US WTI Crude Oil Extends Rally Above The $78.00 Mark As Interest Rate Concerns Ease

- US WTI Crude oil Futures extends rally above the $78.00 mark, buoyed by the weakening U.S. dollar as a result of dovish Powell's remarks

- China's demand outlook brightens, in turn, offers support to crude oil prices

- Supply concerns as a result of an earthquake in Turkey underpin crude oil prices

- U.S. API weekly Crude oil stocks unexpectedly fall

U.S. WTI Crude Oil futures rose for a fourth day on Thursday as Fed's Chair, Jerome Powell, eased market concerns about interest rate hikes while an industry report pointed to a drop in U.S. Crude inventories. As per press time, US WTI Crude oil was up 0.18%/14 cents for the day to trade at $78.54 per barrel, while its counterpart Brent crude oil was up 0.19%/ 16 cents to trade at $$85.20 per barrel.

In a speech at the Economic Club of Washington on Tuesday, Federal Reserve Chairman Jerome Powell repeated that inflation was slowing. However, they reiterated the need for further hikes as the mission to bring inflation down to the central bank's target still has a long way to go amid a red-hot labor market. "We didn't expect [the January jobs report] to be this strong, but it shows you why we think that this will be a process [to bring down inflation] that takes a significant period of time because the labor markets are extraordinarily strong," Powell said. The Fed Chair went further to say, "The reality is we're going to react to the data, So if we continue to get, for example, strong labor market reports or higher inflation reports, it may well be the case that we have to do more and raise rates more than is priced in." Commenting on Powell's speech, "Powell expects they're not going to be cutting rates anytime soon, but that there is a good path, that they're accomplishing what they need to accomplish," said Shawn Cruz, head trading strategist at T.D. Ameritrade.

That said, markets priced in Powell's speech as less hawkish than feared, boosting risk appetite and weighing on the dollar. A weaker dollar makes oil cheaper for other currency holders and, in turn, boosts demand, leading to increased oil prices.

Further Lifting US WTI crude oil prices were the forecasted stronger demand in China after it lifted its harsh pandemic measures. The International Energy Agency expects half of this year's global oil demand growth to come from China, the agency's chief said on Sunday, adding that jet fuel demand was surging. Saudi Arabia, the world's top oil exporter, raised prices for its flagship crude for Asian buyers for the first time in six months amid expectations of demand recovery, especially from China.

Additionally, OPEC and its allies, known as OPEC+, decided to keep output curbs in place last week. On Wednesday, an Iranian official said the group would likely stick with the current policy at its next meeting.

In other news, In Turkey, operations at a 1-million-barrel-per-day (bpd) oil export terminal in Ceyhan were halted on Monday after a major earthquake hit the region, which paralyzed crude oil flows from Iraq and Azerbaijan. B.P. Azerbaijan has declared force majeure on Azeri crude shipments from the port. Iraq's pipeline to Ceyhan resumed flows on Tuesday.

Elsewhere data from the American Petroleum Institute showed U.S. Crude Oil Inventories unexpectedly fell in the previous week more than expected. Stocks of crude oil in the United States dropped by 2.184 million barrels in the week ended February 3rd, 2023, following a 6.330 million barrels rise in the previous week. It was the first decline since the week ended December 23rd, 2022, compared with market expectations of a 2.15 million barrels increase. U.S. crude production is expected to rise as we advance in 2023 while demand will stay flat, the U.S. Energy Information Administration (EIA) said in its Short-Term Energy Outlook (STEO) on Tuesday.

