GBP/USD Steadily Climbs Back Above Mid 1.21000s Amid Recovery In Risk Sentiment, US CPI Eyed

- GBP/USD pair extends the modest rebound from the multi-day low touched earlier on Monday

- A modest recovery in the global risk sentiment undermines the greenback

- Optimism surrounding U.K. workers and the upbeat British GDP helps to cap the cable against further downtick

- Investors await the release of the Key U.S. inflation data

GBP/USD cross-extended the corrective rebound from the vicinity of the 1.20311 level and gained positive traction for the second successive day on Tuesday. The momentum has lifted spot prices to a two-week high, around the 1.21378 - 1.21519 levels regions during the first half of the Asian session. The shared currency looks to maintain its offered tone amid a weakening U.S. Dollar.

The USD Index, which measures the greenback's performance against a basket of currencies, fell on Monday in choppy trading after last week's strong rally, weighed down by recovery in risk sentiment depicted by firmer stocks and lower long-dated Treasury yields, as investors consolidated positions ahead of today's crucial U.S. consumer price index (CPI) data and U.K.'s job numbers.

This, along with the risk-on impulse, combined with recent firm data from the U.K., has capped the cable against further downtick. Data from the U.K. Office for National Statistics on Friday showed the British economy had expanded 0.4% year-on-year in the last quarter of 2022, the weakest performance since the first quarter of 2021, but matching preliminary estimates. Considering the full year 2022, the GDP grew 4%, following a record 7.6% growth in 2021 but the U.K. economy is still 0.8% smaller than before the Covid pandemic.

Following the growth numbers, U.K. Chancellor Jeremy Hunt mentioned that "the fact the U.K. was the fastest growing economy in the G7 last year, as well as avoiding a recession, shows our economy is more resilient than many feared."

In other news, a survey released on Monday revealed that British employers intend to increase their employees' salaries by the highest rate in at least 11 years, but the 5% pay hikes offered would still be lower than the projected inflation rate, Reuters reported on Monday. The Chartered Institute of Personnel Development (CIPD) found that 55% of recruiters plan to increase base or variable pay this year as they face challenges in recruiting and retaining workers in the U.K.'s tight labor market.

The news could help the U.K. policymakers overcome multi-week-old workers' strikes, help the economy avoid recession, propel inflation, and help the Bank of England (BoE) remain hawkish. However, the Bank of England is concerned that the increase in inflation may be challenging to control if pay deals continue to rise. BoE Governor Andrew Bailey expressed concerns about wage-setting last week, despite signs that the surge in inflation has turned a corner. The Central Bank Governor's comments were about the news that showed the annual inflation in the U.K. had fallen to 10.5% in December after hitting a 41-year high of 11.1% in October.

Shifting to the U.S. docket, the sour mood continues to undermine the safe-haven greenback amid mildly positive Fedspeak, especially after Friday's strong U.S. Consumer Sentiment and inflation expectations. The US-China jitters over the "Unidentified Objects" also continue to pressure the safe-haven greenback.

However, despite the combination of negative factors, investors now seem convinced that the U.S. central bank will stick to its hawkish stance for longer amid the risk of higher inflation print for January, due for release today. In turn, this should help cap the downside for the USD and cap gains for the GBP/USD pair.

Speculations were sparked by a review of the prior month's data, which indicated that consumer prices had increased in December, contrary to previous estimates that they had fallen. Additionally, according to the University of Michigan survey, one-year inflation expectations rose from 3.9% in January to 4.2% this month.

As we advance, investors look forward to the U.S. docket featuring the release of the US CPI data seen higher at 0.5% monthly and lower at 6.2% yearly from 0.1% and 6.5% levels, respectively. Excluding food and energy, the Core Cpi is unchanged at 0.4%. While annually, the Core Cpi is seen lower at 5.5% from 5.7% the previous month. Investors will look for clues from the release of the U.K. employment numbers during the early European session.

