FRA40 Index Surrenders Modest Intraday Recovery Gains, Retreats Below €7500.00 Mark

Key Takeaways:

- The CAC 40 (FRA40) futures index moves back below the €7500.00 mark, weighed by slight weakness in industrial and consumer discretionary stocks

- ECB holds rates as expected and maintains a hawkish stance

- Publicis Groupe S.A., Plc. (Paris: PUBP) and Teleperformance S.E., Plc. (Paris: TEPRF) led the list of top gainers and losers, respectively, before the bell

The CAC 40 (FRA 40) futures index slipped lower on Friday during the Asian session, weighed down by slight weakness in industrial and consumer discretionary stocks as investors continued to digest the European Central Bank's (ECB) monetary policy decision and the latest U.S. GDP figures.

As of press time, futures tied to the CAC 40 index fell around 0.23% (17.59 points) to trade at the €7498.25 level. The current price move follows an extension of the modest bounce from the vicinity of the €7517.96 level touched earlier in the session and seems to have snapped a two-day winning streak.

The CAC 40 (FRA 40) futures index rose heavily over the last two days, supported by a rally in tech stocks and increased market bets that the European Central Bank (ECB) will leave rates unchanged during the January monetary policy meeting after the past few weeks saw policymakers push back the idea of early rate cuts, particularly after the December eurozone CPI climbed to 2.9% from 2.4% the prior month.

The bets were reaffirmed after the European Central Bank on Thursday announced it had kept its interest rates unchanged at record-high levels during its first meeting of 2024 and pledged to maintain them at sufficiently restrictive levels for as long as necessary to bring inflation back to its 2% target promptly, despite concerns about a looming recession and a gradual easing in inflationary pressures.

The primary refinancing operations rate remained at a 22-year high of 4.5% for a third consecutive time, while the deposit facility rate held steady at a record of 4%. During the central bank's press conference, President Lagarde told reporters that officials unanimously concurred that it was premature to engage in discussions regarding interest rate cuts.

Elsewhere, Germany's Ifo Business Climate indicator fell for a second consecutive month to 85.2 in January 2024, down from a revised 86.3 seen in the previous month and falling short of the market consensus of 86.7. Additionally, the Ifo Current Conditions indicator for Germany fell to 87.0 in January 2024, down from 88.5 in the previous month and falling short of the market consensus of 88.6.

Across the North Atlantic Ocean, a U.S. Bureau of Economic Analysis (BEA) report released on Thursday showed the U.S. economy expanded an annualized 3.3% in Q4 2023, much better than forecasts of a 2% rise, following a 4.9% rate in Q3. Considering the entire 2023, the U.S. economy grew 2.5%, compared to 1.9% in 2022 and the Fed's estimates of 2.6%.

FRA 40 Index Movers

Here are the top FRA40 index movers today before the bell. This week, the primary index is on track to post one of its best weekly gains in almost two months.

Top Gainers

- Publicis Groupe S.A., Plc. (Paris: PUBP) rose 3.61%/3.20 points to trade at €91.96 per share.

- Airbus S.E., Plc. (Paris: AIR) added 1.19%/1.74 points to trade at €148.48 per share.

- Edenred S.A., Plc. (Paris: EDEN) gained 1.18%/0.66 points to trade at €56.62 per share.

Top Losers

- Teleperformance S.E., Plc. (Paris: TEPRF) lost 6.17%/9.45 points to trade at €143.75 per share.

- Renault SA, Inc. (Paris: RENA) declined 1.71%/0.60 points to trade at €34.21 per share.

- Kering SA, Inc. (Paris: PRTP) shed 1.03%/3.75 points to trade at €361.00 per share.

Market participants now look forward to Bundesbank President Buba Balz's speech during the early European session. Investors will look for cues from releasing the Core Price Consumption Expenditure (PCE) price index –the Fed's preferred inflation gauge.

