US WTI Crude Oil Futures Surrenders Modest Recovery Gains Despite Global Economic Optimism

- US WTI Crude futures rally was muted on Thursday but stuck to a near two-week high

- U.S. inflation is expected to have eased further last month, which should herald smaller interest rate hikes in the coming months in turn, uplift crude oil prices in the long run

- US WTI Crude Oil Futures rose 3% to a one-week high on Wednesday, extending the sharp recovery after a weak start to 2023

- U.S. Crude Stocks rise most since February 2021: EIA

US WTI Crude Oil Futures prices retreated on Thursday from the vicinity of the $77.90 level. Still, they remained stuck near a two-week high amid increased expectations that U.S. consumer inflation data will ease further and herald smaller interest rate hikes in the coming months.

As per press time, US WTI Crude Oil Futures was down 0.16%/12 points to trade at $77.54 per barrel despite the growing expectation of smaller rate hikes by the FED ahead of a critical inflation data report set for release later in the day.

The latest U.S. Crude oil futures lacklustre performance comes from a significant rally in oil prices witnessed the last week as hopes for an improved global economic outlook and concern over the impact of sanctions on Russian crude output outweighed a massive surprise build in U.S. crude stocks. Additionally, the prospect of a less hawkish Fed and a U.S. government forecast that global petroleum demand will hit a record high this year.

The reopening of China's border with Hong Kong after the end of strict COVID-19 curbs also gave crude oil prices the much-needed boost as china was battling with surging Covid-19 infections, which in turn impacted crude oil prices significantly. Data on Thursday showed that Chinese inflation improved slightly in December after the government began easing its COVID-19 restrictions.

That said, crude prices are also expected to take support from tighter supply in the coming months as the European Union prepares more sanctions on Russian oil shipments due to take effect in February.

This comes after the U.S., and its allies introduced strict price caps on Russian supply in December as retaliation for Moscow's invasion of Ukraine in early 2022. Any escalation in the conflict is also expected to disrupt global oil supplies, which could increase oil prices.

It is worth noting that Russian oil producers have had no difficulties securing export deals despite Western sanctions and price caps, Russian Deputy Prime Minister Alexander Novak told a televised online government meeting.

On Wednesday, the U.S. Energy Information Administration (EIA) said crude inventories jumped by 19.0 million barrels last week, the third biggest weekly gain ever and the most since stocks rose by a record 21.6 million barrels in Feb 2021. Last week's increase came as refiners were slow to restore production after a cold freeze shut operations in late 2022.

That compares with the 2.2 million-barrel decline in crude stocks that analysts forecast in a Reuters poll and industry data from the American Petroleum Institute (API), showing a 14.9 million-barrel build.

