USD/CHF Sticks To Fed-Inspired Losses And Weakens Below 0.90500 Mark, Swiss Inflation And U.S Initial Jobless Data Awaited

Key Takeaways:

- The USD/CHF pair extended the overnight retracement slide and moved back below the 0.90500 mark

- Retreating Treasury bond yields bolstered by a dovish Fed undermines the buck and helps exert downward pressure on the USD/CHF cross

- Better-than-expected Swiss retail sales data extend support to the Swiss Franc (CHF)

- Markets await the release of Swiss inflation data and the U.S. initial jobless claims data report for fresh directional impetus

The USD/CHF cross extends its overnight slide from the vicinity of the 0.91127 level, or the monthly high, drifts lower for the third consecutive session on Thursday. As of press time, the shared currency is trading in heavy losses below the 0.90500 round mark and looks set to maintain its bid tone heading into the European session.

The ongoing decline in U.S. Treasury bond yields forced the U.S. dollar to trim most of its gains from early last week. It was last seen trading in modest losses below the 106.300 round mark, which in turn was seen as a key factor that drove flows towards the Swiss Franc (CHF) and helped cap the upside for the USD/CHF cross. Apart from this, the generally positive sentiment surrounding the U.S. equity markets was another factor that undermined the buck and helped exert downward pressure on the USD/CHF cross.

The Federal Reserve (Fed) on Wednesday announced its decision to keep its benchmark policy rate steady at 5.25% to 5.5% during its November meeting, matching market expectations and marking the second consecutive time the U.S. central bank has decided to hold rates in the current policy-tightening cycle while also reflecting policymakers' dual focus on returning inflation to the 2% target while avoiding excessive monetary tightening.

The accompanying monetary policy statement noted that the committee is still "determining the extent of additional policy firming" needed to achieve its goals. "The Committee will continue to assess additional information and its implications for monetary policy," the statement said.

In a post-interest rate announcement press conference, Fed Chair Jerome said, "The process of getting inflation sustainably down to 2% has a long way to go." He stressed that the central bank hasn't made any decisions yet for its December meeting, saying that "the committee will always do what it thinks is appropriate at the time." Powell added that the FOMC needs to consider or discuss rate reductions now, shutting down the belief that it may be challenging to hike rates following two consecutive pauses.

Wednesday's decision was widely expected after surging Treasury yields pushed longer-term interest rates sharply higher, making it less necessary for the Fed to raise rates yesterday. Additionally, the dovish rhetorical comments by top Fed officials in recent weeks suggested the likelihood of a second pause in November.

That said, the immediate market implications following the Fed's decision saw U.S. Treasury bond yields tumble, with the 2-year Treasury note most susceptible to fed rate hikes declining 11 basis points to 4.96%. In comparison, the yield on the 10-year Treasury dropped about 11 basis points to 4.766%. The U.S. dollar, on the other hand, fell by as much as 0.4% (0.432 points) and is currently trading under heavy bearish pressure, which in turn is seen as a key factor exerting downward pressure on the pair.

Further contributing to the sentiment around the USD/CHF cross was the impressive Swiss macro data, which showed retail sales in Switzerland declined 0.6% year-on-year in September 2023, slowing from an upwardly revised 2.2% fall in the previous month. To a greater extent, the better-than-expected Swiss retail sales figures overshadowed a drop in manufacturing activity in Switzerland last month. That said, any surprises to the incoming Swiss inflation data could support the Swiss franc (CHF), which would help exert further bearish pressure on the USD/CHF cross.

As we advance, investors look forward to the Swiss docket featuring the release of the Consumer Price Inflation (CPI) (MoM) (Oct) data report. Investors will further look for cues from the release of the U.S. Initial Jobless Claims (previous week), U.S. Nonfarm Productivity (QoQ) (Q3), and the U.S. Factory Orders (MoM) (Sep) data reports.