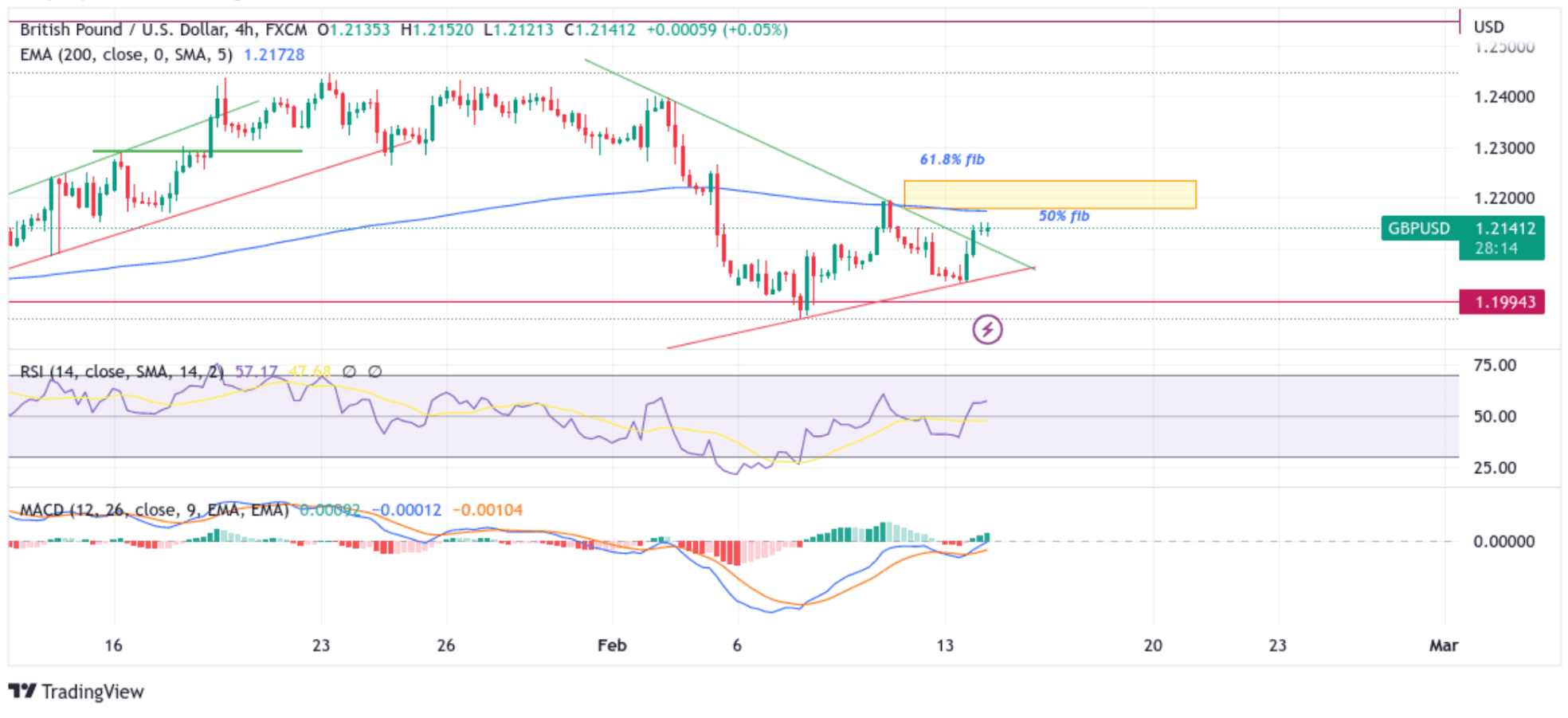

Technical Outlook: Four-Hours GBP/USD Price Chart

From a technical perspective, using a four-hour price chart, the price has extended the modest rebound from the vicinity of 1.20311 level after a form rejection from the key support level plotted by an ascending trendline of the Bearish Pennant chart pattern extending from the 7th February 2023 swing lower-low. A bullish price breakout (trendline breakout above the key resistance level) supported prospects for further gains. That said, some follow-through buying would uplift spot prices toward the technically strong 200 Exponential Moving Average (EMA) at 1.21729 level en route to the 50% and 61.8% Fibonacci Retracement levels at 1.21780 and 1.22337 levels, respectively. A clean break above these barriers would negate any-near term bearish outlook and pave the way for aggressive technical buying.

All the technical oscillators portray a bullish outlook. The impending moving average convergence divergence (MACD) crossover above the signal line would add credence to the bullish bias. On the other hand, The RSI (14) level at 57.17 is above the signal line and portrays a bullish filter.

On the flip side, any meaningful pullback now finds some support near the demand zone ranging from 1.21219 - 1.21064 levels. This is followed by a support level plotted by a descending trendline of the Bearish Pennant chart pattern extending from the 2nd February 2023 swing lower-higher, which, if broken decisively, will negate the positive outlook and pave the way for aggressive technical selling. The downward trajectory could then accelerate toward the 1.20865 support level, which, if broken convincingly, would pave the way for additional losses around the GBP/USD pair.