USD/CAD Submits To Further Selling Pressure And Edges Lower Below 1.34000 Mark, US PPI Eyed

- USD/CAD cross attracts some selling on Thursday and extends the Bearish Trajectory further below 1.34000 Mark

- Downbeat U.S. inflation numbers and unimpressive Fed Minutes weigh on U.S. Dollar.

- The combination of negative Canada macro data gets overlooked by key U.S. risk catalysts

- Markets look forward to the release of the US PPI Inflation data report for directional impetus

USD/CAD pair extended the modest pullback from the 1.35470 - 1.35537 region or the monthly high and witnessed selling for the fourth successive day on Thursday. This also marked the fifth day of a negative move in the past nine days and dragged spot prices to a five-week low, just below the mid-1.34000s.

Retracing treasury bond yields and a weaker risk tone forced the U.S. dollar to trim most of its gains on Wednesday as investors absorbed the release of new inflation figures and the Federal Reserve’s latest meeting minutes. This supported the Loonie and helped exert downward pressure on the USD/CAD pair. A goodish rebound in the U.S. equity markets undermined the greenback and helped cap the USD/CAD pair against any meaningful uptick. A US Bureau of Labor Statistics report on Wednesday showed inflation pressures continued to ease in the U.S. after the annual inflation rate in the U.S. slowed for a ninth consecutive period to 5% in March of 2023, the lowest since May of 2021 from 6% in February, and below market forecasts of 5.2%. Core C.P.I., excluding food and energy, increased 5.6% during the year and 0.4% during the month, as expected.

The better-than-expected inflation data report reinforced investor bets that the Federal Reserve is nearly done with its tightening cycle. The upbeat inflation report came on the back heel of a series of negative US macro datas in the previous weeks which all suggested that the FED. will adopt a less hawkish stance in its next monetary policy meeting.

Additionally, dovish comments from San Francisco Fed President Mary Daly on Wednesday triggered the treasury bond yields to move lower. They prevented the U.S. dollar bulls from joining on board as she raised the possibility of fewer rate hikes by the Fed, stating that policy was at a point where rates did not need to be raised at every meeting.

However, Minutes from the March Federal Open Market Committee meeting released on Wednesday slightly changed the Fed pivot narrative as it showed the central bank expects a recession this year of the turmoil in the banking sector stemming from the collapse of Silicon Valley Bank. “Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years,” the meeting summary said. Investors assessed the Fed’s minutes and concluded that more rate hikes are on the way and the Fed will not pivot anytime soon as initially thought in its bid to stamp down inflation and bring it down to its 2% target. This, in turn, triggered dip buying around the U.S. dollar, which helped limit further U.S. dollar bleeding. The prevalent risk-off mood helped the U.S. Dollar Index (D.X.Y.), which measures the value of the United States dollar relative to a basket of foreign currencies, to rise slightly higher and settle above 101.530 on Tuesday but still poised to end the week in heavy losses.

That said, on Thursday, Fed Fund Futures traders have seen pricing in a roughly greater chance of a 50 bp rate hike in May, with the rest of the odds tilted toward a pause from the Fed. On Thursday, the probability of a 50 bps hike next month was more than 67%, up from 43.3% last week.

Shifting to the Canadian docket, The Bank of Canada on Wednesday, in its interest rate decision, announced it had held the target for its overnight rate unchanged at 4.5% in its April 2023 meeting, as previously signalled, and stated that it would continue to monitor the latest economic data for future decisions on the policy rate. The decision followed the tightening pause in March. The Governing Council believes that current borrowing costs are restrictive enough to bring inflation down to 2% and opted to support slowing growth. Following the banks’ decision, the Loonie weaken significantly against its peers, sliding as far as 0.14% against the dollar.

