NZD/USD Sticks To Modest Recovery Gains Above 0.63000 As N.Z. Services PMI Beats Expectations

- NZD/USD cross witnessed some buying on Monday to rebound from a two-week low

- The current sour mood as a result of investor's decision to stay on the sidelines and the US-China jitters caps the downside for the NZD/USD pair

- New Zealand Service Sector expands at a Faster Rate according to Business N.Z.

- Traders now await the key inflation data report set for release tomorrow

The NZD/USD pair finds some support near the 0.6300 mark and rebounds a few pips from a two-week low earlier this Monday. Spot prices, however, remain vulnerable to extend the recent sharp pullback from the highest level since June 2022 touched two weeks ago and ahead of the key inflation data report set for release tomorrow.

A fresh leg down in the U.S. Treasury Bond yields and a weaker risk tone undermined the safe-haven greenback. As such, the yield on the 2-year treasury dipped less than one basis point to 4.524%. Apart from this, signs of stability in the U.S. equity markets capped the safe-haven greenback and helped limit the downside for the major. The U.S. Dollar index (DXY) measures the value of USD against a basket of currencies that weakened in early European trade on Monday and traded 0.06% lower to 103.700, falling back from the monthly peak of 103.961 seen last week.

The current price action suggests USD Bulls have decided to stay on the sidelines ahead of tomorrow's key inflation data release. The investor's decision comes amid an inflation expectation report by the St Louis Federal Reserve which showed the U.S. inflation expectations per the 10-year and 5-year breakeven inflation rates are expected to remain firmer around the monthly highs marked in the last week.

The current mood remains sour as the US-China jitters over the "Unidentified Objects" join the mixed Fed talks and cautious mood ahead of the key U.S. Consumer Price Index (CPI).

A host of Fed officials have spoken lately concerning the fed's monetary policy, with Philadelphia's president being the latest to speak recently. During the weekend, Philadelphia Federal Reserve President Patrick Harker pushed back the chatters of a Fed rate cut during 2023. However, the policymaker mentioned, "Fed not likely to cut this year but may be able to in 2024 if inflation starts ebbing." His comments were mostly in line with Fed Chair Jerome Powell's cautious optimism and hence challenged the U.S. Dollar buyers.

Philadelphia Federal Reserve President's comments came days after Mary Daly of the San Francisco Fed, who doesn't have a vote on the FOMC this year, said that the December projection of a Fed terminal rate of 5.1% was still a decent benchmark and that policy needed to stay restrictive for some time to come. Additionally, Atlanta Fed President Raphael Bostic, another non-voting member, weighed in, saying that his base case was still for two more hikes at least.

Shifting to the New Zealand docket, a New Zealand Services PMI data report released on Sunday showed the New Zealand service sector expanded faster than expected. The Business NZ Performance of Services Index for New Zealand rose to 54.5 in January 2023, up from a downwardly revised 52.0 in the previous month. The latest reading signalled the fastest pace of expansion in the country's service sector since last October, helped by an acceleration in the activity/sales growth (52.1 vs 51.9 in December) and a rebound in employment levels (51.9 vs 46.9). The positive microdata was seen as a factor that underpinned the kiwi and exerted upward pressure on the NZD/USD pair.

As we advance, the focus turns to tomorrow's key inflation data, seen higher at 0.5% every month and lower at 6.2% every year from 0.1% and 6.5% levels, respectively. Excluding food and energy, the Core Cpi is seen unchanged at 0.4%.

While on an annual basis, the Core Cpi is seen lower at 5.5% from 5.7% the previous month. In the meantime, the U.S. bond yields and broader market risk sentiment will continue to influence the U.S. dollar and allow traders to grab some trading opportunities around the NZD/USD pair.

