US TECH 100 Falls Below 12000.00 Mark As Investors Await Key Job Data

- Nasdaq 100 Futures extended their downside rally and fell below 12000.00 Psychological Mark

- A Modest USD uptick undermines the US TECH 100 Futures

- Feds Preferred Inflation Gauge(PCE) Lands below markets expectations

- Elon Musk Makes Peace with Apple

- Okta Inc Stock Jumps 15% After better than expected revenue report while G-III Apparel Stock Crashes Over 40% On Looming License Expiration, Outlook Cut

- The U.S. Bureau of Labor Statistics will announce today the Non-farm Payroll Report

Nasdaq 100 Futures extended their downside rally on Friday as investors continued to assess the global economic outlook ahead of the November Non-farm payrolls job data release.

As per press time, the tech-heavy Nasdaq 100 futures index is down over 0.3% to trade at 11983.29 amid renewed U.S. Dollar Demand across the board. The U.S. Dollar index(DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, was slightly up on Friday to trade at 104.876 as of 04:30 (UTC+3) despite falling the previous day to a 16-week low after data showed that U.S. consumer spending increased solidly in October, while inflation moderated, adding to expectations that the Federal Reserve is closer to reaching a peak in interest rates.

The core personal consumption expenditures price index, a gauge that excludes food and energy and is favored by the Federal Reserve, rose 0.2% for the month and was up 5% from a year ago according to data by the American Bureau of Economic Analysis. The monthly increase was below the 0.3% Dow Jones estimate, while the annual gain was in line. Including food and energy, headline PCE was up 0.3% monthly and 6% yearly. The monthly increase was the same as in September, while the annual gain was a step down from the 6.3% pace.

Additionally, In another key report, a widely followed gauge of manufacturing activity posted its lowest reading in two and a half years for November.

The ISM Manufacturing Index registered a reading of 49%, representing the level of businesses reporting expansion for the period. The reading was 1.2 percentage points below October and the lowest since May 2020, in the early days of the Covid pandemic.

In other economic news Thursday, the Labor Department reported that weekly jobless claims totalled 225,000, a decline of 16,000 from the previous week and below the 235,000 estimates. The firmer prints of the weekly jobless claims at a pivotal time for the Fed, amid an interest rate-hiking campaign in an effort to bring down inflation. That said, the mixed Macroeconomic U.S. data were key factors that underpinned the greenback and exerted downward pressure on the US TECH 100 index.

In a Speech on Wednesday at a Brookings Institution, Fed Chair Jerome Powell said that rate hikes could be slowed as soon as December.

"It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down," he explained at an event by the Brookings Institution.

Following Powell's dovish remarks, the NASDAQ 100 index futures rallied over 4.54% to close at 12085.60. At the same time, its counterpart Dow Jones (US30) jumped over 700 points which saw the blue-chip gauge meet the technical definition of an exit from a bear market, rising 20.4% from its September 30 closing low. Mped over 700 points which saw the blue-chip gauge meet the technical definition of an exit from a bear market, rising 20.4% from its September 30 Closing low. Additionally, the USD weakened and fell as low as 104.82 against a basket of currencies, the weakest since August 11.

Elon Musk Makes Peace with Apple

Elon Musk has said he has "resolved" a misunderstanding with Apple(NASDAQ: AAPL) over his claim that Twitter was being threatened with removal from the iPhone maker's app store.

The new Twitter owner tweeted on Wednesday that he had had a "good conversation" with Apple CEO Tim Cook and that Apple had "never considered" removing the social media platform from its app store.

On Monday, Musk used his Twitter account to claim that Apple had broached removing Twitter for unspecified reasons. The Tesla CEO then indicated it was related to moderation standards at Twitter, while he launched a series of tweets criticizing Apple including its policy of taking a cut of up to 30% from app sales.