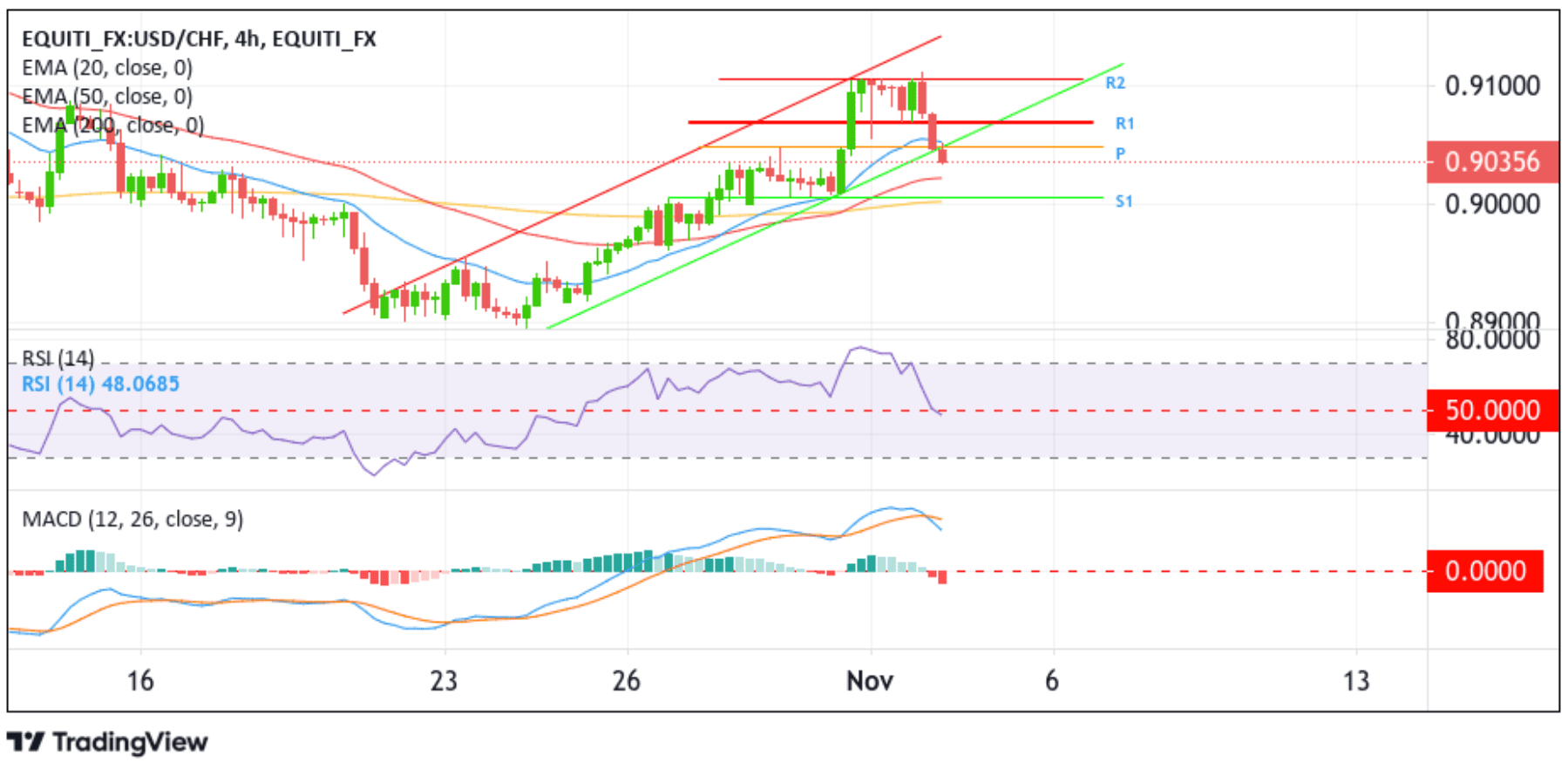

Technical Outlook: Four-Hour USD/CHF Price Chart

From a technical standpoint, the price's ability to break below the lower limit (key support level) of the ascending channel pattern on Thursday during the mid-Asian session favors sellers. It supports the case for further sell moves. A further increase in selling momentum will drag spot prices to tag the 50-day (red) Exponential Moving Average (EMA) at the 0.90231 level. Acceptance below this level will pave the way for a drop toward the 0.90061 support level (S1), which sits above the technically strong 200-day (yellow) EMA level at the 0.90026 level. Sustained weakness below these levels would negate the bullish outlook and act as a new trigger for side-lined sellers to join, hence rejuvenating the bearish momentum and provoking an extended decline below the 0.90000 psychological mark toward the next relevant support level at the 0.89849 level.

On the flip side, suppose dip-buyers and tactical traders jump back in and trigger a bullish reversal. In that case, initial resistance comes in at the key support level (lower limit of the ascending channel pattern) plotted by an ascending trendline extending from the late-October 2023 swing low now turned resistance level. A subsequent break above this key level, followed by acceptance above the 0.90481 pivot level (P), will pave the way for an ascent toward attacking the 0.90694 resistance level (R). On further strength, USD/CHF could rally further toward the 0.91062 resistance level (R2) and, in highly bullish cases, could extend a leg-up toward retesting the upper limit (key resistance level) of the ascending channel pattern.