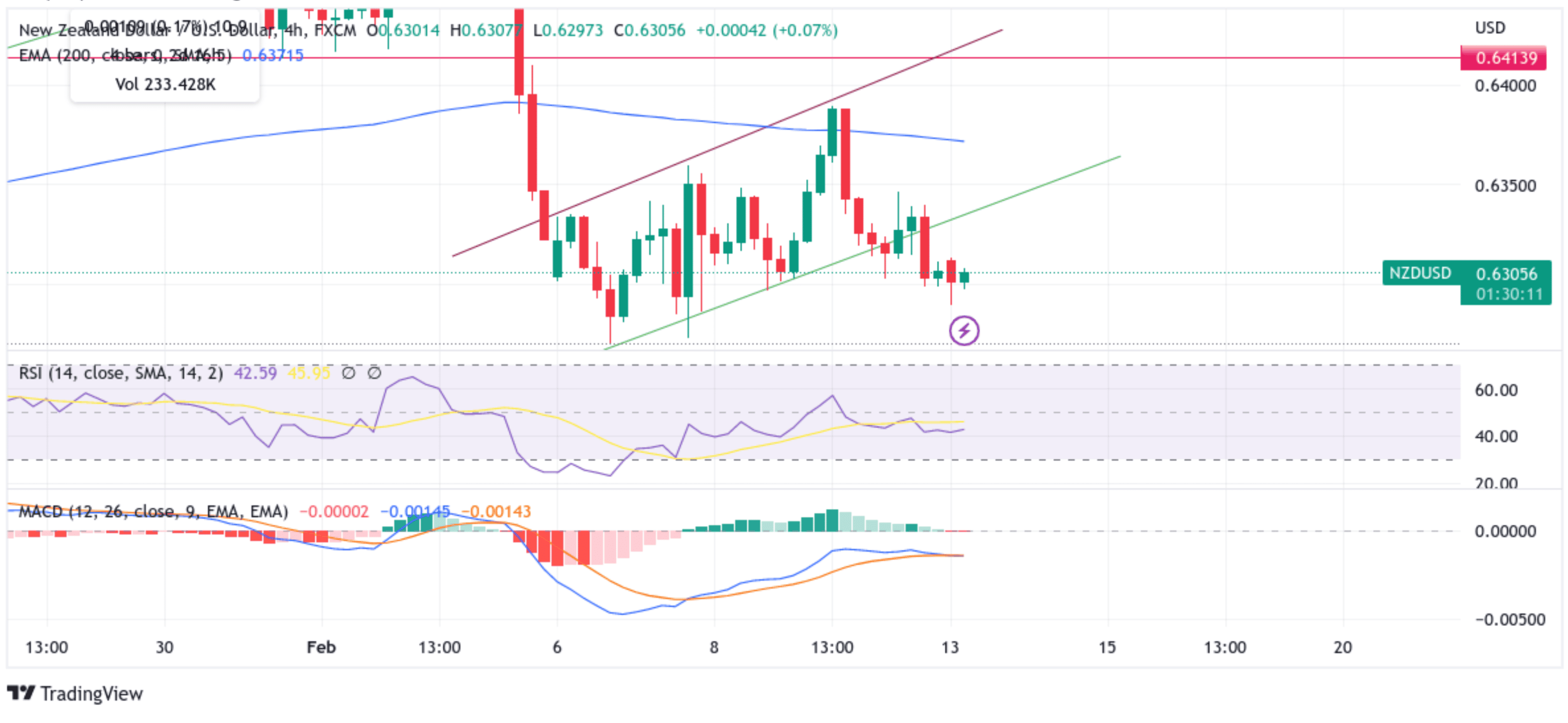

Technical Outlook: Four-Hour NZD/USD Price Chart

From a technical standstill using a four-hour price chart, the price found some support near the 0.6300 mark after a heavy sell-off that saw the kiwi decline and break below the key support level plotted by an ascending trendline extending from the 6th February 2023 swing low. Some follow-through buying would lift spot prices toward the aforementioned trendline now turned resistance level. That said, a clean break above the aforementioned resistance level would trigger bulls to continue pushing the price up and pave the way for more gains. The upward trajectory could accelerate towards the technically strong 200 EMA level at 0.63714. A clean move above this level would negate any near-term bearish outlook and pave the way for additional gains around the NZD/USD pair.

The RSI (14) level at 42.39 is below the signal line and portrays a bearish filter. On the other hand, the moving average convergence divergence (MACD) crossover is also below the signal line and paints a bearish filter. Additionally, acceptance of price below the 200 Exponential Moving Average (EMA) at 0.63714 indicates the overall bias is bearish.

On the flip side, any meaningful pullback now finds some support at the 0.63000 psychological mark. This is followed by the 0.62736 key support level, which, if broken decisively, will negate the positive outlook and prompt aggressive technical selling. The downward trajectory could then accelerate toward the key demand zone ranging from 0.61924 - 0.62052 levels. A convincing break below this zone would pave the way for more losses around the NZD/USD pair.