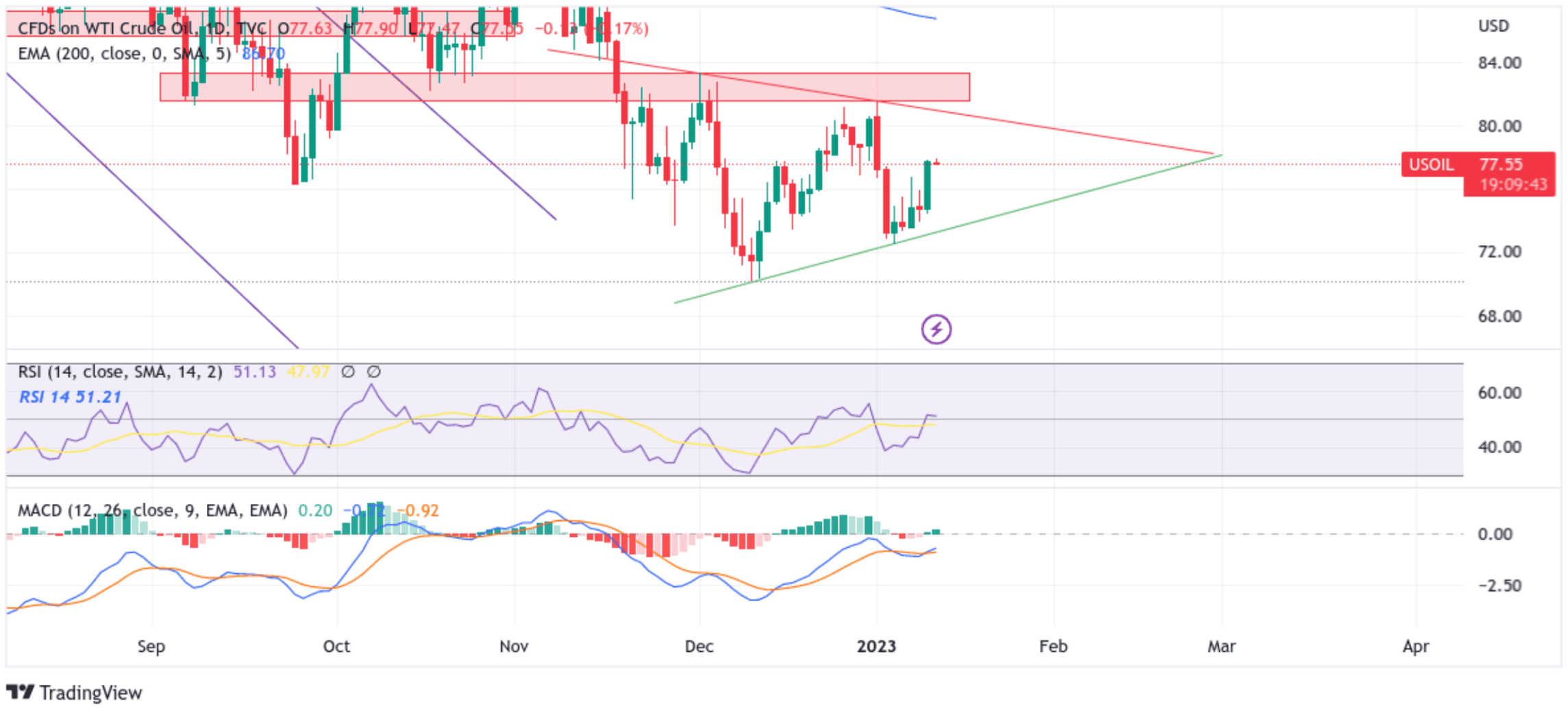

Technical Outlook: US WTI Crude Oil Four-Hour Price Chart

From a technical standstill, the price has rebounded from the vicinity of $77.90 level after a strong bullish uptick witnessed in the last week. Some follow-through selling would drag spot prices towards the next relevant hurdle plotted by 50 and 61.8% Fibonacci Retracement levels at 75.21 and 74.51, respectively. Suppose sellers manage to break below these levels. In that case, downside pressure could accelerate toward retesting the key support level plotted by an ascending trendline of a bearish pennant chart pattern extending from the December 2022 swing low. Further weakness below the aforementioned support level would pave the way for aggressive technical selling around the US WTI Crude Oil Futures.

The RSI (14) at 51.21 is above the signal line and portrays a bullish filter; however, moving below the signal line would add credence to the downside bias. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is below the signal line, validating the downside bias and pointing to a bearish sign for price action this week.

On the flip side, if buyers resurface and spark a bullish turnaround, initial resistance comes in at the 78.08 level (61.8% bullish Fibonacci retracement level). If the price pierces this barrier, buying interest could gain momentum, creating the right conditions for an advance toward retesting the key resistance level plotted by a downward-sloping trendline of the bearish pennant chart pattern extending from the December 2022 swing high. A convincing break above the aforementioned resistance level (bullish price breakout) would pave for additional gains around the US WTI Crude oil futures. Still, the bullish trajectory would face an immediate hurdle plotted by a strong supply zone ranging from 81.50 - 83.32 levels. Sustained strength by buyers above this barrier would negate any-near term bearish outlook and pave the way for aggressive technical buying around the US WTI Crude Oil Futures.