USD/CHF Sticks To US-CPI Inspired Gains Above 0.91300's, U.S. Retail Sales In Focus

- USD/CHF Cross attracted some buying on Wednesday during the early Asian session to extend the sharp rebound from the 0.91362 level.

- Inflation rose 0.5% in January, more than expected and up 6.4% from a year ago

- Switzerland's Inflation rate rose more than estimated in January hence supporting the case for further rate hikes by the Swiss Central Bank

- Investors now look forward to the release of U.S. Retail sales data later today

USD/CHF pair witnessed renewed buying pressure after attracting fresh bullish bets during the early hours of the Asian session to extend the modest pullback from the 0.91362 level or the weekly low touched mid-day on Tuesday. The pair now looks to build upon its offered tone heading into the European session.

Rising treasury bond yields buoyed by stronger U.S. inflation data and a positive risk tone underpinned the greenback. Apart from this, a weaker risk tone surrounding the U.S. equity markets offered an additional boost to the safe-haven greenback and helped limit the downside for the major.

The U.S. Dollar index (DXY), which measures the value of USD against a basket of currencies, was up 0.10% for the day at $103.312 after initially rallying over 0.4% as data for January showed the smallest annual increase in U.S. consumer prices since October 2021 but did not alter market expectations of further interest rate hikes amid hotter yearly Core Cpi data.

The consumer price index, which measures a broad basket of everyday goods and services, rose 0.5% for the month, translating to an annual gain of 6.4%. Economists surveyed by Dow Jones had been looking for respective increases of 0.4% and 6.2%. Excluding volatile food and energy, core CPI increased 0.4% monthly and 5.6% from a year ago, against respective estimates of 0.3% and 5.5%, the U.S. Bureau of Labor Statistics reported on Tuesday.

According to the BLS report, the main driver of inflation was Rising shelter costs, which accounted for about half the monthly increase. Energy was another significant contributor, up 2% and 8.7%, respectively, while food costs rose 0.5% and 10.1%, respectively. Increasing costs resulted in a decrease in actual wages for employees. According to a different report from the BLS, which considers inflation, the average hourly earnings decreased by 0.2% during the month and were 1.8% lower than a year ago.

Commenting on the report, "Inflation in the U.S. is clearly sticky. This will keep the Fed policies on track, keeping the U.S. dollar strong - not necessarily stronger. The big picture is that the inflation data clearly show that the market is too optimistic about inflation dropping enough this year to allow the Fed to start cutting rates," said Athanasios Vamvakidis, global head of G10 FX strategy, at Bank of America. Following the report, Futures tied to the Fed's policy rate stuck to bets on Tuesday that the U.S. central bank will raise interest rates at least twice. The futures contracts pricing showed traders are betting heavily that the Fed will raise rates by a quarter of a percentage point at each of its meetings in March and May.

That said, further boosting the treasury bond yields were comments by Dallas Fed President Lorie Logan on Tuesday, who cautioned that the central bank might need to push rates higher than expected, mainly if super-core remains anchored in the 4% - 5% range. "We must remain prepared to continue rate increases for a longer period than previously anticipated if such a path is necessary to respond to changes in the economic outlook or to offset any undesired easing in conditions," she said during a speech in Prairie View, Texas. Shifting to the swiss docket, Swiss Federal Statistics data on Monday showed inflation in Switzerland rose more than expected in January. The annual inflation rate in Switzerland rose to 3.3% year-on-year in January 2023, the highest reading since September 2022, from 2.8% in the prior month and above market expectations of 2.9%. Monthly, consumer prices grew by 0.6% in January, after a 0.2% decline in December, compared to market forecasts of 0.4%. The report raised bets for further rate increases by the Swiss National Bank.

In fact, according to the SNB Chairman, as reported by Reuters early this month, the Swiss National Bank expects inflation to remain elevated in Switzerland "for the time being," Chairman Thomas Jordan said on Thursday, raising the possibility of further interest rate hikes to bring price rises under control. "Inflation in Switzerland is currently above the level of price stability," Jordan told an event in Zurich. "It cannot be ruled out that the SNB has to increase interest rates to ensure price stability."

As we advance, the main focus now turns toward the U.S. retail sales data seen higher at 1.8% from - 1.1% in December, while on a year-to-year basis, retail sales are expected to remain constant at 6%. That said, "If retail sales also show strength today, it will further increase chances of significant rate hikes in its next two policy meetings. In the meantime, the U.S. bond yields and broader market risk sentiment will continue to influence the U.S. dollar and allow traders to grab some trading opportunities around the USD/CHF pair.

