Gold Price Extends Corrective Move Above Mid-1800.00s Amid Renewed USD Supply, A Slew Of US Data Awaited

- XAU/USD Pair attracted some buying on Thursday to extend the corrective rebound above the mid-1800.00s

- Better-than-expected U.S. economic data raise worries the Federal Reserve could hike interest rates further

- Current Price Actions suggest investors have overlooked key economic data pointing to further rate hikes

- Investors look forward to a slew of U.S. data scheduled for release during the early North-American session

Gold witnessed some buying during the early Asian session on Thursday and extended the late-evening corrective rebound from the vicinity of the 1830.581 level or a three-week low. As per press time, gold is up 0.3% for the day to trade at $1841.525 and looks set to maintain its bid tone in the coming sessions.

The Non-Yielding yellow metal has been on a bearish trajectory for the better part of this month. It dropped to its lowest in over a month on Wednesday, weighed down by a stronger dollar as better-than-expected U.S. economic data raised worries the Federal Reserve could hike interest rates further. This, in turn, is seen as a key factor driving flows away from the U.S. Dollar-denominated Gold price.

Markets seem convinced Federal Reserve (Fed) will stick to its hawkish stance after an inflation report on Tuesday showed that inflation is still a nuisance in the U.S. Following the report, Futures tied to the Fed's policy rate stuck to bets on Tuesday that the U.S. central bank will raise interest rates at least twice. The futures contracts pricing showed traders are betting heavily that the Fed will raise rates by a quarter of a percentage point at each of its meetings in March and May.

Further weighing down on gold prices was the better-than-expected U.S. Retail sales data, which smashed expectations despite rising inflation. Advance retail sales for the month increased by 3%, compared with expectations for a rise of 1.9%, the Commerce Department reported Wednesday. According to the report, sales rose 2.3%, excluding autos, which is not adjusted for inflation. The ex-autos estimate was for a gain of 0.9%. Retail sales increased 6.4% yearly, precisely in line with the consumer price index move reported Tuesday.

Additionally, a series of hawkish comments by influential FOMC Members triggered the treasury bond yields to rise higher, which in turn was seen benefitting the greenback and exerting downward pressure on the XAU/USD pair. Richmond Fed President Thomas Barkin told Bloomberg TV that inflation is normalizing, but it's coming down slowly. Barkin added that if it persists at levels well above the target, the Fed will have to raise rates to a higher level than previously anticipated. On Tuesday, separately, Dallas Fed President Lorie Logan cautioned that the central bank might need to push higher rates higher than expected, mainly if super-core remains anchored in the 4% - 5% range. "We must remain prepared to continue rate increases for a longer period than previously anticipated if such a path is necessary to respond to changes in the economic outlook or to offset any undesired easing in conditions," she said during a speech in Prairie View, Texas.

That said, the latest yield curve inversion also adds worries about the possibility of a recession in the U.S. which in turn undermines the precious yellow metal. The prevalent cautious mood also tempered investors' appetite for perceived riskier assets. This was evident from a weaker tone around the equity markets, which drove some flows toward the safe-haven greenback.

Despite the negative factors, the current price action suggests investors have decided to overlook all the data pointing to a likelihood of interest rates remaining elevated. This key factor led to some U.S. Dollar deep selling on Thursday. The U.S. Dollar index (DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, was down 0.22% at $103.662 as of 06:00 (UTC+3), extending its modest rebound from the $104.110 level/ monthly high touched on Wednesday.

As we advance, the main focus now turns to the US PPI data report for January, seen higher at 0.4% from -0.4% in the previous month. Excluding food and energy, the Core PPI for January is also higher at 0.3% from 0.1 % in December. Investors will further look for clues from the release of the Building permits preliminary data seen higher at 1.350M, up from 1.337M the previous month. Investors will also look into the Initial jobless claims data report for directional impetus, which is seen higher at 200K, up from 196K in January.

