NZD/USD Extends Post- NFP Rally Amid China Relaxing Covid-19 Restrictions

- NZD/USD Cross attracted some buying on Monday to extend the bullish trajectory witnessed over the last eight weeks amid prevalent U.S. Dollar Selling

- The US NFP-Job Report came in Hotter-than-Anticipated

- CME's Fed Watch Tool is now pricing in a 75.8% probability the Fed will raise its benchmark interest rate by 25 - 50bps

- China's services sector contracted sharply in November; a private survey showed on Monday

NZD/USD pair prolonged its recent strong move-up witnessed since early last week and gained positive traction for the sixth day on Monday. The momentum lifted spot prices to near an eight-week high, around the 0.64266 - 0.64296 region during the first half of the Asian Session. The pair looks set to maintain its offered tone heading into the European session.

Rebounding treasury bond yields as investors look beyond the stronger than expected Non-Farm payrolls Job data saw the U.S. Dollar lose steam and weaken significantly on Post Nfp-report. The U.S. Dollar index (DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, was 0.23% down on Monday at 104.250 below the 16-week low touched earlier last week.

According to data from The U.S. Bureau of Labour Statistics, job growth was much better than expected in November despite the Federal Reserve's aggressive efforts to slow the labour market and tackle inflation.

Non-farm payrolls increased by 263,000 in November while the unemployment rate was 3.7%, the Labor Department reported on Friday. Economists surveyed by Dow Jones had been looking for an increase of 200,000 in the payrolls number and 3.7% in the jobless rate.

The monthly gain was a slight decrease from October's upwardly revised 284,000. A broader measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons edged lower to 6.7%.

In another blow to the Fed's anti-inflation efforts, average hourly earnings jumped 0.6% for the month, double the Dow Jones estimate. Wages were up 5.1% on a year-over-year basis, also well above the 4.6% expectation.

Following the report, The Dow Jones Industrial Average fell as much as 350 points after the announcement on worries the hot jobs data could make the Fed even more aggressive. At the same time, the U.S. Dollar index surged more than 1.00% to trade at 105.567 before losing steam and falling again by 1.00% to close at 104.688.

"To have 263,000 jobs added even after policy rates have been raised by some [375] basis points is no joke," said Seema Shah, chief global strategist at Principal Asset Management. "The labor market is hot, hot, hot, heaping pressure on the Fed to continue raising policy rates."

It is worth remembering that mid-last week, Fed Chairman Jerome Powell said the job gains are "far in excess of the pace needed to accommodate population growth over time" and said wage pressures contribute to inflation.

"To be clear, strong wage growth is a good thing. But for wage growth to be sustainable, it needs to be consistent with 2 percent inflation," he said during a speech Wednesday in Washington, D.C.

"CME's Fed Watch Tool is now pricing in a 75.8% probability the Fed will raise its benchmark interest rate by 25 - 50bps, lifting its overall fed funds rate to 4.25% - 4.50%. That's likely to be followed by a few more increases in 2023 before the central bank can pause to see how its policy moves are impacting the economy, according to current market pricing and statements from several central bank officials.

Lifting the Kiwi was the news of China relaxing its strict covid rules late last week, loosening testing and quarantine rules in the wake of nationwide protests calling for an end to lockdowns and greater political freedoms.

In the wake of the unrest across China, several cities have begun loosening Covid restrictions, such as moving away from daily mass testing requirements, a tedious mainstay of life under Beijing's stringent zero-Covid policy.

As of Friday, the southwestern metropolis of Chengdu will no longer require a recent negative test result to enter public places or ride the metro, instead only requiring a green health code confirming they have not travelled to a "high risk" area.

In other news, China's services sector contracted sharply in November; a private survey showed on Monday, as rapidly rising COVID-19 cases invited more lockdown measures and further disrupted economic activity.

The Caixin Services purchasing managers index (PMI) read fell to 46.7 in November from 48.4 in the prior month, missing expectations of 48.0. The index marked its third straight month below 50, indicating a pronounced contraction in the sector. The data comes in line with an official survey released last week, highlighting deepening economic cracks in China due to its COVID-related restrictions.

Manufacturing activity also shrank substantially over the past three months, with the Caixin composite PMI tumbling to 4 in November, showing an extended decline in business activity. The mixed macro data was seen as a key factor that underpinned the Kiwi and exerted upward pressure on the NZD/USD pair.

As we advance, investors look forward to the U.S. economic docket featuring the release of the ISM Non-Manufacturing PMI (Nov) and Services PMI (Nov), which are expected to land at 53.1 and 46.1 from 54.4 and 46.1 readings in October. The reports would influence the near-term USD Price dynamics. This, in turn, should assist traders in determining the next leg of a directional move for the NZD/USD Pair.

