USD/CHF Moves Back Close To A One-Week Low On Fresh U.S. Dollar Supply; Focus Remains on U.S. CPI Data

Key Takeaways:

- The USD/CHF pair moved back closer to a one-week low, just below the 0.84600 mark, during the mid-Asian session

- Retreating U.S. Treasury bond yields acts as a headwind to the safe-haven buck and helps cap the upside for the USD/CHF cross

- Softer Swiss domestic consumer inflation figures support the case for a less hawkish SNB, which weighs on the Swiss Franc (CHF)

- The market's focus remains on the release of the U.S. consumer price inflation figures for fresh USD/CHF directional impetus

The USD/CHF pair extended its recent sharp pullback from the 0.85764 - 0.85757 region or the monthly high and witnessed selling for the third successive day on Tuesday. This also marked the fourth day of a negative move in the previous six and dragged spot prices near a one-week low, just below the 0.84600 mark during the mid-Asian session.

The modest pullback in U.S. Treasury bond yields and a softer risk tone undermine the greenback and help cap the upside for the USD/CHF pair. The generally positive tone around the U.S. equity markets further undermines the safe-haven buck. It drives flows toward the risk-sensitive Swiss Franc, prompting further follow-through buying around the USD/CHF pair. Additionally, the buck continues to be weighed down by a New York Fed report on Monday, which showed that U.S. consumers' projection of inflation over the short run fell to the lowest level in nearly three years in December.

A drop in inflation closer to the Fed's 2% annual target would make it more likely that the U.S. central bank will cut rates in the coming months.

Further weighing on the buck and contributing to the sentiment around the USD/CHF pair is the decision by investors to stay on the side-lines ahead of the release of the U.S. inflation data report on Thursday. According to a consensus report, headline inflation in the U.S. is expected to have jumped modestly to 0.2% in December from 0.1% in November. Excluding food and energy, inflation in the U.S. is expected to have dropped to 0.2% from 0.3% in November.

That said, diminishing doubts over early interest rate cuts by the Federal Reserve remain supportive of retreating Treasury bond yields and continue to act as a headwind to the buck.

Atlanta Federal Reserve President Raphael Bostic said on Monday that his bias was towards keeping monetary policy tight with inflation still above the central bank's 2% target. However, he reiterated his earlier view that he does anticipate rate reductions this year, with two-quarter percentage point cuts likely needed by the end of 2024.

Shifting to the Swiss docket, a Swiss Federal Statistics Office report released on Monday showed that the Consumer Price Index in Switzerland decreased by 0% in December 2023 over the previous month. The softer Swiss domestic consumer inflation figures support the case for a less hawkish central bank shortly, which in turn acts as a headwind to the Swiss Franc.

As we advance, investors look forward to the U.S. docket featuring the release of the Trade Balance (Nov) data report. The main focus, however, remains on Thursday's U.S. inflation data report.