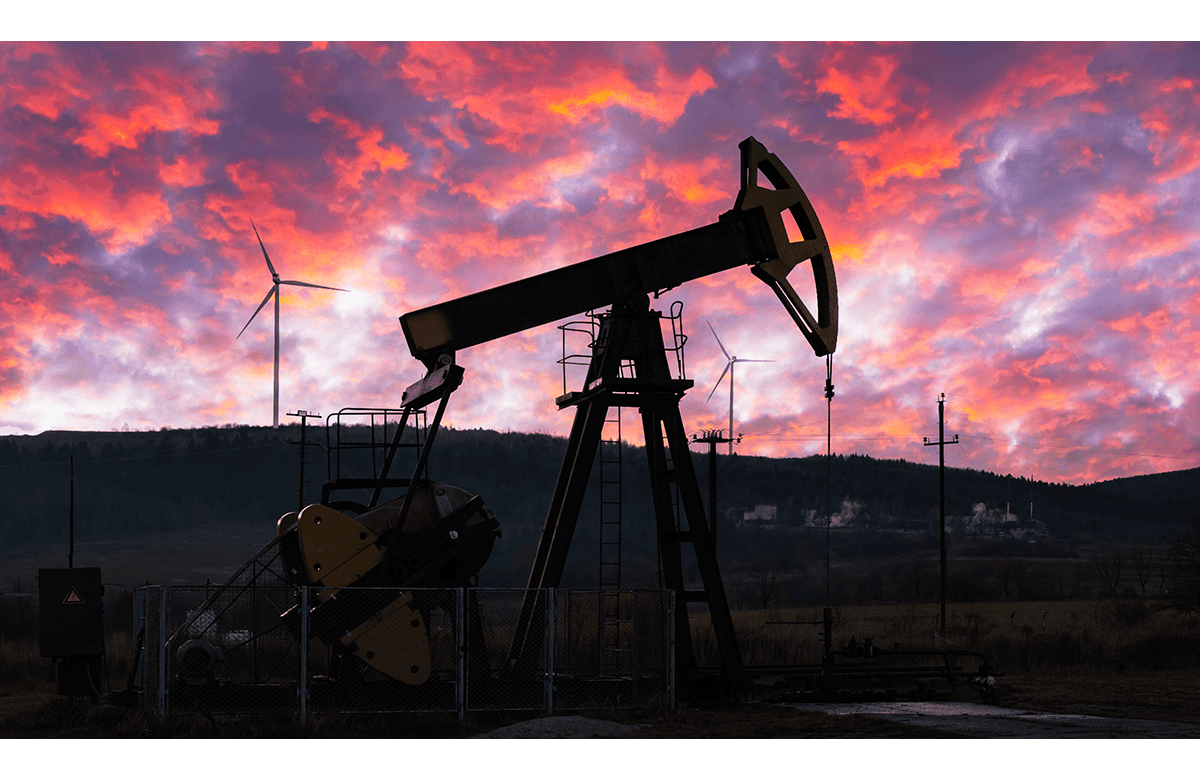

Further limiting the Loonie was sliding crude oil prices as markets gauged soft Chinese data, the prospect of a U.S. recession against more signs of easing inflation and growing bets that the Federal Reserve will pause its rate hike cycle. In addition to the inflation data, signs of improving U.S. demand aided retreating crude oil prices. While overall U.S. crude inventories unexpectedly grew in the week to April 7, a bulk of this increase was driven by a release from the Strategic Petroleum Reserve (S.P.R.). The key U.S. risk catalysts influencing the USD/CAD price movement have overlooked the combination of negative Canadian macro data.

Going forward, investors look forward to the U.S. docket featuring the release of the Produce Price Index (PPI) data for March, seen higher at 0.1%, up from -0.1% the previous month. Excluding food and energy, the Core PPI data is expected to land at 0.3%, up from 0% the previous month. Investors will look for cues from the initial jobless claims data release, seen higher at 232K, up from 228K the previous week.