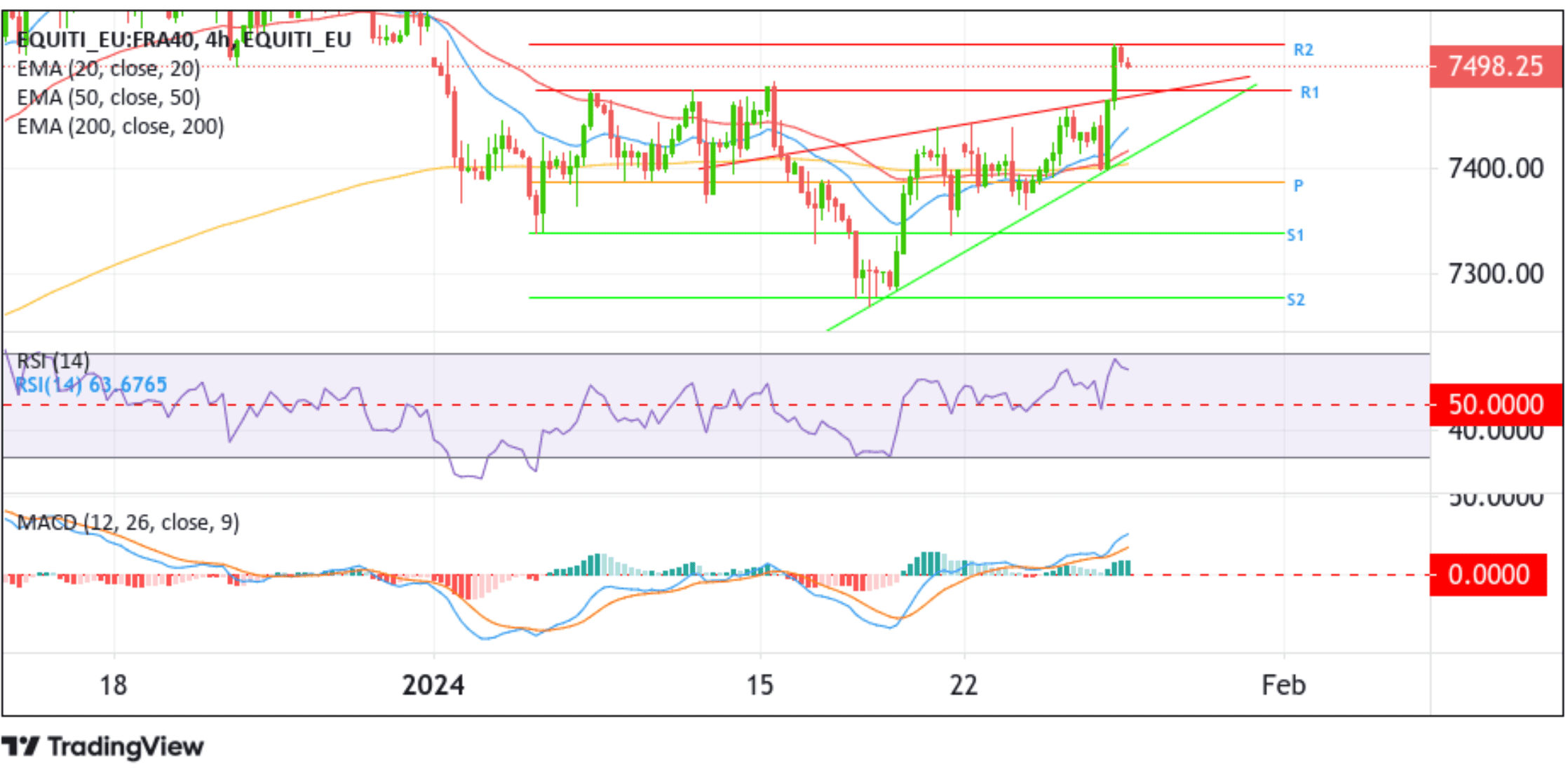

Technical Outlook: Four-Hour FRA40 Futures Index Price Chart

From a technical standpoint, Thursday's bullish price breakout above the upper limit of the Bearish Symmetrical Triangle chart pattern extending from the mid-January 2024 swing to higher highs reaffirmed the bullish bias. It supported the case for further upside moves. The current price action shows the primary index price is trading below the €7500.00 mark after extending the modest bounce from the vicinity of the €7517.88 level; however, further selling would still be seen as a buying opportunity and risk the chance of fizzling out sooner or later due to the heavy resistance below the current price level. Furthermore, the acceptance of the price above the technically strong 200-day (yellow) EMA level at €7395.28 favors buyers and supports the case for further buying. Moreover, the chart's technical oscillators (RSI and MACD) hold positive territory, suggesting continuing the bullish price action today.

Hence, if buyers resurface and catalyze a bullish reversal, the primary index could rise above the €7500.00 mark and ascend toward 7517.88 (R2). A clean move above this level would pave the way for further gains around the main index.

On the flip side, if sellers extend the corrective pullback in the coming sessions, initial support will appear at the 7474.79 level (R1), which is now the support level. A decisive move below this level will pave the way for a further decline toward the upper limit of the Bearish Symmetrical Triangle chart pattern. A clean break (bearish price breakout) below this resistance-turned-support level would see the primary index accelerate its decline to tag the 20-day(blue) EMA level at 7442.47, followed by the 20-day(EMA) level at 7419.49 before moving to retest the critical support level (lower limit of the Bearish Symmetrical Triangle chart pattern extending from the mid-January 2024 swing lower-lows). If sellers manage to breach this floor, downside pressure could accelerate, paving the way for a drop toward the 7388.85 pivot level (p). On further weakness, the focus would shift lower to 7338.02 (S1), followed by 7276.82 (S2).