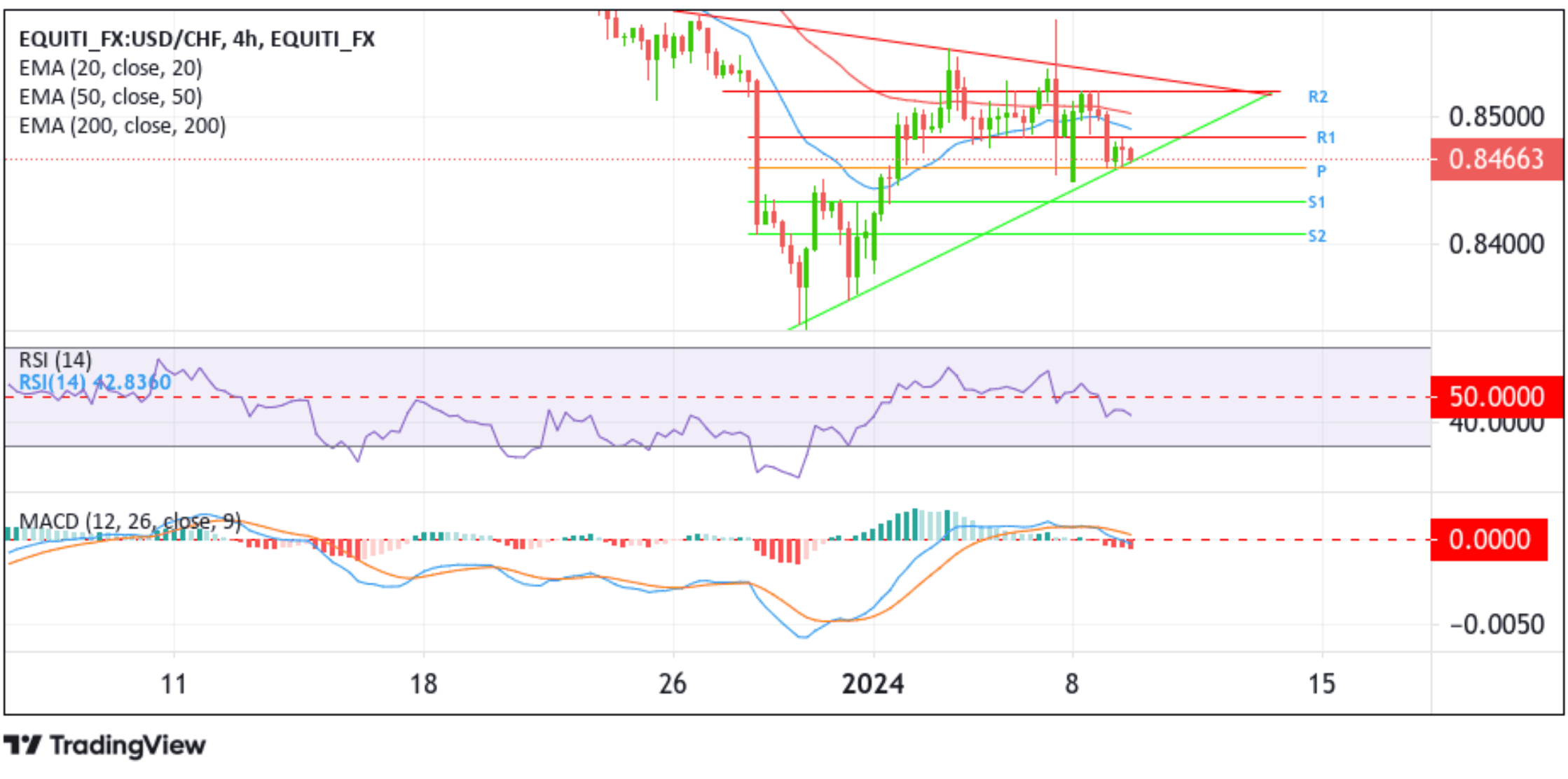

Technical Outlook Four-Hours USD/CHF Price Chart

From a technical standpoint, the USD/CHF price currently sits directly below the lower limit of the Bearish Symmetrical Triangle chart pattern extending from the late-December 2023 swing lower-low. A four-hour candlestick close below this key support level, followed by a convincing move below the pivot level (p) at 0.84595, would act as a fresh trigger for new sellers to jump in, paving the way for an accelerated decline toward the 0.84336 support level (S1). A clean move below this level could see the bearish momentum extend further downward, paving the way for a move toward the 0.84078 support level, and in highly bearish cases, the USD/CHF cross could extend a leg down toward the 0.83390 - 0.83320 demand zone.

On the flip side, if buyers return and catalyze a bullish reversal, initial resistance comes in at 0.84844 (R1). A decisive move above this level would see the USD/CHF cross ascend to tag the 20 (blue) and 50 (red) day Exponential Moving Average (EMA) at 0.84880 and 0.85011 levels, respectively. Acceptance above these levels would see the shared currency extend its corrective pullback toward the cluster resistance (R2) at the 0.85198 level. A decisive flip of this resistance level into a support level would pave the way for a move toward the upper limit of the Bearish Symmetrical Triangle chart pattern extending from the late-December 2023 swing higher. If bulls manage to drive prices above this ceiling, buying interest could intensify, paving the way for a potential move toward the 0.86000 round mark. Further strength would draw attention toward the technically 200-day solid (yellow) EMA level at 0.864111.