day solid (yellow) EMA level at 7536.78. A convincing move above this level would negate any near-term bullish outlook and pave the way for extending the recovery momentum toward the next relevant resistance level (R1) at 7627.40. Acceptance above this barrier will pave the way for the UK 100 Index to retest the key resistance level plotted by a downward-sloping trendline extending from the mid-September swing high. A decisive break above this resistance level will reaffirm the bullish outlook and pave the way for an ascent toward the 7702.06 resistance level (R2). On further strength, the main index could ascend further toward confronting the supply zone, ranging from 7747.90 to 7725.81 levels. Sustained strength above this barricade will pave the way for more gains around the benchmark FTSE 100 index.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support appears at the 7437.68 level (S1). If sellers manage to breach this floor, the main index could drop toward the 7375.90 support level (S2). A subsequent break below this level could see the main index accelerate its decline toward confronting the demand zone, ranging from 7230.31 - 7201.78 levels. Sustained strength below this barricade, followed by acceptance below the key support level, plotted a downward-sloping trendline extending from the early-October swing high will pave the way for dip losses around the main index.