USD/CNH Remains Steady Above The 7.1700 Mark Despite China Stimulus; U.S. CPI Awaited

- The USD/CNH pair attracts some buying on Thursday to extend the bullish trajectory

- Fed minutes show central bank sees more rate increases, higher rates for longer

- PPI data for September came in hotter than expected

- China's local governments to buy houses to aid real-estate developers

- U.S. Inflation Data Set to be released today

USD/CNH pair prolonged its recent strong move over the past eight days and gained traction on Thursday for the seventh day. The momentum lifted spot prices to a one-week high, around 7.17234 - 7.18094 region, during the first half of the Asian Session.

A fresh leg up in the U.S. treasury bond yields on Thursday and a softer risk tone offered some support to the safe-haven greenback, which in turn exerted upward pressure on the pair. Additionally, prospects of further aggressive rate hiking by the FED continued giving consent to the USD Bulls. Federal Reserve Governor Michelle Bowman confirmed on Wednesday that if high inflation does not start to wane, she will continue to support aggressive rate rises aimed at taming price pressures, reported Reuters. The Fed policymaker's comments agreed with the latest Federal Open Market Committee (FOMC) Meeting Minutes, which showed that the central bank expects to continue increasing interest rates and hold them higher until inflation shows signs of abating. "Several participants underlined the need to maintain a restrictive stance for as long as necessary, with a couple of these participants stressing that historical experience demonstrated the danger of prematurely ending periods of tight monetary policy designed to bring down inflation," the minutes stated.

Wholesale prices came in hotter than expected. September's producer price index data, which measures wholesale prices of goods, rose 0.4%, according to a Wednesday report from the Bureau of Labor Statistics. Excluding food, energy, and trade services, PPI increased by 0.3%. Economists surveyed by Dow Jones were expecting headline PPI to add 0.2%. That said, the consumer inflation data set to be released today were to come in hotter than expected, it would add to the growing pressure on the FED to put in a significant rate hike in its next two meetings. The latest offshore Yuan struggles could also be attributed to the ongoing US-China trade wars. The Biden administration on Wednesday announced stricter rules for doing business with China. "The Biden administration's new restrictions on doing business with China are sending shock waves through the global semiconductor industry, with chip-equipment makers girding for perhaps the most painful fallout," stated Bloomberg.

The sweeping rules mean companies must apply for a license if they want to sell certain advanced computing semiconductors or related manufacturing equipment to China, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) said in a release Friday. It is also worth remembering that the Biden administration announced a broad list of export controls targeting China's ability to access US-born semiconductors. Further Limiting the Chinese Yuan is the New Covid cases spiking across mainland China, prompting many local authorities to tighten controls on movement. According to a model from Nomura, about 4.8% of China's gross domestic product was negatively affected by Covid rules as of Monday. That's up from 4.3% a week ago. However, according to China Securities Times, Local governments are set to support developers by buying houses as part of economic stimulus in turning around the economy enticed the Yuan bears and could limit further uptick for the pair going forward. Additionally, U.S. Treasury Secretary Janet Yellen's remarks about the potential for a breakdown in trading U.S. treasuries gave more hope to the Yuan bears.

As we advance, investors will look for directional impetus from the release of the U.S. Consumer Price Index data(CPI) data for September. Analysts expect core inflation-a measure better suited to predict the Fed's monetary policy actions-to cross the wires at 6.5% from a year ago, a figure higher than the prior month's 6.3%. Traders will further take cues from the release of the Initial Jobless Claims data by the U.S. Department of Labor, which is expected to land at 225,000, up from a prior figure of 219,000. The reports would cause a lot of volatility in the market, warranting caution against submitting aggressive bets on the pair.

