U.S. WTI Crude Oil Eases Above $90.52 Level On Tight Supply Prospects

- US WTI Crude oil prices rebounded on Tuesday during the mid-Asian session amid renewed supply fears

- A stronger US Dollar continues to undermine the US WTI crude oil in the long run as rising aggressive rate hike bets mount

- Saudi Arabia-led OPEC+ cartel agreed to cut output by 2 Million barrels per day at a meeting in Vienna last week; this in turn led to high Oil prices

US WTI Crude oil prices rebounded on Tuesday on supply fears despite slipping the previous day by as much as 69 cents to end the day at $90.76 per barrel. As per press time, WTI Crude oil prices are up 0.66%/ 60 cents to trade at $91.12 per barrel as of 05:01 UTC+3.

US WTI Crude Oil prices continue to be undermined by a strong US Dollar which keeps rising faster than its peers. The US Dollar index rose by 0.36% to 113.08 to move closer to its 52-week high of 114.75 on Monday following high treasury bond yields bolstered by market expectations that the FED will continue to hike its interest rates in its next policy meetings after a job reading data released last week showed a resilient jobs market. Market investors have now priced in a likelihood of a 75basis point rate hike at next month's Federal Reserve Meeting. Fed Fund's future and overnight index swaps(OIS) are now pricing a near 100% chance for a larger rate hike. It is worth noting a stronger greenback is generally bearish, making it more expensive for buyers with other currencies in the dollar-denominated oil market. This, in turn, was seen as another factor that underpinned oil prices, exerting upward pressure on the precious black liquid.

Supporting increased oil prices late last week was the move by the Saudi Arabia-led OPEC+ cartel, which agreed to cut output by 2 Million barrels per day at a meeting in Vienna last week, a move targeted at pushing prices per barrel back to $100 per barrel for the first time since July. The move drew a sharp response from President Biden, who called on his administration and congress to explore ways to boost US Energy production and reduce OPEC'S control over energy prices.

"The President is disappointed by the shortsighted decision by OPEC+ to cut production quotas while the global economy is dealing with the continued negative impact of (Russian President Vladimir) Putin's invasion of Ukraine," national security adviser Jake Sullivan and National Economic Council Director Brian Deese said in a statement. Biden warned that he will now continue to direct releases from the nation's Strategic Petroleum Reserve "as necessary," a shift from the White House's previous comments that it would end the drawdown in the coming weeks.

That said, The White House is now worried about the cut cementing Saudi Arabia's closer cooperation with Russia, also a member of OPEC+, as oil revenues fund Moscow's war machine in Ukraine. "Look it's clear that OPEC Plus is aligning with Russia with today's announcement," White House spokesperson Karine-Jean Pierre told reporters aboard Air Force One on Wednesday. Putin's invasion of Ukraine seven months ago has failed to achieve any of its strategic objectives.

In recent weeks, it has sustained increasingly heavy losses of men and equipment as Ukrainian forces have recaptured significant territory in the country's east. Russia's initial invasion of Ukraine caused oil prices to skyrocket in February, given that substantial consumers in Europe and Asia rely heavily on Moscow for supplies. That said, European Union late last week endorsed a G7 plan to impose a price cap on Russian oil exports. Analysts have warned that the complicated new sanctions package could end up shutting in considerable supplies of Russian crude. "A recessionary economic outlook will lead to lower oil demand," Fitch Ratings said on Monday. "However, we expect pricing volatility to remain high in the short term as geopolitical factors, such as further sanctions lead to a reduction in Russian exports," Fitch said that those political factors could alter supply patterns and cause greater price volatility.

Meanwhile, services activity in China during September was contracted for the first time in four months as COVID-19 restrictions hit demand and business confidence, as shown on Saturday. The slowdown in China, the world's second-largest oil consumer behind the United States, adds to growing concerns over a possible global recession triggered by numerous central bank charts raising interest rates to combat high inflation. Rising rates, coupled with heightened inflation, are expected to weigh on crude demand by slowing economic growth. High-interest rates also limit consumers' spending ability, weighing on gasoline demand.

