NZD/USD Bulls Aim To Reclaim Back The 0.56000 Mark Amid A Softer USD; China's Trade Balance Data Awaited

- NZD/USD Cross attracts fresh selling on Monday to extend a modest rebound from last week's low

- China's central bank's action to drain cash offers some support to the risk-sensitive Kiwi

- The current price action, which seems to suggest that the market has priced in a narrow deficit in the trade balance, offers support to the Kiwi and exerts upward pressure on the pair.

- The fundamental Backdrop still favors USD Bears amid prospects of further rate hikes by the FED

- China's Trade Balance report to be released today

NZD/USD pair attracted some dip-buying from the vicinity of 0.55576 levels during the Mid-Asian session. So far, the cross has managed to extend the modest rebound from last Friday's daily/weekly low to stage an intraday recovery, and at the same time, the pair has managed to recover a part of its previous losses. A modest rebound in the treasury bond yields boosted by weakened USD demand saw the U.S. Dollar Index (DXY) continue its corrective slide from the vicinity of 113.380 level to exert upward pressure on the pair and keep a lid on the minor against any further downtick.

Lifting the Kiwi could be the news that China's Central Bank may drain cash next Monday via a partial rollover of maturing medium-term loans while keeping policy rates steady, a Reuters survey showed, as ample market liquidity and a sliding Yuan reduce the need for imminent policy easing. The poll also mentioned, "But some still expect the People's Bank of China (PBOC) to ease banks' reserve requirements next month, to aid an economy hit by the COVID-19 pandemic and property market woes." Additionally, the "PBOC injected 2 billion yuan via 7-day reverse repos at 2.00% versus prior 2.00%," stated Reuters. Market updates suggest that the PBOC injects 500 billion yuan into a 1-year Medium Term Lending Facility (MLF).

Further uplifting the Kiwi could be the current price action which seems to suggest that the market has priced in a narrow deficit in the China trade balance report. The report is expected to show an increased volume of goods exported last month in China compared to the ones imported to land at 81.0 Billion Dollars, up from a prior figure of 79.3 Billion Dollars in August.

That said, the U.S. dollar still draws support from prospects of further aggressive rate hiking by the FED as the latest inflation data released last week came in hotter than expected. Additionally, a produce price index data report and an initial jobless claims data report for august all beat market expectations, further adding to the growing pressure on the FED to put in a significant rate hike in its next two meetings. Furthermore, an NFP report released early this month aligned with market expectations and showed a resilient jobs market. Following the report's releases, retail traders have now priced in a likelihood of a 75basis point rate hike at next month's Federal Reserve Meeting. Fed Fund's future and overnight index swaps(OIS) are now pricing a near 100% chance for a more significant rate hike.

As we advance, investors will look for cues from the release of the New York Empire State Manufacturing index report, which is expected to show improving business conditions in the state of New York and land at -4.00 against a prior figure of -1.50. The market attention shifts toward releasing the New Zealand Consumer price index (CPI) data which is expected to show inflation decreased last month and landed at 1.6% against a prior figure of 1.7%. In the meantime, the US Bond Yields and the broader market risk sentiment will influence the U.S. Dollar and allow traders to grab some trading opportunities around the pair.

