NZD/USD Hovers In A Range Of 0.60637- 0.62085 Levels As NZ Trade Deficit Gets Largely Overshadowed

- NZD/USD stuck between 0.60637 - 0.62085 levels as the Kiwi Bulls triggered a bullish turnaround during the early Asian session

- Fresh US Dollar a Selling Offers Some Support to the Kiwi

- New Zealand Trade Deficit Widens in October

- Downbeat New Zealand Trade Balance Data largely overshadowed by the expectation of further rate hikes by the RBNZ

- A slew of major macroeconomic data from the US dockets is set to be released tomorrow, but the main attention remains on the RBNZ Interest Rate Decision

NZD/USD Pair has been oscillating in a narrow range of 0.60637 - 0.62085 since early last week as cautious investors await the Reserve Bank of New Zealand Interest Rate Decision to be released on Wednesday. That said, the cross met fresh demand on Tuesday during the early hours of the Asian session after attracting bullish bets to lift up spot prices from the previous day's YTD low. At the time of speaking, the pair is up 11 pips for the day and looks set to maintain its bid tone heading into the European session.

Fresh US Dollar a Selling Offers Some Support to the Kiwi

The US Dollar index (DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, fails to capitalize on the overnight bounce from a three-month low/ 105.401 level and meets fresh supply on Tuesday, which, in turn, offers some support to the risk-perceived Kiwi. The markets now seem convinced that the Federal Reserve (Fed) will hike interest rates at a slower pace in the coming months amid signs of easing inflationary pressures. The speculations were fueled by a surprise drop in US consumer inflation during October. Furthermore, last week's Tuesday's softer Producer Price Index (PPI) reinforces the peak inflation narrative and continues to weigh on the buck.

Despite the soft inflation data released last week, hawkish signals from several Fed officials last week suggested that the US central bank is still far from pausing its policy-tightening cycle and continues to act as a tailwind for the buck.

That said, further limiting the greenback is the modest rebound in the US treasury bond yields, with the ten treasury bond yields down 0.20 points/0.52% at 3.82% as of 05:12 (UTC+3). Apart from this, a goodish rebound in the US equities market further undermined the Safe-haven greenback.

New Zealand Trade Deficit Widens in October

According to Statistics New Zealand, New Zealand recorded a trade deficit of 21.29 NZD billion in October of 2022 versus 16.15 billion in the previous month. Goods exports rose $758 million (14 percent) to $6.1 billion in October 2022, compared with October 2021. Milk powder, butter, and Cheese was the most significant contributor to the rise, up $503 million (34 percent) to $2.0 billion. Goods imports rose $1.6 billion (24 percent) to $8.3 billion in October 20zz, compared with October 2021. Vehicles, parts, and accessories rose $323 million (37 percent) to $1.2 billion. Petroleum and products rose $289 million (44 percent) to $943 million.

That said, the Downbeat macro data was widely overshadowed by growing expectations of an aggressive rate increase by the Reserve Bank of New Zealand (RBNZ) in its Interest Rate Decision tomorrow. Following an inflation print of 7.2% in October, decreasing from 7.3% in September and beating the consensus of 6.6, inflation in the New Zealand remains entrenched above the Central Bank's 1.0-3.0% target band. Additionally, Food prices rose 0.8 percent in October 2022. After seasonal adjustment, they were up 1.8 percent. Compared to September 2022, meat, poultry, and fish prices rose 2.7 percent, while grocery food prices rose 1.8 percent (up 2.0 percent after seasonal adjustment). According to Statistics New Zealand, non-alcoholic beverage prices rose 2.0 percent, while restaurant meals and ready-to-eat food prices rose 1.0 percent. In its November Meeting, market participants now expect the New Zealand Central Bank to lift its official Cash rate by 75bps to 4.25%.

As we advance with the absence of any major economic moving data today, investors now look forward to the New Zealand docket featuring the release of the RBNZ Interest Rate Decision and the RBNX Rate Statement. Investors will further look for cues from the release of the US Building Permits data, the US Core Durable Goods Order (MOM) data for October, the US Initial Jobless Claims data, the US Manufacturing PMI data for (Nov), the US Services PMI data for (Nov), the Markit Composite PMI data for (Nov), the New Home sales data for (Oct) and the Michigan Consumer Sentiment data for (Nov). The reports would influence near-term USD sentiment and provide trading opportunities around the NZD/USD Pair.