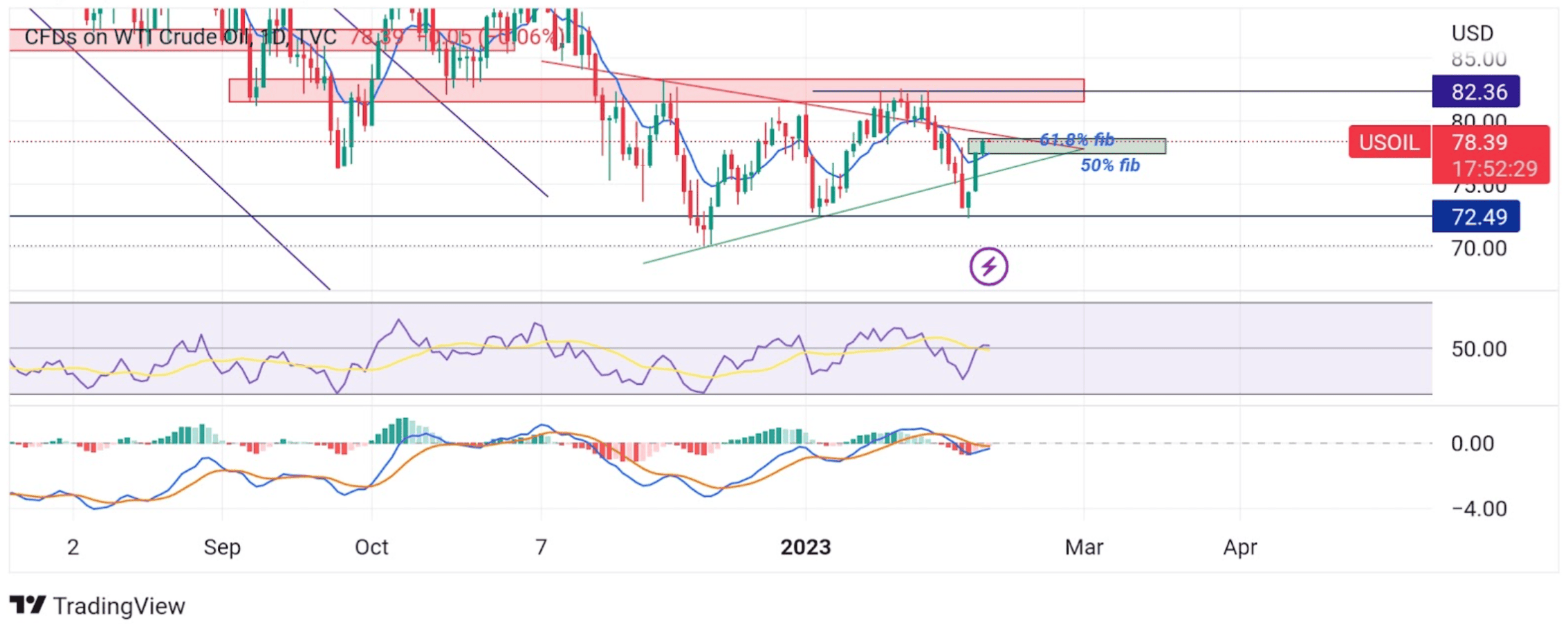

Technical Outlook: US WTI Crude Oil One-Day Price Chart

From a technical standstill, Price extended the modest rebound from the vicinity of $72.49 level and currently sits below a technical barrier represented by a 61.8% Fibonacci Retracement level at $78.62. Suppose bulls manage to pierce this ceiling in the coming sessions. In that case, a bullish uptick could gain momentum and rally towards retesting the key resistance level plotted by a downward-sloping trendline extending from the early January 2022 swing high. A convincing break above this level (bullish trendline breakout) would pave the way for aggressive technical buying. The bullish momentum could then accelerate towards the key supply zone ranging from $81.50 - $83.32 levels, of which sustained strength above these levels would pave the way for additional gains around US WTI crude oil prices.

The RSI (14) at 51.60 is above the signal line and portrays a bullish filter. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is below the signal line, pointing to a bearish sign for price action. Still, a move above the signal line would add credence to the bullish bias.

On the flip side, if dip-sellers and technical traders jump back in and trigger a bearish reversal, the price will find support at the $76.26 support level. If sellers manage to breach this floor, downside momentum could pick up the pace, paving the way for a drop toward retesting the key support level plotted by an ascending trendline extending from the early January 2023 swing low. Sustained weakness below this level (bearish trendline breakout) would pave the way for a drop toward the $76.00 psychological mark. A convincing move below this mark would pave the way for aggressive technical selling around the US WTI Crude oil prices.