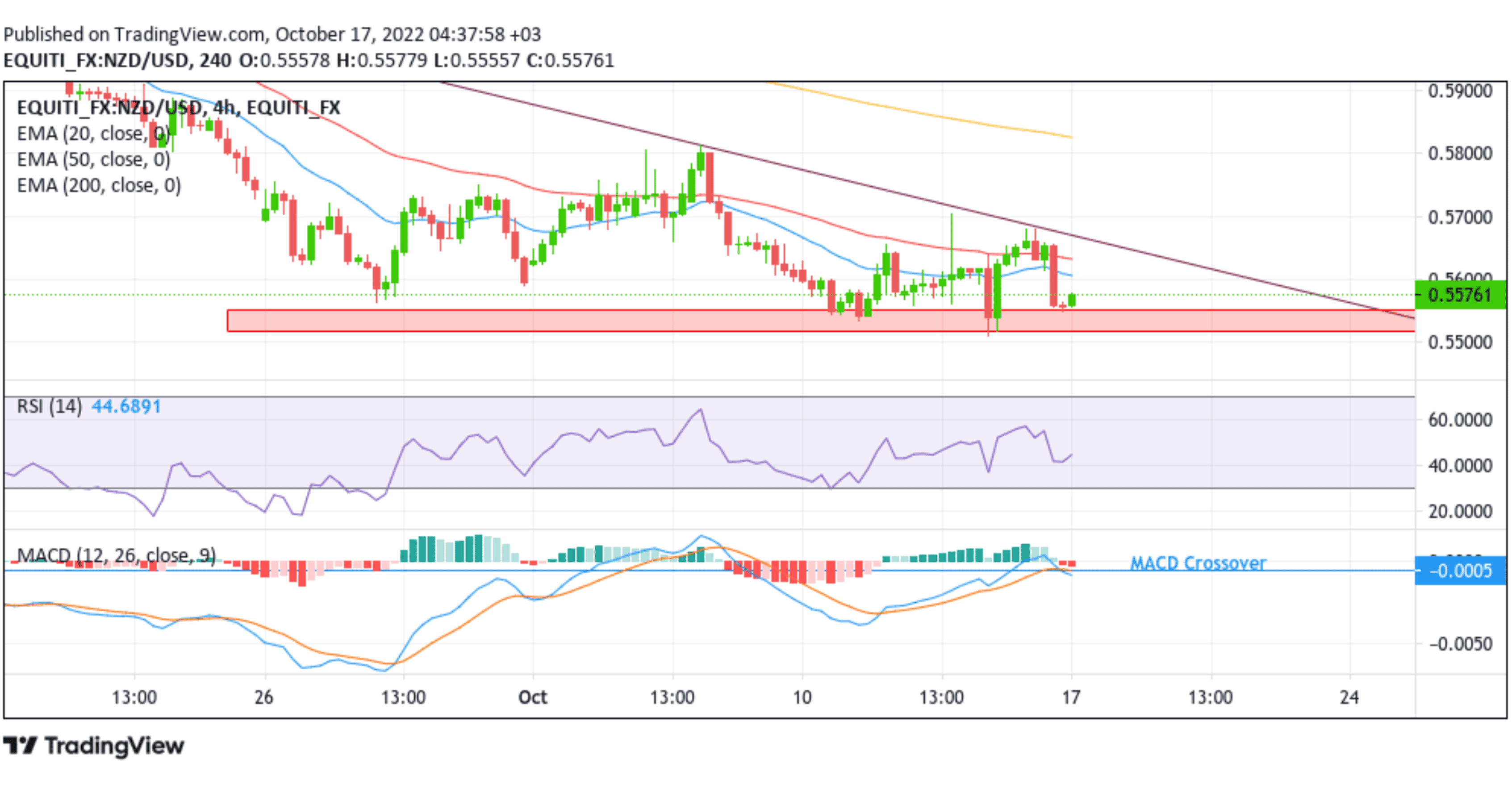

Technical Outlook: NZD/USD Four-Hour Price Chart

From a technical standstill, using a four-hour price chart, the price has extended the modest rebound from the vicinity of 0.55511 levels after sensing a strong key demand zone ranging from 0.55167- 0.55511 levels. Some following-through buying would lift spot prices toward the 20 and 50 EMA immediate hurdle at 0.56074 and 0.56348 levels, respectively. If the buyers manage to break above this ceiling, the attention shifts toward retesting the resistance level plotted by a downward-sloping trendline from the 13th September swing highs. A convincing break above this hurdle would negate any near-term bearish outlook and pave the way for aggressive technical buying.

All the technical oscillators are in positive territory. The RSI(14) at 44.6891 shows a firmer inclination. However, it is still far away from flashing overbought conditions, with the Moving Average Convergence Divergence (MACD) crossover at the -0.0005 level on the verge of moving above the signal line, pointing to a bullish sign for price action this week.

On the Flipside, if dip-sellers and technical traders jump in and trigger a bearish turnaround, the initial resistance will be at the demand zone ranging from 0.55167 - 0.55511 levels. If sellers manage to pierce this floor, it would negate any near-term bullish outlook and pave the way for aggressive technical selling. The downward trajectory could then accelerate toward testing the lower trendline of the multi-week descending channel pattern plotted from the May 2022 swing low. A breach below the aforementioned floor would expose the pair to more losses.