Okta Inc Stock Jumps 15% After better than expected revenue report

Okta Inc(NASDAQ: OKTA). executives on Wednesday said they would report an adjusted profit in the fourth quarter and, in a surprise, predicted profitability for the next fiscal year, trumping profit concerns stemming from recent sales-operation issues.

Okta, +26.46% for the fourth quarter, guided for adjusted earnings of 9 cents to 10 cents a share on revenue of $488 million to $490 million. Analysts, on average, were expecting an adjusted loss of 12 cents a share on sales of $488.3 million, according to FactSet.

In a surprise announcement during the conference call, Chief Financial Officer Brett Tighe also revealed a full forecast for fiscal 2024. He said Okta executives are aiming for adjusted profits for the entire year on revenue of $2.13 billion to $2.15 billion.

G-III Apparel Stock Crashes Over 40% On Looming License Expiration, Outlook Cut

G-III Apparel Group (NASDAQ: GIII) shares fell over 40% after Thursday's open after its Q3 earnings results included warnings on licenses and a pared full-year forecast.

The apparel manufacturer reported a mixed third quarter, missing the bottom line but exceeding sales expectations. Yet, management noted that coming quarters would continue under pressure from inflation, consumer belt-tightening, supply chain issues, and foreign currency impacts.

For the full fiscal-year 2023, the company anticipates between $2.90 and $3.00 in earnings per share, down sharply from the prior guidance of $3.60 to $3.70 and well below the consensus estimate of $3.59. Adjusted EBITDA forecasts were also trimmed from $265M to $270M and $318M to $323M.

The company warned that licensing deals with PVH Corp. (PVH) will expire in the coming years. The Calvin Klein and Tommy Hilfiger brands are key brands licensed by G-III. While licensing deals were renewed through 2025 and 2027, PVH made clear its intention to bring the brands in-house after those staggered expirations.

In the Nasdaq 100 Index, the best-performing sector so far is Information technology, led by Splunk Inc(NASDAQ: SPLK), which rose 17.78%/13.81 points to trade at $91.49 per share. Zscaler Inc(NASDAQ: Z.S.) came in second after it gained 8.28%/11.05 points to trade at $144.50 per share. Synopsys Inc(NASDAQ: SNPS) closed the list after it added 5.39%/18.30 points to trade at $357.84 per share. On the other hand, the biggest losers included Costco Wholesale Corporation(NASDAQ: COST), which lost 6.56%/35.39 points to trade at $503.86 per share. Micron(NASDAQ: M.U.) also declined 3.75%/2.16 points to trade at $55.49 per share. Marvel Tech Inc(NASDAQ: MRVL) closed the list of top losers after it shed 2.41%/1.12 points to trade at $45.40 per share.