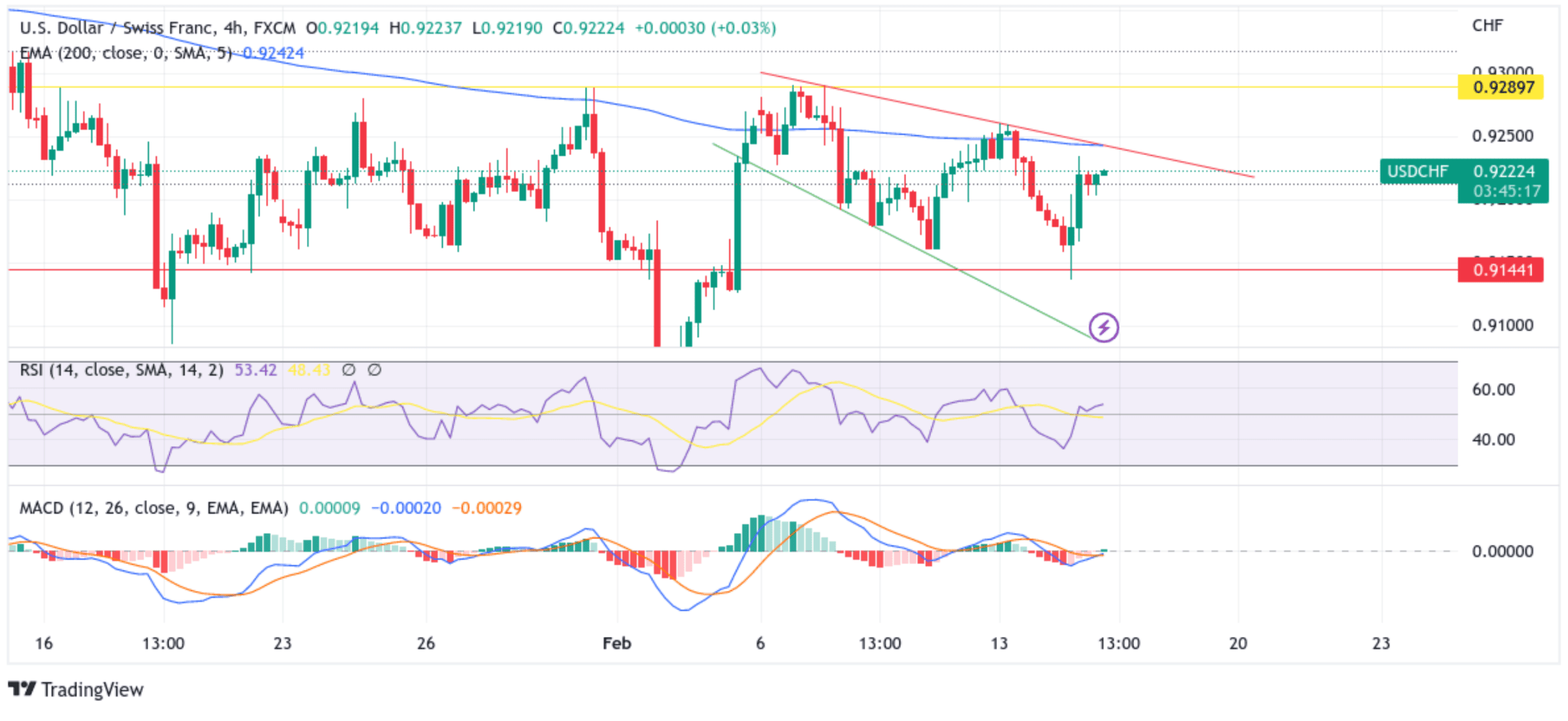

Technical Outlook: Four-Hours USD/CHF Price Chart

From a technical standstill using a four-hour price chart, the price has extended the sharp pullback from the vicinity of the 0.91362 level. Sustained strength would uplift spot prices to the immediate hurdle, the technically strong 200 Exponential moving average (EMA) at the 0.92441 level, which also coincides with the key resistance level plotted by a descending trendline extending from the 7th February 2023 swing high. A clean break above the aforementioned barriers (including a bullish price breakout) would negate any near-term bearish outlook and pave the way for aggressive technical buying. The bullish trajectory could then accelerate toward retesting (third retest) the 0.92897 key resistance level. If sellers fail to break above this level and slide below it, it will form a triple top chart pattern which would act as a Sell signal to sellers to push down the price.

The RSI (14) level at 53.42 is above the signal line and portrays a bullish filter. On the other hand, the moving average convergence divergence (MACD) crossover is on the verge of moving above the signal line, and if that happens in the coming sessions, it will act as a sell signal for bulls to push the price. Investors should refrain from placing aggressive bullish bets ahead of today's key risk event and wait for a break above the 200 Exponential Moving Average (EMA) at 0.92441 level for confirmation of the extension of the bullish trajectory.

On the Flipside, if dip-sellers and tactical traders jump in and trigger a bearish reversal, the price will first find support at the 0.91937 level en route to the 0.90999 level. This is followed by the key support level plotted by a descending trendline extending from the 7th February 2023 swing low. That said, If sellers manage to breach these floors (including a bearish Price breakout), the USD/CHF could turn vulnerable and accelerate the downfall toward the 0.90000 psychological mark. Sustained weakness below this barricade would pave the way for additional losses around the USD/CHF pair.