NZD/USD Extends Bullish Momentum Further Beyond Key Resistance Level Amid Subdued USD Demand

- NZD/USD cross attracts some buying and extends the bullish momentum for the second successive day

- U.S. NFP Beats Forecast

- U.S. Services Sector Unexpectedly Shrinks: ISM

- China reopens border with Hong Kong

NZD/USD pair prolonged the strong move-up witnessed since late last week and gained positive traction for the second day on Monday amid subdued USD demand. The momentum lifted spot prices to a one-week high around 0.63715 - 0.67743 region during the second part of the Asian session.

Retreating treasury bond yields amid signs that the FED will likely maintain its hawkish rhetoric stance toward fighting inflation after a U.S. jobs data report released on Friday showed a resilient job market. In contrast, a separate report showed the U.S. service sectors unexpectedly shrank in December were seen as factors that forced the U.S. Dollar to trim the majority of its gains and, in turn, exerted upward pressure on the NZD/USD pair.

The U.S. Dollar index(DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, was down 0.3% at the 103.2386 level extending its steep decline from the monthly high/105.3491 level touched late last week after the U.S. jobs data showed a strong, but not blockbuster employment picture in December, while a separate report showed that U.S. services industry activity contracted for the first time in more than 2-1/2 years that month.

Nonfarm payrolls increased by 223,000 monthly, above the Dow Jones estimate of 200,000. At the same time, the unemployment rate fell to 3.5%, 0.2 percentage points below the expectation, according to data released on Friday by the U.S. Bureau of Labor Statistics. The job growth marked a slight decrease from the 256,000 gain in November, revised down 7,000 from the initial estimate.

Wage growth was less than expected, indicating that inflation pressures could weaken. Average hourly earnings rose 0.3% for the month and increased 4.6% from a year ago. The respective estimates were for growth of 0.4% and 5%.

Commenting on the Jobs data report, "There was a bit of a fear that this could be quite a blockbuster print in terms of job growth," which was a risk due to seasonal adjustments that are common in December, said Mazen Issa, senior foreign exchange strategist at T.D. Securities in New York.

The easing wage growth was also "encouraging," Issa added, though he noted hawkish elements in the data.

"You had the unemployment rate dropping, which was not expected, and an increase in the participation rate," Issa said. "This number doesn't do anybody any favors in determining whether the Fed needs to do 25 or 50 at its next meeting."

Further commenting on the December Jobs data report was Atlanta Federal Reserve President Raphael Bostic, who said on Friday that the latest U.S. jobs data was another sign that the economy is gradually slowing and should that continue, the Fed can step down to a quarter percentage point interest rate hike at its next policy meeting.

Richmond Fed President Thomas Barkin also said the U.S. central bank's move to smaller interest rate hike increments would help limit damage to the economy.

The Fed hiked rates 50 basis points at its December meeting after making four consecutive 75-bp increases.

Fed funds futures traders increased bets the Fed will hike rates by 25 bps after its two-day meeting on Feb. 1 after Friday's data. A 25-bp increase is now seen as a 73% probability, compared with 54% before the jobs report, with a 50-bp hike now seen as a 27% probability.

That said, the greenback was further weighed down by the latest ISM's non-manufacturing Purchasing Managers' Index data report, which showed that production numbers fell, a sign that the Fed's rate hikes may be working to slow the economy. The ISM Services PMI for the U.S. fell to 49.6 in December of 2022, well below market forecasts of 55, and compared to 56.5 in November. The reading pointed to the first contraction in the services sector since May 2020 at the height of the covid pandemic. New orders contracted sharply (45.2 vs 56 in November) as demand weakened and inventories shrank faster (45.1 vs 47.9).

Shifting to New Zealand docket, the Kiwi got some intraday boost after a report from China emerged that Hong Kong and Mainland China resumed quarantine-free travel over the weekend, signalling the end of the zero-Covid policy, which kept borders effectively closed for nearly three years. This, in turn, was seen as another factor that undermined the greenback and drove flows away toward the safe-haven Kiwi.

Going forward, in the absence of any major market-moving economic news releases from both dockets, the FEDS monetary policy, U.S. bond yields, and broader market risk sentiment will influence the U.S. dollar and allow traders to grab some trading opportunities around the pair. However, the focus now remains on the U.S. Federal Reserve Chairman Jerome Powell's speech set for release on Tuesday, which would contain subtle clues on future monetary policies.

