Gold Remains Confined In A Narrow Range But Treads Near 8-month High On Bets Of A Weaker Dollar

- XAU/USD cross attracts fresh selling on Wednesday during the early Asian session but remains confined in a narrow range

- A fresh leg up in the treasury bond yields as investors weighed remarks from Federal Reserve officials offered some support to the greenback

- Fed's Powell expects political pushback from rate hikes

- Focus is now squarely on the U.S. CPI data, which is expected to show that inflation eased further in December from the prior month

XAU/USD pair has been oscillating in a narrow range of 1880.36 - 1870.45 levels/ near an eight-month high since Monday amid subdued USD demand. That said, the cross met fresh supply on Wednesday during the early hours of the Asian session after attracting bearish bets to drag spot prices lower toward the lower limit of the narrow range. At the time of speaking, the pair is down 47 pips for the day and looks set to maintain its bid tone heading into the European session.

A fresh leg up in the treasury bond yields as investors weighed remarks from Federal Reserve officials and scanned them for hints about the Central Bank's monetary policy plans offered some intraday boost to the safe-haven greenback. Additionally, a rebound in the U.S. equity markets was another factor that underpinned the greenback and exerted downward pressure on the pair.

The U.S. Dollar index (DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, was up 0.14%/14.2 points, extending the modest rebound from the weekly low/102.954 level touched on Monday as investors looked to comments from the Fed officials for fresh insights into the central bank's expectations for inflation and interest rate hikes.

Speaking at an Atlanta Rotary Club event on Monday, Atlanta Fed president Raphael Bostic said interest rates should go above 5% and stay at this level until 2024. Bostic also suggested that the size of the next rate hike would be linked to upcoming inflation data.

On Tuesday, Federal Reserve Chairman Jerome Powell emphasized the need for the central bank to be free of political influence while it tackles persistently high inflation.

In a speech delivered to Sweden's Riksbank, Powell noted that stabilizing prices requires making tough decisions that can be unpopular politically.

"Price stability is the bedrock of a healthy economy and provides the public with immeasurable benefits over time. But restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy," the chairman said in prepared remarks.

"The absence of direct political control over our decisions allows us to take these necessary measures without considering short-term political factors," he added.

That said, uncertainty about whether the Fed will increase rates by 25 or 50 basis points at its next meeting later this month is widespread among investors. CME's Fed watch tool is now pricing in a 79.2% probability of the Fed raising its interest rates by 25bps in its next meeting slated for 1st February 2023.

Focus is now squarely on the U.S. CPI data, which is expected to show that inflation eased further in December from the prior month. The data also comes on the heels of December's nonfarm payrolls report, which showed that labor market activity is cooling.

Easing inflation and cooling labor market activity will drive increased expectations that the Fed will slow its pace of rate hikes this year after a series of sharp hikes in 2022. This scenario presents a positive outlook for metal markets, battered in 2022 as rising rates pushed up the opportunity cost of non-yielding assets.

It is worth noting Bullion prices marked a strong start to the year, having gained nearly 3% since last week as the prospect of smaller U.S. rate hikes offered much relief to the non-yielding asset. The yellow metal was also buoyed by increased safe-haven demand amid growing concerns over a global recession this year. Additionally, China's rapid reopening of its borders following COVID-19 pandemic restrictions provided another boost toward the non-yielding asset and currencies this week away from the safe-haven appeal of the greenback, especially china linked currencies.

As we advance, investors look forward to the U.S. docket featuring the release of the US CPI data on Thursday. In the meantime, the US Bond Yields and the broader market risk sentiment will influence the U.S. Dollar price dynamics and allow traders to grab some trading opportunities around the XAU/USD pair.

