GBP/USD Weakens Further Below The 1.09000 Mark Amid BOE Intervention, A Slew Of U.K. Economic Data Awaited

- GBP/USD pair attracted some selling on Wednesday and dropped further below the 1.09000 mark

- The Bank of England on Tuesday announced an expansion of its emergency bond-buying operation

- Encouraging UK Jobs data fail to impress Buyers

- The backdrop favors USD Bears amid prospects of further rate hiking by the FED

- A slew of U.K. economic data is to be released today during the early European session

GBP/USD cross attracted some selling on Wednesday during the early part of the Asian session and looked set to extend the downward trajectory. This marked the sixth day of a negative move in the previous twelve days and dragged spot prices to over a two-week low.

The Bank of England on Tuesday announced an expansion of its emergency bond-buying operation as it looks to restore order to the country's chaotic bond market. The central bank said it will widen its purchases of U.K. government bonds — known as gilts — to include index-linked gilts from October 11 until October 14. Index-linked gilts are bonds where payouts to bondholders are benchmarked in line with the U.K. retail price index. This, in turn, led to the U.S. Treasury bond yields ticking up on Tuesday, with the work on the benchmark 10-year Treasury note rising about 5 basis points, trading at 3.937% at Tuesday's market close. On the other hand, the U.K. bonds slumped following the announcement, with the 10-year gilt yield slipping to 4.426% while the 30-year yield was roughly flat at 4.713%. This, in turn, undermined the Cable and exerted downward pressure on the pair.

It is worth noting the wild moves in the U.K. bond markets were triggered by Finance Minister Kwasi Kwarteng's controversial fiscal policy announcements on September 23, which contained large swathes of debt-funded tax cuts as part of the new government's aim to drive economic growth to 2.5%. That said, Kwarteng announced Monday his detailed expansion on the policy statement that spooked markets would take place on October 31, three weeks before initially scheduled. Further limiting the British Pound was the news on Moody's and other credit rating agencies' revised down outlook for U.K. sovereign debt; Des Lawrence, a senior investment strategist at State Street Global Advisors, suggested that the correlation between U.S. long-dated Treasury yields and U.K. gilts also limits the Bank of England's reach. Additionally, the number of people receiving unemployment benefits in the U.K. increased more than expected. It rose by 25.5K during September versus expectations of -11.4K and 6.3K prior, according to the latest figure by the U.K. Office for National Statistics. The unemployment rate for June to August 2022 decreased by 0.3 percentage points in the quarter to 3.5%, though it came in slightly with the market expectation of 3.6%.

In the U.S. Docket, prospects for a more aggressive policy tightening by the FED, the renewed US-China trade jitters, and the risk of further escalation in the Russia-Ukraine conflict have been fueling recession fears. This, in turn, remains supportive of the greenback in the long run and should cap the Cable against any meaningful uptick. Additionally, a slew of U.S. economic data released in the past few weeks, including the Fed's preferred inflation gauge, namely the Core Personal Consumption Expenditure (PCE) Price Index for August, which showed inflation running well above the central bank's 2% long-run target and also the recently released Non-farm Payrolls report which showed a resilient jobs market continue to put pressure on the FED in hiking interest rates further in its next two meetings. A series of hawkish comments by top FOMC members last week has also reinforced expectations that the Fed will hike rates faster to curb inflation.

As we advance, investors will look for fresh cues from the release of the UK Gross Domestic Report (GDP) for September, which is expected to show some growth in the U.K. and land at 0.3%, an improvement from a prior figure of 0.2%. Traders will further take cues from the release of the U.K. Manufacturing report for September by the national office of statistics which is expected to land at 0.4% against a prior figure of 0.1%. That said, the primary focus shifts to the upcoming U.S. Consumer Price Index (CPI) data and Retail Sales data due on October 13 and 14, respectively. Analysts expect core inflation-a measure better suited to predict the Fed's monetary policy actions-to cross the wires at 6.5% from a year ago, a figure higher than the prior month's 6.3%. On the other hand, the Core retail sales data is expected to show a positive improvement in the total value of sales at the retail level in the U.S. and land at 0.1% against a prior figure of -0.3%.