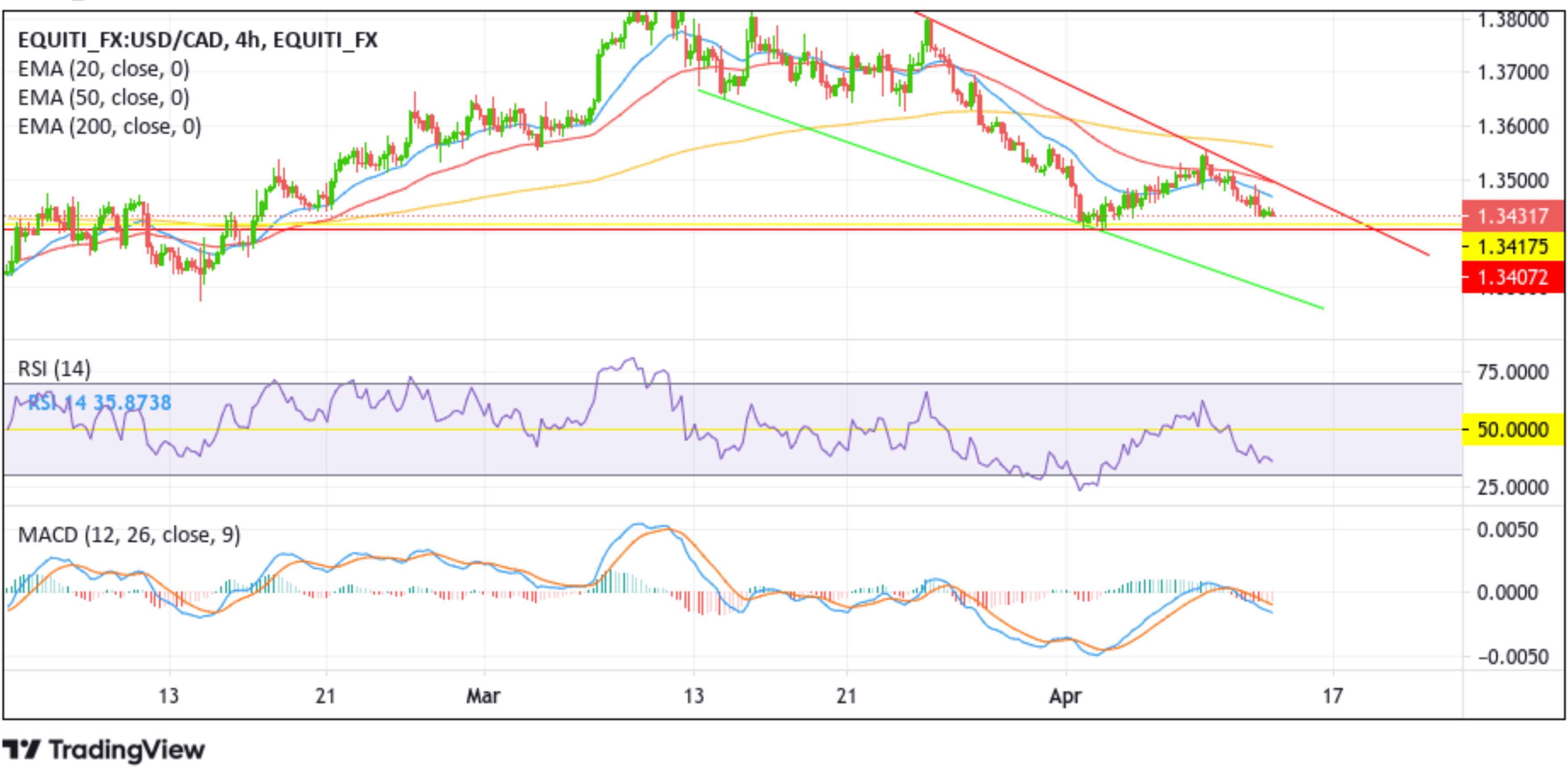

Technical Outlook: Four-Hours USD/CAD Price Chart

From a technical standstill, USD/CAD pair technical sellers heeded the call to keep the price in a bearish decline upon receiving SELL signals from the Technical Oscillators, which are holding in bearish territory. Furthermore, acceptance of price below the technically strong 200 EMA (yellow) at 1.36314 level followed by a 50 E.M.A. and (red) and 200 EMA (yellow) crossover (Golden cross) at 1.36177 level must have triggered more technical sellers to jump in and push down the price. As the Bears look to record more gains, USD/CAD pair faces an immediate hurdle due to the demand zone ranging from 1.34072 - 1.34175 levels. A convincing move below this hurdle could pave the way for USD/CAD to record more gains. For this to happen, bears must increase their selling momentum below current levels.

Past the aforementioned levels, the price could drop further toward retesting the key support level plotted by a descending trendline extending from the late March 2023 swing low. A break below this level could pave the way for aggressive technical selling around the USD/CAD pair.

On the flip side, if buyers resurface and spark a bullish reversal, initial resistance comes in at the 1.34899 level. The focus on further strength shifts toward the 1.35470 - 1.35537 region. Sustained strength above the barricade would pave the way for additional gains around the USD/CAD pair.