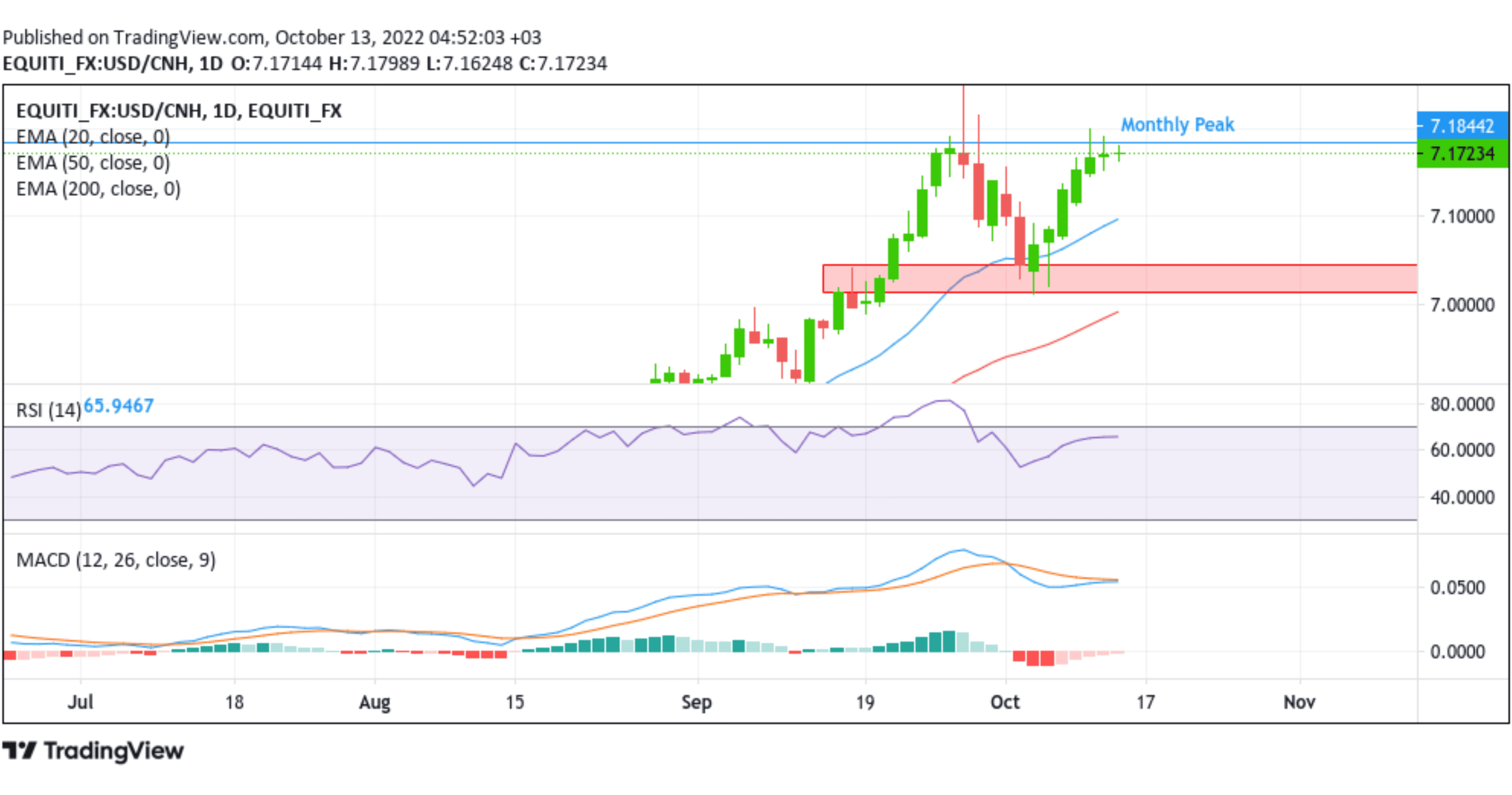

Technical Outlook: One-Day Price Chart

From a technical perspective using a one-day price chart, the price looks to extend the modest rebound from the vicinity of 7.01368 - 7.04447 regions. Further uptick would lift spot prices toward the 7.19805 key resistance level last touched on Tuesday during the mid-Asian trading session. Sustained strength above the aforementioned ceiling would pave the way for additional gains around the USD/CNH pair. The upward trajectory could then accelerate toward the 7.26746 level last reached in 2008, and a further uptick above this level will weaken the Yuan significantly.

All the technical oscillators are in negative territory. That said, the RSI(14) at 65.9467 is on the verge of flashing overbought conditions with the impending Moving Average Convergence Divergence (MACD) crossover above the signal line pointing to a bullish sign for price action this week.

On the flip side, if sellers resurface and spark a bearish turnaround, initial resistance comes in at the demand zone ranging from 7.01368- 7.04447 levels. A convincing break below the aforementioned zone would negate any near-term bullish outlook and pave the way for technical selling around the USD/CNH pair.