Nasdaq 100 Futures Index Trade Slightly Lower As Investors Gear Up for Corporate Earning Season

- Nas 100 futures edged slightly lower in the early Asian trading session ahead of key corporate earnings

- Cooling wholesale inflation plus an easing labor market cement market expectations of rate cuts

- Enphase (NASDAQ: ENPH) and Fastenal (NASDAQ: FAST) lead the list of top gainers and losers, respectively, in the Nas 100 index

- Investor focus now shifts to the first-quarter earnings season

Nasdaq 100 futures edged slightly lower on Friday during the early Asian session as investors looked to the start of the corporate earnings season while assessing the latest inflation and jobs data and their economic implications. As per press time, futures tied to the Nasdaq 100 have lost 0.11%/13.93 points to trade at 13064.60 while its counterpart U.S. 30 futures shed 0.1%/42 points to trade at 33973.0. The moves follow a winning day on Wall Street as better-than-expected economic data reports on Thursday fueled optimism that the Federal Reserve could be nearing the end of its aggressive interest rate hike cycle.

Following the positive reports, all three major U.S. stock indexes surged more than 1%, with interest rate sensitive mega caps including Apple Inc (NASDAQ: AAPL), Microsoft Corp (NASDAQ: MSFT) and Amazon.com (NASDAQ: AMZN) providing the most upside muscle and pushing the tech-heavy Nasdaq up nearly 2% to its biggest one-day percentage jump in almost a month. Data released Thursday before the bell showed a steeper-than-expected cooldown in producer prices for final demand in the U.S. after PPI data fell 0.5% MoM in March of 2023, the biggest decline since April of 2020, compared to forecasts of a flat reading. Year-on-year, producer prices increased 2.7%, the least since January 2021 and below expectations of 3%. The core rate eased to 3.4% as expected, but core prices went down 0.1%, beating forecasts of a 0.3% rise.

In other news, the number of Americans filing for benefits rose by 11,000 to 239,000 in the week ending April 8, overshooting market expectations of 232,000. It was the first increase in unemployment claims in three weeks, in line with a batch of data for March that pointed to the softening of the U.S. labor market.

The two data reports have strengthened current bets that the Federal Reserve could cut rates multiple times this year. The upbeat reports come on the heels of yet another better-than-expected inflation report which showed the annual inflation rate in the U.S. had slowed down for the ninth consecutive period to 5% in March 2023, the lowest since May of 2021 from 6% in February and below market forecasts of 5.2% hence cementing the likelihood of yet another 25 basis point rate hike after next month's Federal Open Market Committee policy meeting. Fed Funds futures traders have now seen pricing in a roughly one-in-three probability that the central bank will press the pause button and let the Fed Funds target rate stand in the 4.75% to 5.00% range, according to CME's FedWatch tool.

As we advance, investor focuses now shifts to first-quarter earnings season, which jumps into full swing on Friday when a trio of big banks, Citigroup (NYSE: CITI), JPMorgan Chase & Co (NYSE: JPM), Wells Fargo (NYSE: WFC) & Co report.

Top Gainers and Losers for the Day

Here are today's top NAS100 index movers, a week in which the index is set to close with modest gains.

Top Gainers

- Enphase (NASDAQ: ENPH): The energy technology company's shares jumped on Thursday after its analysts picked it as a catalyst call to buy the idea at Deutsche Bank. The analysts told investors in a note that the basis for the short-term investment idea follows weakness in the stock, which has been a "material underperformer YTD" down 24% vs a 20+% gain compared to the direct peer group. The company stock value is currently up 6.97%/13.66 points in pre-trading hours to trade at $209.69 per share.

- Netflix (NASDAQ: NFLX) Inc: The entertainment service company's jumped 4% on Thursday after Wells Fargo said it was bullish on the stock on expectations that the streaming giant will likely benefit from the rollout of its paid sharing program. The company stock value is currently up 4.58%/15.16 points in pre-trading hours to trade at $346.19 per share.

- Amazon.com (NASDAQ: AMZN) Inc: The software company shares jumped 3.47% on Thursday after Amazon CEO Andy Jassy announced in a letter to shareholders it would be launching its in-house A.I. model known as Titan as well as big updates to enhance the company's cloud services, an area in which Amazon is already a world leader. The company stock value is currently up 4.67%/4.57 points in pre-trading hours to trade at $102.40 per share.

Top Losers

- Fastenal (NASDAQ: FAST): The wholesale distribution company reported its First quarter earnings on Wednesday which were in line with estimates; however, the company noted that it was experiencing margin pressures, with gross margin contracting 90 basis points and the impact of product pricing on net sales increasing 290-320 basis points compared to the same period last year. The company stock value is currently down 0.42%/0.22 points in pre-trading hours to trade at $52.34 per share.

