US WTI Crude Oil Price Up 2.09% For The Week On Surprise Crude Stockpiles Drop And Rising Geopolitical Tensions

Key Takeaways:

- US WTI crude oil price rose 0.35% on Thursday during the Asian session, denoting a 2.09% weekly gain

- A surprise drops in crude stockpiles pointing to increasing demand underpins crude oil prices

- Ukrainian attacks on Russian refineries exacerbate geopolitical tensions, lending support to crude oil prices

- A generally softer U.S. dollar is also seen as another factor that continues to extend support to crude oil prices

The U.S. West Texas Intermediate (WTI) crude oil price rose modestly on Thursday during the Asian session, extending gains for the second consecutive day as a surprise drop in crude stockpiles pointed to increased demand. In contrast, a potential disruption to crude oil supply following Ukrainian attacks on Russian refineries further underpinned prices.

As of press time, U.S. West Texas Intermediate (WTI) futures rose 27.5 cents, or 0.35%, to trade at $79.424 a barrel. The current oil price move marks a second successive day of crude oil buying and, instead, a third consecutive day of a positive move in the last four to lift spot prices 2.09% for the week and to near a four-month high/$80.82 level touched on March 1.

U.S. Crude Inventories Unexpectedly Fall: EIA

Data from the Energy Information Administration (EIA) Petroleum Status Report showed that crude oil inventories in the U.S. fell by 1.536 million barrels in the week ended March 8, 2024, compared with market expectations of a 1.338 million increase.

To a greater extent, the data indicated increased demand for the precious black liquid, which, in turn, supported crude oil prices. Gasoline stocks led the list with the most significant drop at 5.662 million, the most in nearly one year and above forecasts of 1.9 million.

Ukrainian Attacks on Russian Refineries

Further underpinning crude oil prices were fears of rising geopolitical tensions that would disrupt global crude oil supply following Ukrainian attacks on Russian refineries. Ukrainian drones struck Russian refining facilities in a second day of heavy drone attacks on Wednesday, causing a fire at Rosneft's biggest refinery, a publication by Reuters on Wednesday revealed.

Russian officials said that after seriously damaging Lukoil's refinery in Nizhny Novgorod on Tuesday, Ukraine hit refineries in the Rostov and Ryazan regions.

In Ryazan, a drone attack caused a fire at Rosneft's refinery. Two sources familiar with the situation told Reuters that the refinery had been forced to shut down two primary oil refining units.

Following the attacks, Russian President Vladimir Putin told Western countries on Wednesday in an interview with state media that Russia was technically ready for nuclear war and that if the U.S. sent troops to Ukraine, it would be considered a significant escalation of the conflict.

Softer U.S. Dollar

Another factor extending support to crude oil prices is a generally softer U.S. dollar. The U.S. dollar index, which measures the greenback against a basket of currencies, rose above the $102.800 mark on Thursday, supported by renewed bets that the Fed will leave rates unchanged during the March and May meetings and start cutting rates during the third quarter of 2024, following a slightly hotter-than-expected U.S. consumer inflation reading released on Tuesday.

Despite this, the greenback, which is 1.2% down for the month, continues to face heavy headwinds stemming from growing expectations that the Fed will cut rates this year. This follows Fed Chair Powell's dovish comments before the Joint Economic Committee in Washington, DC, earlier last month, in which he reiterated that rate cuts are on the table this year. The bets were further raised after a mixed U.S. jobs report released on Friday.

Thus, the downside seems limited in the long run, and any selling around crude oil prices could still be seen as a buying opportunity.

Going forward, oil traders look forward to the U.S. docket, which will feature the release of the U.S. retail sales and PPI (MoM) (Feb) data reports. The data reports would influence U.S. dollar price dynamics and help determine the next leg of a directional move for U.S. WTI crude oil prices.

