US WTI Crude Oil Price Ticks Slightly Higher On Positive U.S Debt Talks, Settles Back Above $72.00 Per Barrel

- US WTI crude oil futures tick slightly higher on Tuesday and settles back above $72.00 per barrel

- Crude oil prices rebound modestly on Tuesday supported by the positive tone around Debt Ceiling Negotiations and high gasoline demand ahead of memorial day holiday

- Crude Oil prices face heavy headwinds stemming from a generally stronger U.S. dollar, suggesting the path of least resistance is to the downside

US WTI crude oil futures edged slightly higher on Tuesday during the early Asian session, supported by the positive tone in negotiations between Democratic President Joe Biden and top congressional Republican Kevin McCarthy on Monday on how far the U.S Government could raise its debt ceiling before the 1st June deadline. As per press time, US WTI futures were up 16 cents/0.22% settling at $72.22 after initially slipping in the previous session by 20 cents to close at $72.10 per barrel on Monday. Brent crude futures, on the other hand, were also up 17 cents/0.22% to settle at $76.14 per barrel.

Crude oil prices mark the second week of solid gains after jumping last week by over 2.6% after wildfires shut down large amounts of crude supply in Alberta, Canada. Additionally, crude oil prices seem to have subdued to the call by the International Energy Agency (IEA), meanwhile, warned of a looming oil shortage in the second half of the year when demand is expected to eclipse supply by almost 2 million barrels per day (bpd), the Paris-based agency said in its latest monthly report.

A more positive tone from the latest U.S. Debt ceiling negotiations between the White House and its Republican rivals in Congress on Monday supported the case of rising crude oil prices on Tuesday. According to a report by cnbc.com House Speaker Kevin McCarthy said he had a “productive” and “professional” meeting with President Joe Biden on how to raise the debt ceiling, but that the two did not reach a deal Monday. “I think the tone tonight was better than any other night we’ve had discussions,” McCarthy said outside the West Wing following the hour long meeting. McCarthy further added that both teams were going to “come back together and work through the night” on a compromise deal. “The president and I know the deadline, so I think we’re going to talk every day ... until we get this done.”

That said, crude oil prices were further supported by the higher demand, and prices for gasoline which drove sentiment in energy trading ahead of the upcoming May 29 Memorial Day holiday, which unofficially flags off U.S. summer road travel. Elsewhere, a U.S. Energy Information Administration (EIA) report last week showed US gasoline inventories fell by 1.381 million barrels in the week ending May 12th, 2023, following a 3.168 million drop the week before and compared with market consensus of a 1.06 million decline, data from the EIA Petroleum Status Report showed.

As we advance, oil traders look forward to the conclusion of the debt ceiling negotiations for further guidance on crude oil price movements. However, crude oil prices face heavy headwinds stemming from a generally strong US dollar amid firm market expectations of a hawkish Fed at the next monetary policy meeting. Apart from this, hawkish Fed rhetoric, signs of a potential recession in the U.S., sticky inflation, and more robust job growth remain supportive of the greenback, suggesting the path of least resistance is to the downside for crude oil prices.