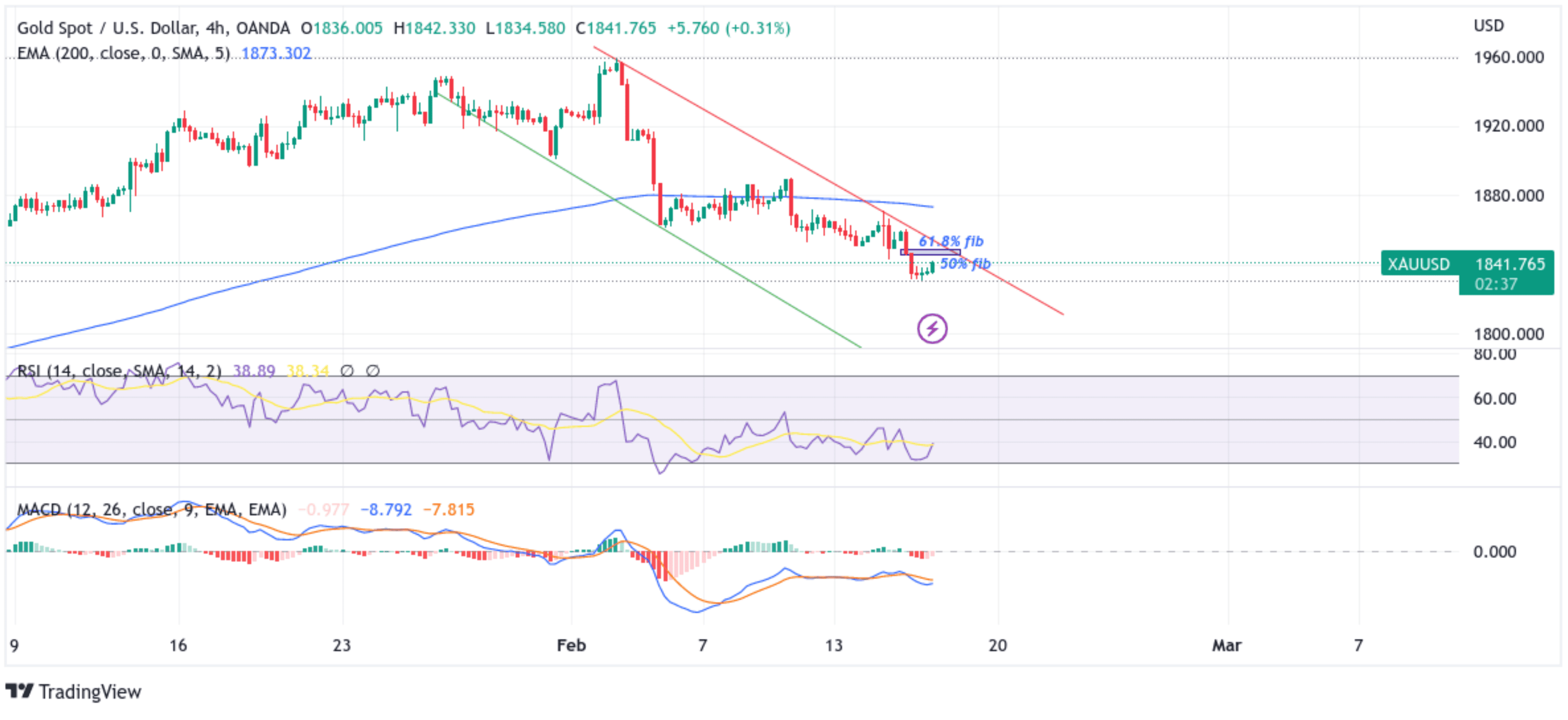

Technical Outlook: Four-Hour Gold Price Chart

From a technical standstill, gold has been moving on a bearish channel since the beginning of this month. The current price action seems to suggest the recent bullish uptick is still a selling opportunity as prices face an immediate hurdle plotted by the 61.8% and 50% Fibonacci Retracement levels at 1845.298 and 1849.052 levels, respectively, followed by a key resistance level plotted by the upper trendline of the descending channel pattern extending from early February 2023 swings high. The bearish outlook is also supported by the acceptance of a price below the technically strong 200 Exponential moving average (EMA) at the 1873.226 level.

Furthermore, oscillators on the four-hour chart hold deep in the bearish territory and are still far from being in the oversold zone. Hence suggesting the corrective move risks chances of fizzling out and further continuation of the overall bearish trajectory is on the cards.

On the flip side, if dip if dip-sellers and tactical traders jump in and trigger a bearish reversal, the price will first find support at the 1838.772 level en route to the 1835.625 key support level. This is followed by the July and September monthly highs at the 1834.231 level. If sellers manage to breach these floors, the XAU/USD could turn vulnerable and accelerate the downfall toward the 1800.00 psychological mark. Sustained weakness below this barricade would pave the way for additional losses around the XAU/USD pair.