USD/CNH Slips Back Below 6.8700 Mark Amid Liquidity Support And Firm 200 EMA Level Rejection

- USD/CNH Pair witnessed selling in the mid-Asian session after sensing rejection from the crucial barricade at the 200 EMA level

- China's Central Bank boosts liquidity support with the rollover of medium-term loans, in turn, causes Yuan to strengthen against the buck

- Backdrop seems tilted in favor of USD Bulls amid bets for further rate hikes by the FED, in turn, should limit further USD/CNH downside move

USD/CNH cross witnessed fresh selling during the mid-Asian session and dragged spot prices below the 6.8700 mark after sensing rejection from its crucial barricade at 6.88219 level 200 EMA. The pair looks set to maintain its bid tone heading into the European session. The Chinese Yuan strengthened against the buck during the mid-Asian session after news emerged that China's central bank had bolstered liquidity support for the economy as it rolled over maturing medium-term policy loans with higher cash offerings for the fifth month on Monday while keeping the interest rate unchanged as expected.

The slightly higher fund injection would help replenish liquidity gaps created by upcoming tax payments by banks and companies as policymakers look to inject momentum into the economic recovery. Monday's operation aimed to keep "banking system liquidity reasonably ample," the central bank said online. Further driving flows toward the Chinese Yuan is the series of negative US Macro data, cemented market expectations that the Federal Reserve could be nearing the end of its aggressive interest rate hike cycle. Apart from this the latest US macro data released on Friday showed consumer spending fell twice as much as expected. Retail sales declined by 1% last month, more than the 0.5% drop expected by economists polled by Dow Jones, partly because consumers paid less for fuel.

Commenting on the report, "Retail sales came in weaker than expected, but a lot of the miss had to do with lower gas prices, which all things being equal is a slight positive for spending," wrote Chris Zaccarelli, Chief Investment Officer at Independent Advisor Alliance.

The disappointing retail sales data came from two back-to-back inflation reports, signalling inflation was cooling in the US. Last week's PPI report for March showed a decline of 0.5% on a monthly basis. Economists previously surveyed by Dow Jones had expected the PPI print to come in flat. This came after the latest consumer price index reading published on Wednesday showed that prices rose by 0.1% in March, slightly less than the 0.2% anticipated by economists, according to a Dow Jones survey.

Fed Funds futures traders are now seeing pricing in an 80.9% probability that the FED will hike interest rates 50 bps up from 71.2% at the beginning of the month despite the latest data pointing to a FED pivot anytime soon. That said, the backdrop still seems tilted in favor of the USD Bulls. Additionally, a generally weaker tone around the equity markets could further undermine the Chinese Yuan and help limit more profound losses for the USD/CNH pair, at least for now.

As we advance, without any major significant economic data from both dockets, the US Bond yields and the broader market risk sentiment will continue to influence the USD price dynamics and provide trading opportunities around the USD/CNH pair.