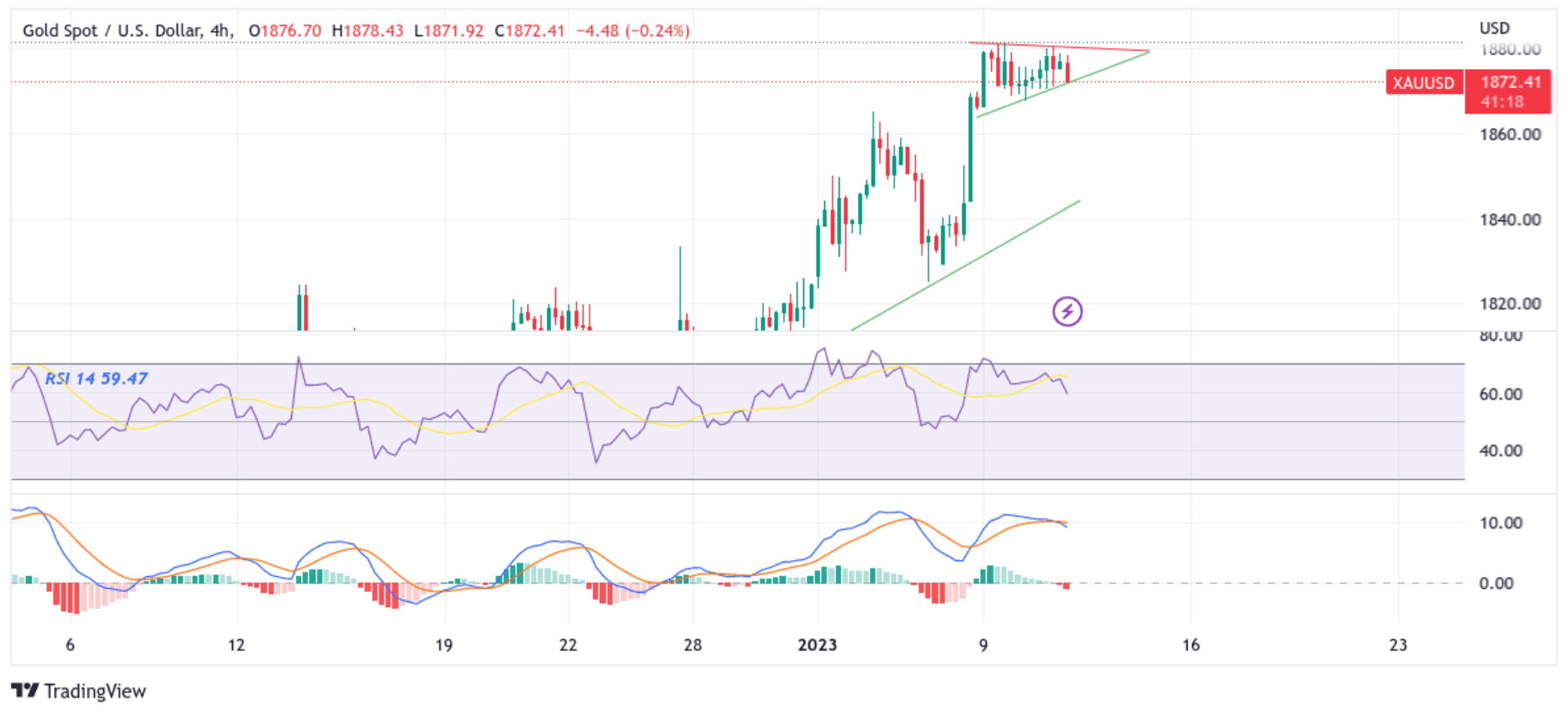

Technical Outlook: Four-Hour XAU/USD Price Chart

From a technical standstill, the price is trading now at a key support level (plotted by an upward ascending trendline of a bullish pennant chart pattern extending from early January 2022 swing high) just a few pips above the lower limit of the range it has been confined in since Monday. If sellers manage to breach this floor(bearish price breakout), it would pave the way for a drop toward the lower limit of the range price has been confined now turned support level (1870.45). On further weakness, the focus shifts down toward the 1865.24 support level.

All the technical oscillators on the four-hour chart are in positive territory, with the RSI (14) at 59.74 above the signal line, portraying a bullish filter; however, a move below the signal line (it would be prudent to wait for a move below the key support levels mentioned above for more confluence) would act as a new trigger to traders to place new bearish bets. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is also above the signal line, pointing to a bullish sign for price action this week.

On the flip side, if buyers resurface and spark, a bullish turnaround resistance comes in at the key resistance level plotted by a descending trendline of a bullish pennant chart pattern extending from the early January 2022 swing high. If the price pierces this barrier (bullish price breakout), it will pave the way for aggressive technical buying around the XAU/USD pair.