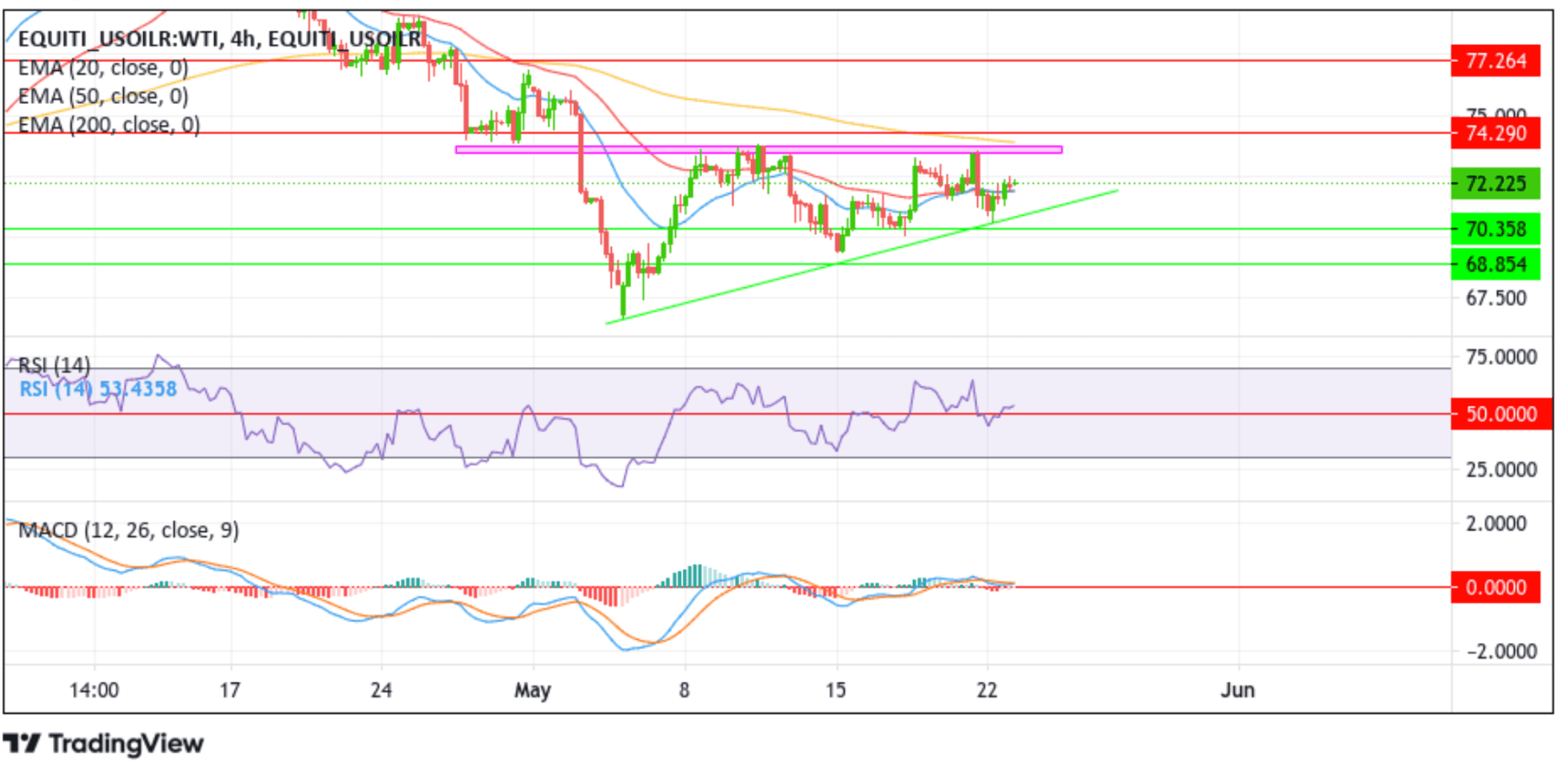

Technical Outlook: Four-Hours US WTI Crude Oil Futures Price Chart

From a technical perspective, oil traders seem to have heeded the call to place BUY trades after receiving confirmation from the technical oscillators on the chart (both RSI (14) and MACD are above their signal lines) plus price acceptance above the buyer congestion zone due to the 20 (blue) and 50 (red) days Exponential Moving Averages (EMA). That said, a further increase in buying pressure could uplift spot prices toward confronting the key supply zone ranging from $73.54-73.86 levels. A subsequent break above this zone would face immediate resistance at the technically strong 200 (yellow) day Exponential Moving Average at $73.91. A convincing move above this level could negate any near-term bearish outlook and act as a trigger for a northbound rally above the $74.290 resistance level toward confronting the next relevant resistance level at $77.264. A decisive flip of this resistance level into a support level could pave the way for further gains around US WTI Crude Oil Futures.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, the price will find support at the buyer congestion zone due to the 20 (blue) and 50 (red) days Exponential Moving Averages (EMA) at $71.88 and $71.82 levels respectively. If sidelined sellers join in from this buyer congestion zone, it will rejuvenate the bearish momentum, provoking an extended decline toward retesting the key support level plotted by an ascending trendline extending from the mid-May 2023 swing low. A breach of this support trendline (bearish price breakout) could pave the way for an extension of the bearish trajectory toward the $70.358 support level. A break below this support level could pave the way for a further downfall beyond the $70.00 psychological mark toward tagging the $68.854 support level.