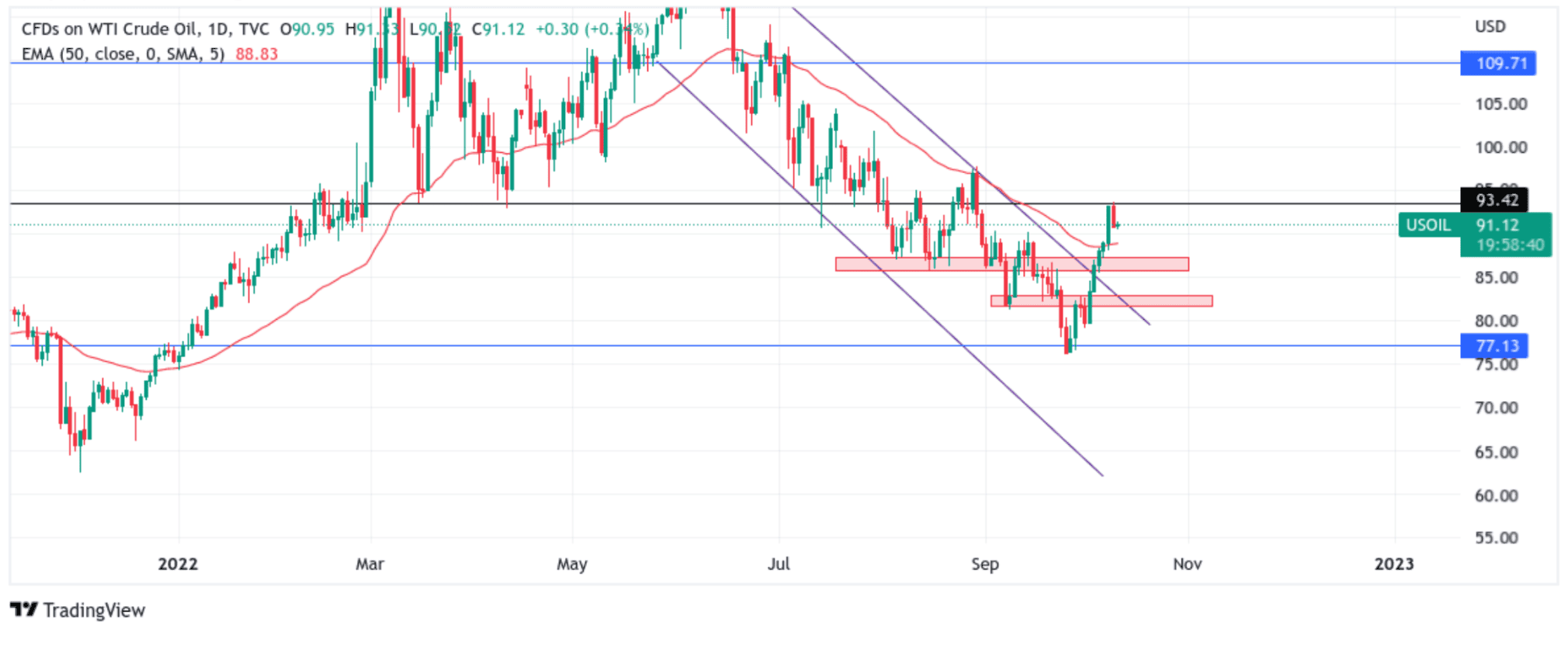

US WTI Crude Oil Technical Outlook: One-day Price Chart

From a technical Standstill, US WTI Crude oil prices rebounded from the vicinity of the $90.52 level after falling the previous day from the vicinity of $93.53 per barrel. Further uptick would drag spot prices toward the relevant hurdle at $94.22 - $97.64. A convincing break above the aforementioned ceiling would pave the way for additional gains toward reclaiming the $100 per barrel mark for the first time since July.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial resistance appears at the 86.33 support level, which coincides with the upper trendline of the descending channel pattern plotted from July 2022 swing high. Selling interest could gain momentum if the price pierces this floor, creating conditions for a drop toward the next relevant hurdle at the $81.74 level. Sustained weakness below this support level would drag US WTI Crude Oil to additional losses.