Technical Outlook: One-Day US WTI Crude Oil Price Chart

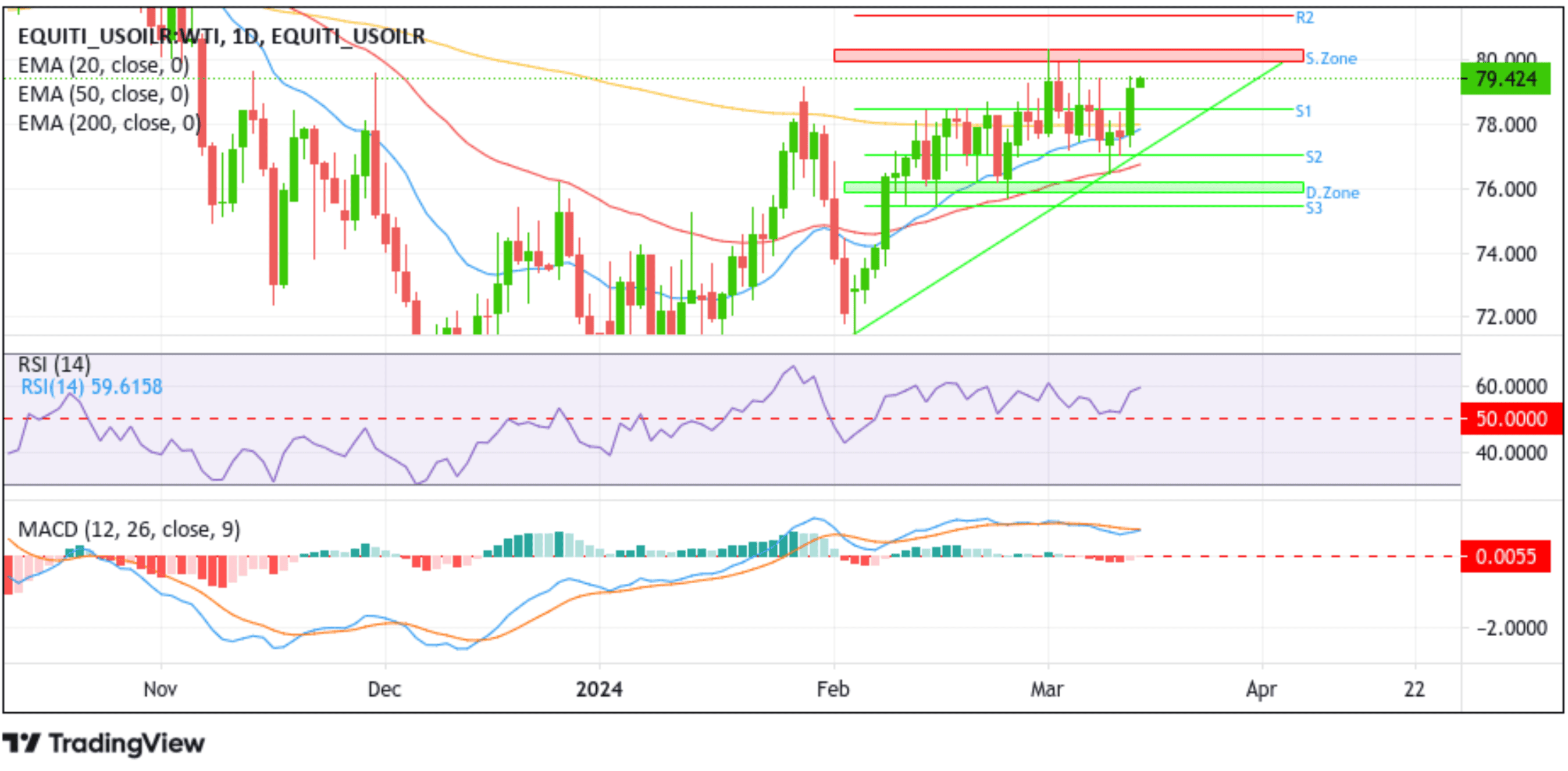

From a technical standstill, the US WTI crude oil price's ability to find acceptance above the very important 200-day (yellow) EMA level at $78.007, followed by a break above the cluster resistance level at $78.449, favors buyers and supports the case for further buying around the dollar-denominated commodity. The US WTI crude oil price is now above the $79.400 level and is sitting directly below a supply zone ranging from 80.307 to 79.988. A further increase in buying momentum in the coming sessions, followed by a convincing move above the aforementioned zone, would pave the way for more gains around crude oil prices. The US WTI crude oil price could then rise to encounter the $81.415 resistance level as a result of the 50 (red) and 200 (yellow) day EMA crossover confluence level, about which, if the price pierces this level, the focus will shift towards the $82.000 and $83.000 levels.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes in at the $78.449 level. A clean move below this level would pave the way for a drop to tag the 200-day (yellow) EMA level at $78.007. A convincing move below this level would pave the way for an accelerated drop toward the upward-ascending trendline extending from the early February 2024 swing lower-lows. A subsequent break below this level, followed by a breach below the $77.032 support level, would pave the way for further accelerating the downward trajectory toward the demand zone, ranging from 76.199 - 75.879 levels. If this zone fails to hold, the US WTI crude oil price could drop further to retest the $75.457 support level (S3).