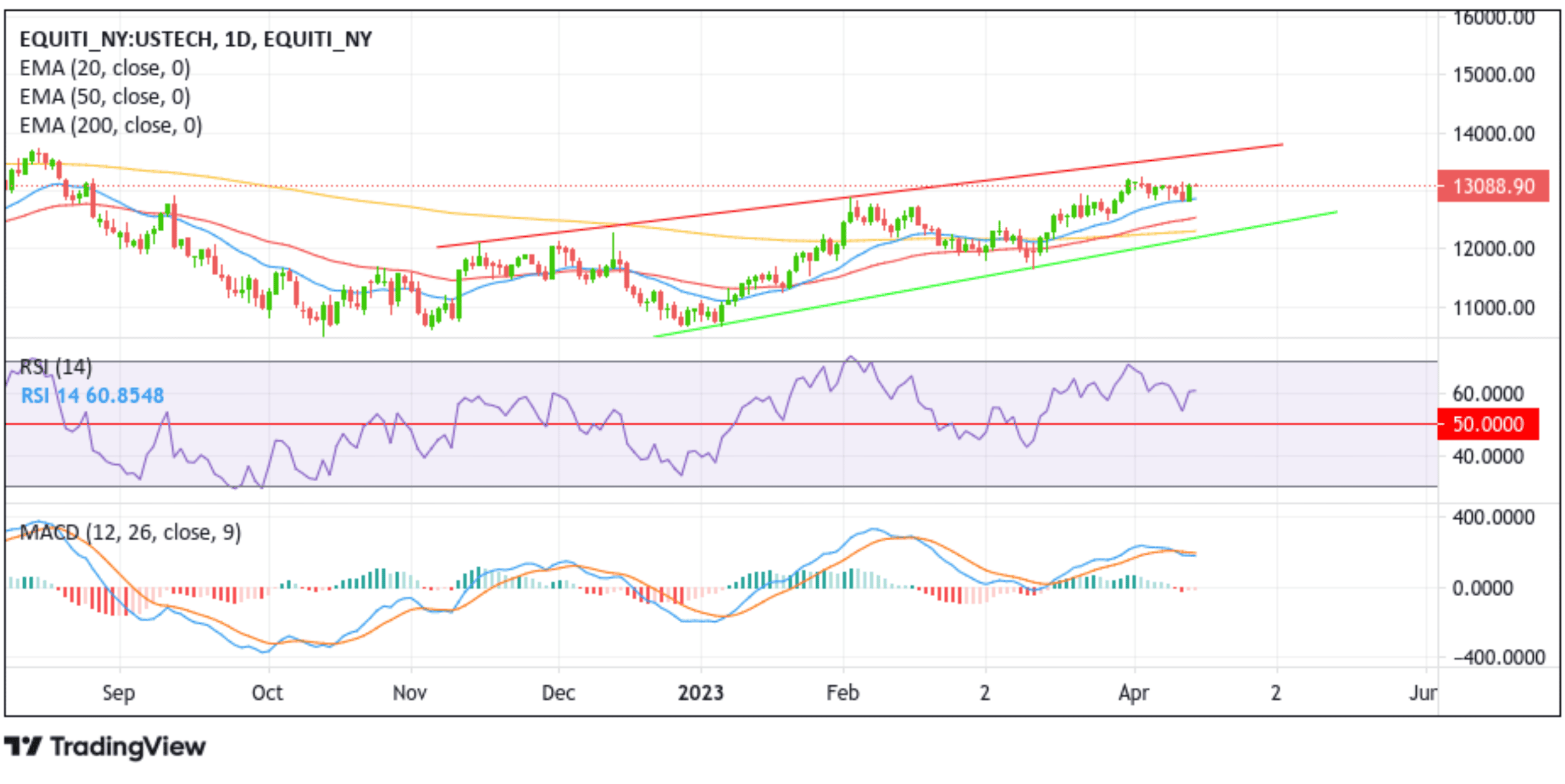

Technical Outlook: One-Day Nas100 Futures Price Chart

From a technical standpoint, the Nas100 futures price has been trading with a bullish bias within the ascending channel for the past three weeks. It is worth noting within the aforementioned period, the price has made several minor corrections followed by major impulsive moves. The current price action suggests that cost could make another little corrective move before another significant impulsive move. If that happens, the price has to drop to tag the 20 EMA (blue) support level at 12866.67, which coincides with the 50% Fibonacci retracement level to form a confluence area.

A four-hour candlestick close above the aforementioned confluence area should set the path for take-off for the price to retest the key resistance level plotted by an ascending trendline extending from November 15, 2022, swing high. We expect a new set of bullish buyers to heed the call, join the bullish momentum at this level, and help push the price up upon receiving confirmation from the technical oscillators, which is a very high chance, would send a BUY signal. Additionally, the acceptance of price above the technically strong 200 EMA (yellow) at 12166.84 level, followed by the 50 (red) and 200 (yellow) EMAs crossover at 12212.59 level, should make it easy for bullish traders to join the bullish bandwagon. That said, a break above the aforementioned resistance level (bullish price breakout) would negate any near-term bearish outlook and pave the way for aggressive technical buying.