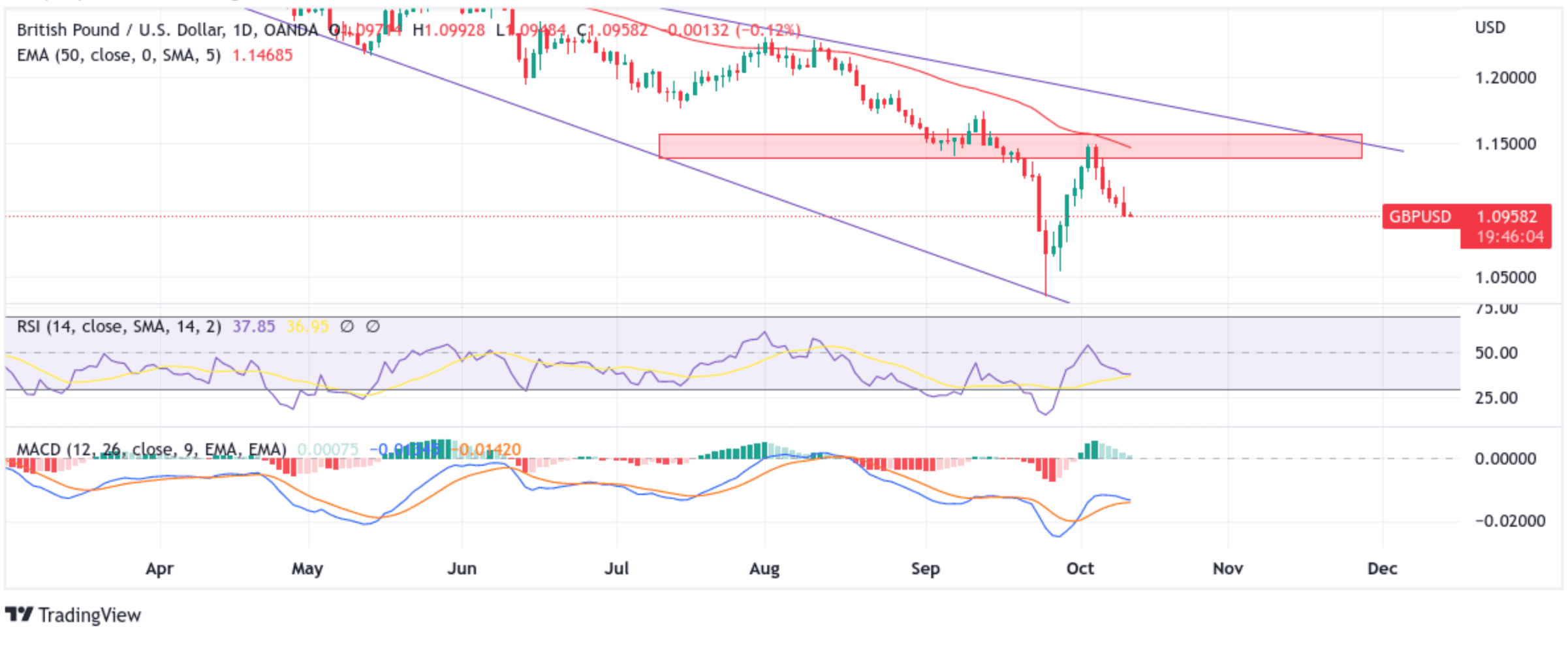

Technical Outlook: GBP/USD One-Day Price Chart

From a technical perspective, using a one-day price chart, the price looks to extend the downward trajectory after a strong rejection from the key 1.14685 resistance level last week. Further downside moves by sellers would drag spot prices lower toward the Key Demand Zone(In the lower time zone-four hours) ranging from 1.07611- 1.08437 levels. If sellers breach the aforementioned floor, this would negate any near-term positive outlook and pave the way for aggressive technical selling around the GBP/USD pair. The downward trajectory could then accelerate toward testing the support level (downward sloping trendline plotted from the march 2022 swing high). A breach below the aforementioned support level exposes the pair to more losses.

All the technical oscillators are in negative territory. That said, the RSI(14) at 37.85 is on the verge of flashing oversold conditions with the impending Moving Average Convergence Divergence (MACD) crossover below the signal line, pointing to a bearish sign for price action this week.

On the flip side, if dip-buyers and technical traders jump in and trigger a bullish turnaround, the initial resistance will be at the supply zone ranging from 1.10374-1.11739 levels plotted on a four-hour chart. Sustained strength above the aforementioned ceiling would lift spot prices toward the next key supply zone ranging from 1.14685- 1.17233 levels. A convincing break above the aforementioned resistance level would set the stage for further near-term appreciating moves.