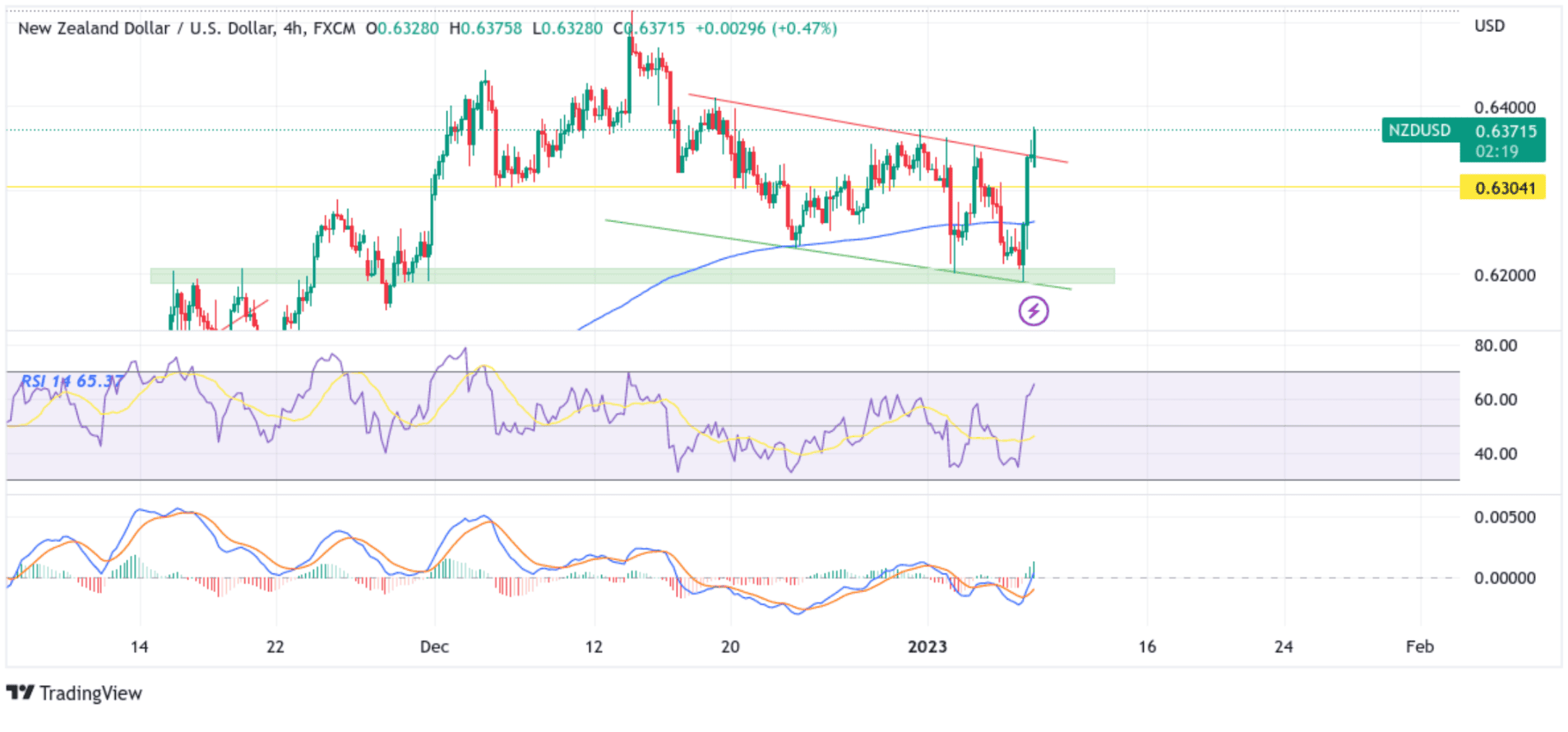

Technical Outlook: Four-Hour NZD/USD Price Chart

From a technical perspective, spot prices are now looking to extend the momentum beyond the downward-sloping trendline of the descending channel pattern extending from the mid-December 2022 swing high. Last Friday's late strong move beyond the 0.63402 level confirmed a solid bullish breakout and supported prospects for additional gains. Some follow-through buying would lift spot prices towards an immediate hurdle (supply zone) ranging from 0.64014 - 0.64133 levels. The aforementioned zone would act as a barricade against the pair against any further uptick however, sustained strength beyond would be seen as a new trigger for bulls to continue pushing the price up and pave the way for additional gains.

The RSI (14) level at 65.37 is on the verge of flashing overbought conditions and warrants some caution ahead of this week's key events/data risks. The moving average convergence divergence (MACD) crossover is below the signal line, portraying a bearish filter. Still, a move above the signal line would signal buyers to place new bullish bets.

On the flip side, any meaningful pullback now finds some support near the 0.63743 support level en route to the downward-sloping trend-line of the descending channel pattern now turned key support level. A convincing break below the aforementioned support levels (including a bearish price breakout) would negate the positive outlook and prompt aggressive technical selling around the pair. The downward trajectory could then accelerate toward the next relevant support (demand zone), ranging from 0.62969 - 0.63047 levels. Sustained weakness below these levels would pave the way for more losses around the NZD/USD pair.