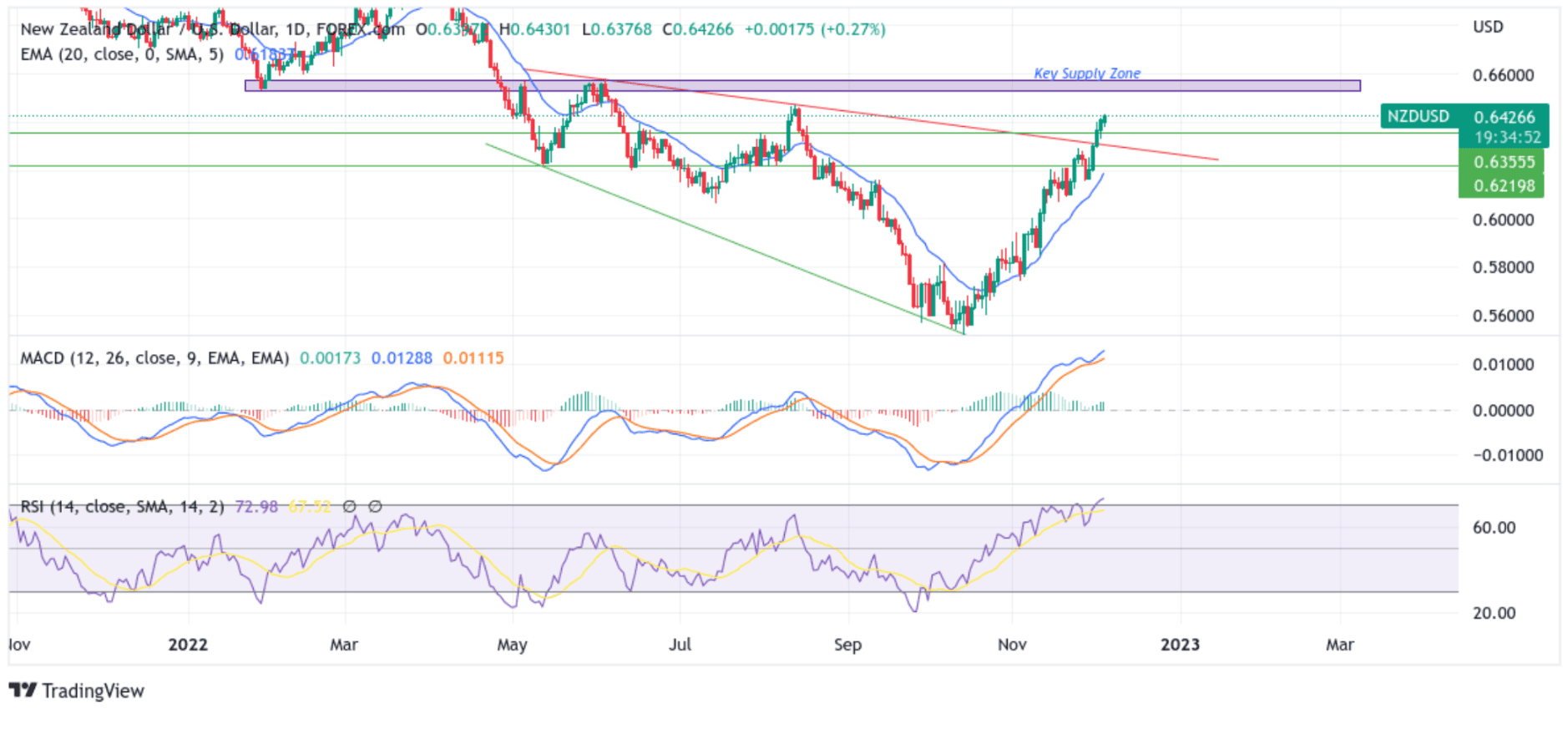

Technical Outlook: One-Day NZD/USD Price Chart

From a technical standstill using a one-day price chart, spot prices are now looking to extend the momentum further beyond the downward-sloping trend-line of the Falling Wedge Chart pattern extending from the June 2022 swing high. Last week Thursday's early Asian Session's strong move beyond the 0.63140 level, confirmed a solid bullish breakout and supported prospects for additional gains. Some follow-through buying would lift spot prices towards an immediate hurdle(supply zone) ranging from 0.65267 - 0.65759 levels. The aforementioned zone would act as a barricade against the pair against any further uptick however sustained strength beyond would be seen as a new trigger for bulls to continue pushing the price up and pave the way for additional gains.

All the technical oscillators on the daily chart are in positive territory, with the RSI (14) at 72.95, far above the signal line, and flashing extreme overbought conditions, which warrant some caution ahead of this week's key events/data risks. The Moving Average Convergence Divergence (MACD) Crossover is above the signal line, pointing to a bullish sign for price action this week.

On the flip side, any meaningful pullback now finds some support at the 0.63555 support level. If sellers manage to breach this floor, downside pressure could accelerate, paving the way for a drop towards the downward-sloping trend-line of the Falling Wedge Chart pattern now turned support level. Sustained weakness below this level (bearish price breakout ) would negate any near-term and pave the way for aggressive technical selling around the NZD/USD Pair.