NZD/USD Moves Back Above 0.62300 Mark On Retreating Treasury Bond Yields And Firmer NZ Trade Balance Data

Key Takeaways:

- NZD/USD cross gained positive traction on Tuesday during the Asian session and rose back above the 0.62300 mark

- Retreating Treasury bond yields undermines the buck and helps cap the downside for the NZD/USD cross

- Better-than-expected New Zealand Trade Balance data offers support to the Kiwi and helps exert upward pressure on the NZD/USD pair

The NZD/USD cross attracted some dip-buying on Tuesday during the early Asian session, extending the overnight bounce from the vicinity of the 0.62032 level, supported by the generally weaker sentiment surrounding the buck. As of press time, the shared currency trades with modest gains above the 0.62300 mark, posting a 0.31% daily gain. The modest pullback in U.S. Treasury bond yields and a softer risk tone undermine the greenback and help cap the downside for the NZD/USD pair. The generally positive tone around the U.S. equity markets further undermines the safe-haven buck. It drives flows toward the risk-sensitive Kiwi, prompting further follow-through buying around the NZD/USD pair.

Additionally, the better-than-expected New Zealand macro data released earlier today underpins the Kiwi and helps exert upward pressure on the NZD/USD pair. New Zealand posted a trade deficit of $1.23 billion in November 2023, narrowing from $2.184 billion in the corresponding month of the previous year, a Statistics New Zealand report showed. Moreover, the Kiwi continues to draw support from data on Monday, which showed the Westpac McDermott Miller Consumer Confidence Index for New Zealand increased to 88.9 in the last quarter of 2023, the highest since the first quarter of 2022, compared to 80.2 in the previous period.

Furthermore, the greenback continued to be undermined by the dovish monetary stance of the Federal Reserve after it announced it had held its key interest rate steady for the third straight time during the December meeting in line with market expectations. It indicated three cuts were coming in 2024.

The downbeat mood surrounding the buck has seen markets shrug off Federal Reserve officials' attempt to push back against how investors and traders perceived last week's Fed chair's comments. This comes from Atlanta Fed President Bostic's remarks, 'I do not feel this is imminent, and they would only need to cut rates in Q3.

Bostic's comments come after New York Federal Reserve President John Williams said Friday rate cuts are not a topic of discussion for the central bank. "We aren't really talking about rate cuts right now," he said on CNBC's "Squawk Box." "We're very focused on the question in front of us, which, as Chair Powell said, is, have we gotten monetary policy to a sufficiently restrictive stance in order to ensure inflation comes back down to 2%? That's the question in front of us."

Going forward, investors look forward to the U.S. docket featuring the release of the Housing Starts (MoM) (Nov) set for release during the early North American session. In the meantime, the U.S. bond yields and the broader market risk sentiment will influence the USD price dynamics and provide short-term trading opportunities around the shared currency.

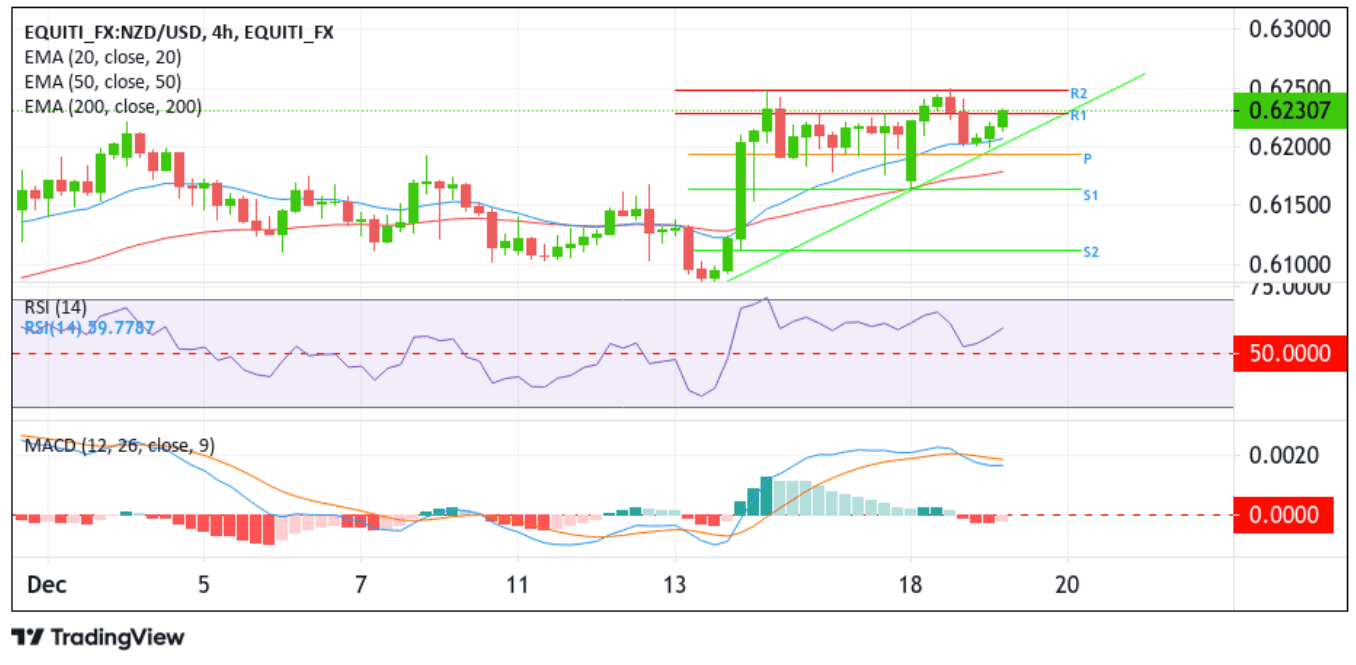

Technical Outlook: Four-Hours NZD/USD Price Chart

From a technical standpoint, the price's ability to find support from the trendline support channel extending from the mid-2023 swing lower-lows supported the subsequent follow-through buying. A further increase in buying momentum will uplift spot prices toward the immediate resistance level (R2) at 0.62489. A clean move above this level will act as a fresh trigger for new buyers to jump in, paving the way for more gains around the NZD/USD cross.

The RSI (14) level at 59.7787 is in bullish territory and portrays a bullish filter. The Moving Average Convergence Divergence (MACD) crossover at 0.0020 is also in bullish territory and adds to the bullish credence, suggesting the continuation of the bullish price action this week. The 50 (red) and 200 (yellow) day Exponential Moving Average (EMA) crossover (Golden Cross) at 0.58969 validates the bullish bias.

On the flip side, any attempted pullback will find support at the 0.62291 level (R1) now turned support level. A convincing move below this level will see the NZD/USD cross-drop to retest the key support level (trendline support channel extending from the mid-2023 swing lower-lows). A subsequent break below this (bearish price breakout) would pave the way for moving toward the pivot level (P) at 0.61935. A clean break below this level could see the shared currency accelerate its downfall to tag the 50-day (red) EMA level at 0.61811 before falling further toward the 0.61637 support level (S1). In highly bearish cases, the NZD/USD cross could extend a leg toward the 0.61031 support level (S2).