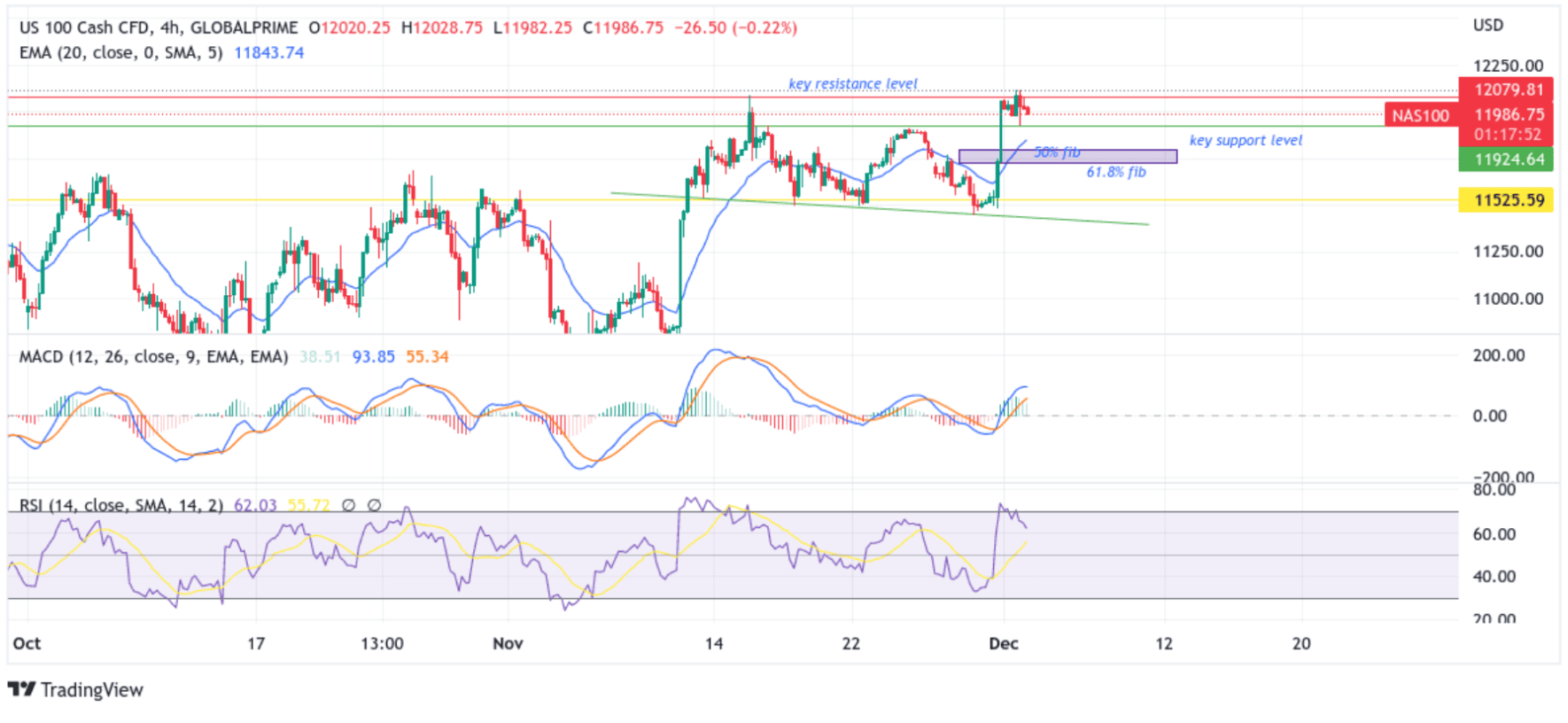

Technical Outlook: Four-Hours US TECH 100 Price Chart

From a technical standstill, using a four-hour price chart, the price extended the modest rebound from the vicinity of the 12116.04 level after an earlier pullback attempt to drive prices up and retest the 12079.81 key resistance level. Some follow-through selling would drag spot prices lower towards the 11924.64 support level. Suppose sellers manage to breach this floor in the coming sessions. In that case, downside momentum could pick up the pace, paving the way towards the 50% and 61.8% Fibonacci retracement levels of the late November 2022 Rally at 11797.34 and 11719.48 levels, respectively. Sustained weakness below the aforementioned fib levels would negate any near-term bullish outlook and pave the way for aggressive technical selling around the Nasdaq 100 futures index.

All the technical oscillators are in positive territory, with the RSI (14) at 62.03 portraying a downward shift after flashing overbought conditions in the previous day; a move below the middle line (50) would act as a sell Signal. The Moving average convergence divergence (MACD) crossover is above the signal line. Still, a move below the signal line would be a signal for bears to enter the market (it is prudent to wait first for a break below the 11924.64 support level before positioning for any further downward move).

On the flip side, if dip-buyers and technical traders jump in and spark a bullish turnaround, initial resistance appears at the 12030.06 level en route to the 12079.81 key resistance level. If the price Pierces the aforementioned barriers, buying interest could gain momentum, creating the right conditions for an advance toward the 12200.00 Psychological Mark.