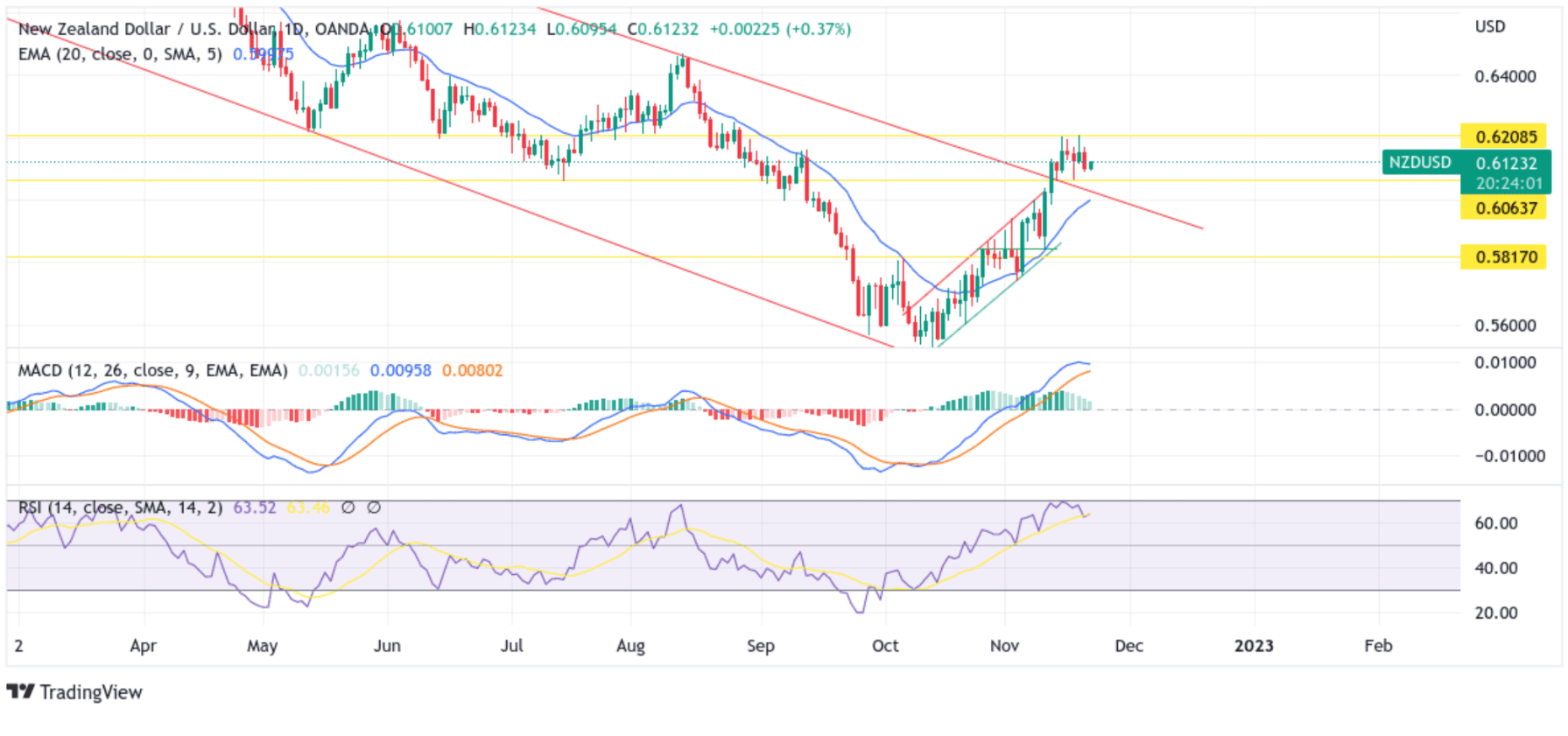

Technical Outlook: One-Day NZD/USD Price Chart

From a technical standstill using a One-day price chart, the price rebounded from the vicinity of 0.60966 level a few pips from the lower level of the oscillating range (0.60637 support level). Some follow-through buying would uplift spot prices to the upstream hurdle(upper limit of the oscillating field) at the 0.62085 resistance level. Sustained strength above this barricade would pave the way for aggressive technical buying around the NZD/USD pair.

All the technical oscillators are in positive territory. That said, the RSI (14) at 63.52 is on the verge of flashing overbought conditions with the Moving Average Convergence Divergence (MACD) crossover above the signal line, pointing to a bullish sign for price action this week.

On the flip side, if dip-sellers and tactical traders resurface and spark a bearish turnaround, initial resistance appears at the 0.61000 Psychological mark en route to the 0.60637 support level. If prices breach these floors, selling interest could gain momentum, creating the right conditions for a drop toward the upper trendline of the descending channel pattern plotted from the April 2022 swing high.