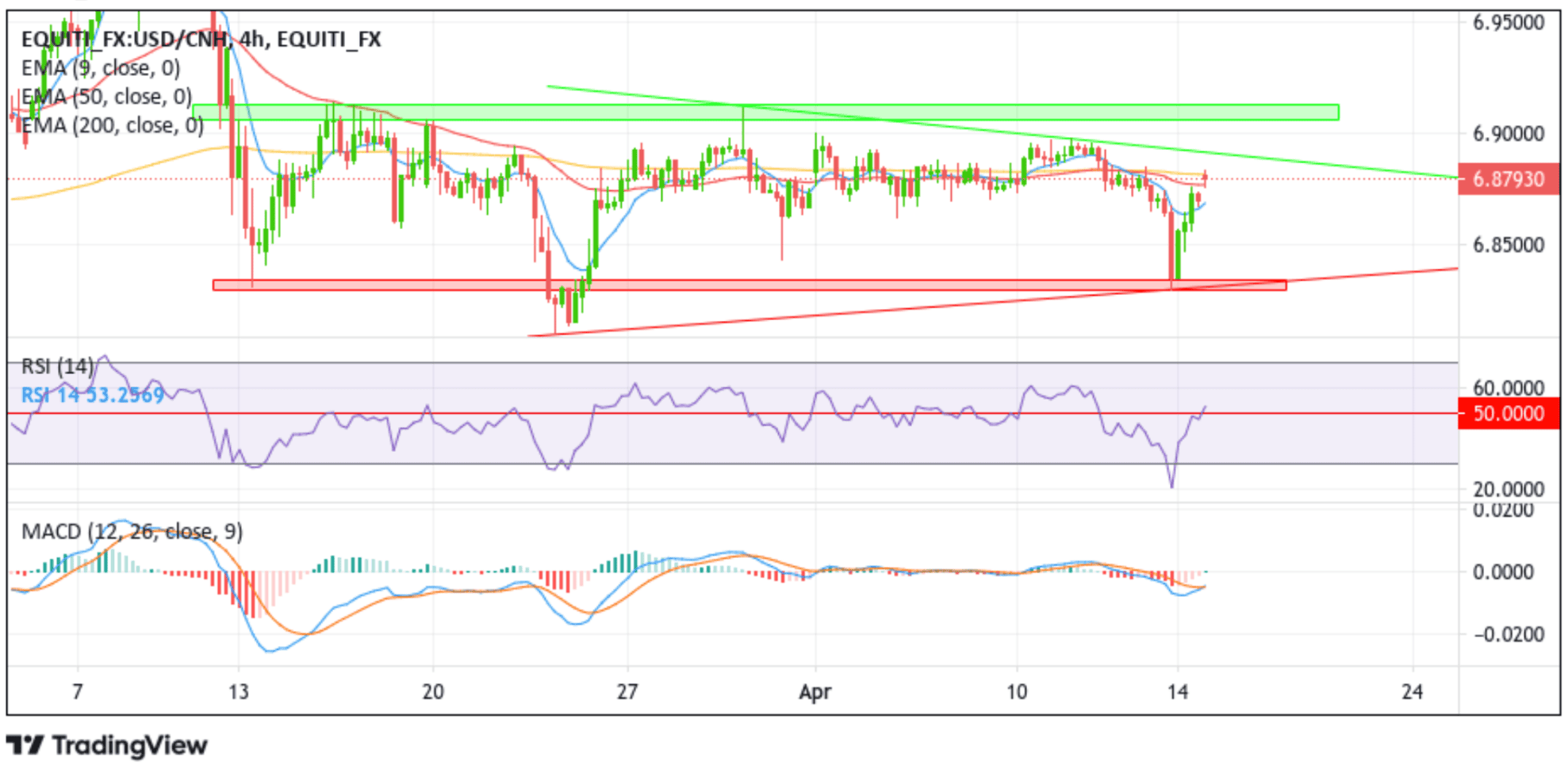

Technical Outlook: Four-Hours USD/CNH Price Chart

From a technical standpoint, the price returned below the 6.8800 mark after encountering stiff resistance from the technically strong 200 EMA (yellow) at the 6.88219 level earlier in the session. Some follow-through selling would face initial resistance at the 50 EMA (red) support level at 6.87795 level. A convincing move below this level would pave the way for a further downside toward tagging the 20 EMA (Blue) support level at 6.87169. A decisive flip of this support level into a resistance level would negate any near-term bullish outlook and pave the way for aggressive technical selling.

An RSI 14 confirmation of a move below the signal level (50) and a break below the 50 and 20 EMA levels would send a new SELL signal for traders to continue pushing down the price. This move would be validated by the MACD Confirmation (crossover is below the signal line) plus the 200 EMA rejection to validate the overall bearish thesis.

On the flip side, if dip buyers and tactical traders jump back in and trigger a bullish reversal, the price will encounter stiff resistance from the 200 EMA resistance level. A decisive flip of this technically strong level into a support level could negate the bearish outlook. The USD/CNH pair could then ascend toward retesting the key resistance level plotted by a descending trendline extending from the late-March 2023 swing high. A four-hour candlestick close above this level could see the bullish rally extending toward the key supply zone ranging from 6.90633 to 6.91296 level.