US WTI Crude Oil Lacks Clear Direction In The Wake Of Fresh Supply Tightness Concerns

Key Takeaways:

- The US WTI crude oil price lacked clear direction on Monday during the Asian session

- News of lower exports from Russia and fresh crude oil disruptions fail to lend enough support to crude oil prices

- Concerns that the Fed could leave rates at restrictive levels next year offer support for the greenback and act as a headwind to crude oil prices

The U.S. West Texas Intermediate (WTI) crude oil price was a little unchanged on Monday during the Asian session as concerns that the Fed could leave rates at restrictive levels next year seem to have offset oil supply tightness poised by lower exports from Russia and fresh attacks by the Houthis on ships in the Red Sea over the weekend. As of press time, the precious black liquid fell below the $72.100 mark after rising during the early hours of the Asian session, albeit still looks poised to finish the day with modest gains.

According to a Reuters article published earlier today, on Sunday, Russia announced its intention to increase the reduction of oil exports in December by possibly 50,000 barrels per day or even more, surpassing its previous commitment. This move aligns with efforts by major global exporters to bolster international oil prices. This comes after Moscow suspended about two-thirds of loadings of its main export-grade Urals crude from ports due to a storm and scheduled maintenance on Friday.

Further adding to oil supply tightness was the news over the weekend by the world's most significant container shipping lines, MSC and A.P. Moller-Maersk, of their intention to steer clear of the Suez Canal due to increased attacks by Houthi militants on commercial ships in the Red Sea.

However, the combination of factors has failed to lend enough support to crude oil prices. This comes amidst fresh fears that the Fed could leave rates at restrictive levels next year, which remain supportive of the greenback, debunking earlier market expectations of rate cuts in 2024.

New York Federal Reserve President John Williams said Friday rate cuts are not a topic of discussion for the central bank. "We aren't really talking about rate cuts right now," he said on CNBC's "Squawk Box." "We're very focused on the question in front of us, which, as Chair Powell said, is, have we gotten monetary policy to a sufficiently restrictive stance in order to ensure inflation comes back down to 2%? That's the question in front of us." That said, U.S. WTI crude oil ended its longest streak of weekly losses in more than two years with a slight gain last week after the Federal Reserve (Fed) last week announced it had held its key interest rate steady for the third straight time during the December meeting in line with market expectations and indicated three cuts were coming in 2024.

As we advance, without any significant market-moving economic news data, the Treasury bond yields and the general market risk sentiment will continue to influence U.S. dollar dynamics and ultimately provide directional impetus to crude oil prices.

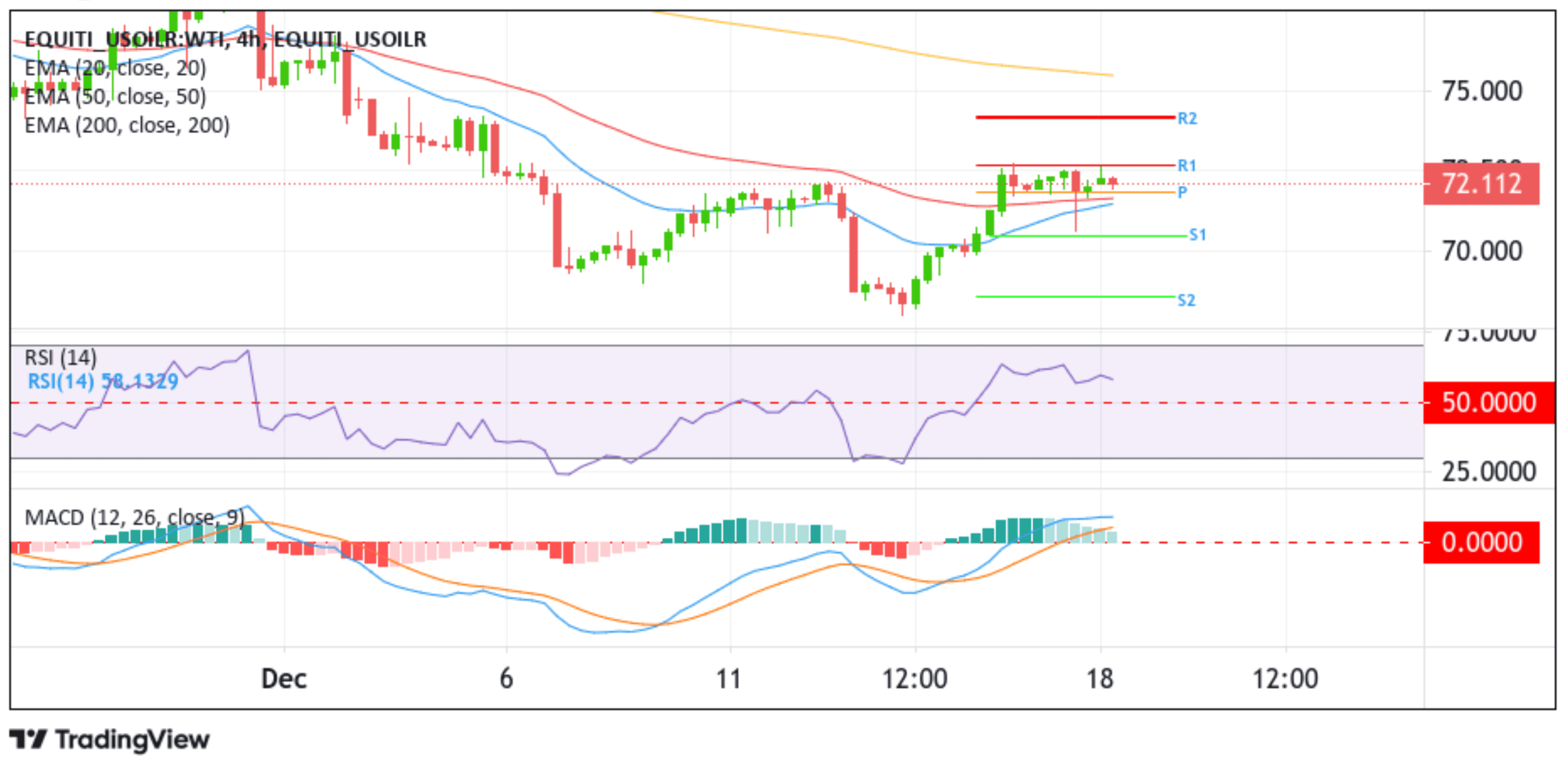

Technical Outlook: Four-Hours US WTI Crude Oil Price Chart

From a technical standpoint, the US WTI crude oil price is trading within a range with no clear direction. However, in the coming sessions, if selling pressure increases and the price finds its way below the pivot level (p) at $71.822, followed by acceptance below the 50 (red) and 20 (blue) days Exponential Moving Averages (EMA) at $71.639 and $71.463 levels, respectively, downside momentum could pick up pace, paving the way for a drop toward the $70.461 support level (S1). A clean break below this level could see the downside trajectory extend toward the $68.547 level, denoting a 4.99% decline.

On the flip side, if buyers resurface and spark a bullish turnaround, initial resistance comes in at the $72.673 level (R1). On further strength, the focus shifts higher to $74.177 (R2), followed by the technically strong 200 (brown) day EMA level around $75.400.