GBP/USD Bulls Aim To Extend Recovery Above 1.12000 Mark, FOMC Minutes In Focus

- GBP/USD cross witnessed some buying on Wednesday to extend recovery from the weekly low

- Declining Treasury bond yields force the U.S. Dollar to trim its intraday gains which in turn offers support to the Cable

- U.K. Manufacturing Contraction deepens at the end of 2022

- Investors look ahead towards the release of a slew of major economic news data, but attention remains on the release of the FOMC Meeting Minutes

GBP/USD pair attracted some deep buying in the vicinity of the 1.19663 level and staged a modest intraday recovery from the weekly low touched on Tuesday. The pair was last seen trading 25 pips up for the day and looked set to maintain its bid tone heading into the European Session.

Retreating treasury bond yields amid uncertainty surrounding the economic outlook for the New Year prompted some technical U.S. dollar selling on Wednesday, lending support to the risk-perceived Cable. Additionally, the positive tone surrounding the equity market was another factor that undermined the greenback and exerted upward pressure on the GBP/USD pair.

At the time of speaking, the U.S. Dollar Index, which measures the greenback against a basket of six other currencies, was down 0.10% at 104.475, extending its modest rebound from the weekly high touched on Tuesday amid a risk-off market mood ahead of a crucial day featuring the release of the U.S. JOLTs Job Openings data, US ISM Manufacturing PMI data and the FOMC December Meeting Minutes.

Intact Investors are now concerned that the Federal Reserve may have to implement stricter measures to control persistent inflation. According to a note from Bloomberg analyst Bill Dudley, the Fed will need to focus on three main issues in CY2023: the tight labor market and low unemployment rate leading to wage inflation, the potential for underinvestment in the oil and gas sector due to Russia's control over major oil supply potentially causing further inflation, and the projected budget deficit of approximately 5% of GDP in 2023.

Shifting to the U.K. docket, a market data report on Tuesday showed Manufacturing activity in the U.K. continued to contract intensely towards the end of 2022. The S&P Global/CIPS UK Manufacturing PMI was revised slightly higher to 45.3 in December 2022 from a preliminary estimate of 44.7 compared with November's figure of 46.5. Still, the latest reading was the lowest for 31 months and one of the weakest since mid-2009, excluding the series lows registered during the first pandemic lockdown.

That said, Cable got some intraday lift after a German inflation data report showed inflation in Germany slowed down last month more than the market consensus. The annual consumer price inflation in Germany fell to 8.6% in December 2022, from 10% reported in November and below the market consensus of 9.1%, a preliminary estimate showed. It was the lowest rate since August, as a government's initiative to lower household natural gas bills came into effect. Berlin announced a one-off federal payment in December to cover the monthly instalment for gas and heat for all households and small-to-medium-sized businesses.

As we advance, investors look forward towards the U.S. docket featuring the release of U.S. JOLTs Job Openings data for November 2022, seen lower at 10 Million job vacancies down from 10.334 Million Job Vacancies in early November. Investors will look for cues from the release of the ISM Manufacturing PMI data report for January, seen lower at 48.5, down from 49.0 in December. The focus, however, remains on the release of last month's FOMC meeting minutes that will shed light on the Central bank's thinking around interest rates and inflation. The reports would influence the U.S. Dollar sentiment and provide trading opportunities around the GBP/USD pair.

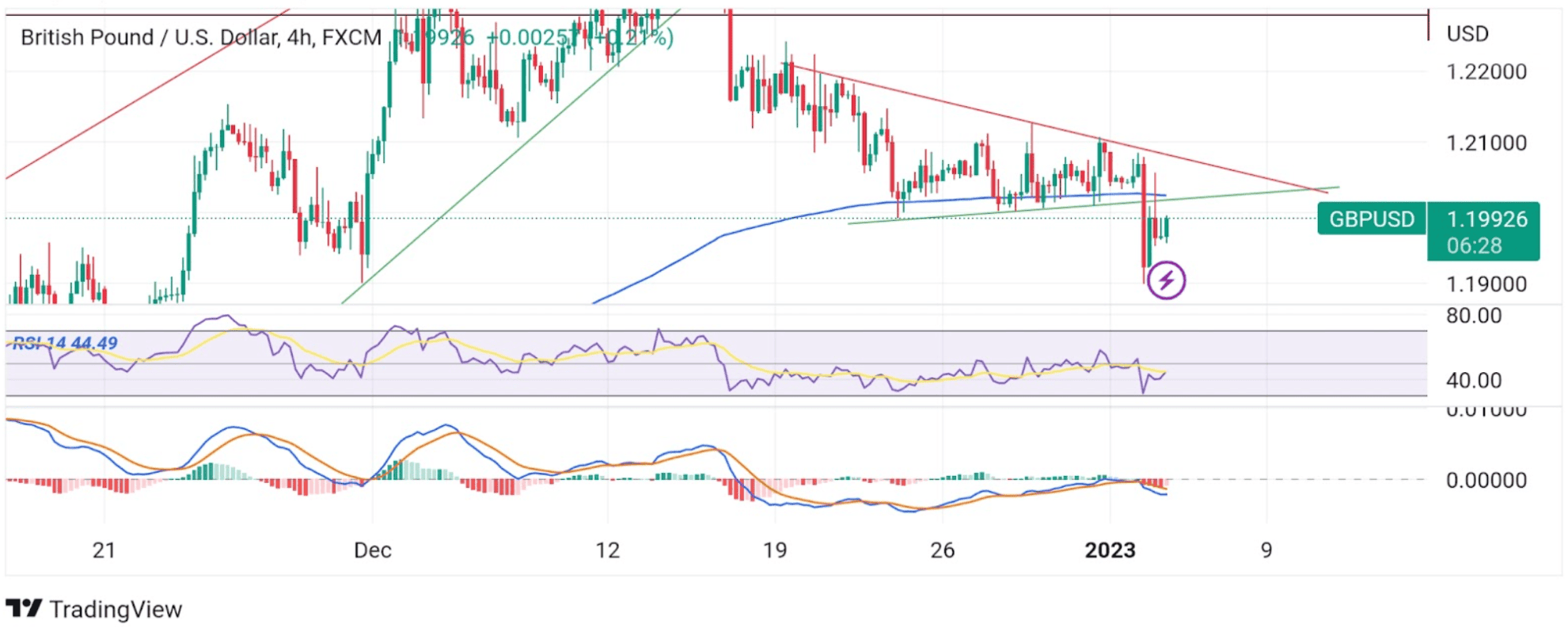

Technical Outlook: Four-Hours GBP/USD Price Chart

From a technical standstill, the price looks to extend its recovery from the weekly low touched on Tuesday but faces an immediate hurdle now turned key resistance level plotted by an ascending trendline of a bearish Pennant Chart Pattern extending from 22nd December 2022 Lower-lows. Sustained strength above the aforementioned hurdle (bullish price breakout) would pave the way for additional gains surrounding the GBP/USD. The Bullish uptick could then accelerate but would need acceptance above the strong 200 Exponential Moving Average (EMA) at 1.20238. If the price Pierces this barrier, it would negate any-near term bearish outlook and pave the way for aggressive technical buying around the GBP/USD pair.

All the technical oscillators on the chart are in negative territory, with the RSI (14) at 44.49 below the signal line portraying a bearish filter. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is also below the signal line, validates the downside bias, and further points to a bearish sign for price action this week.

On the flip side, any meaningful pullback now finds some support at the 1.19407 support level en route to the 1.19000 round-figure mark. The aforementioned support levels, if broken decisively, will negate the positive outlook and prompt aggressive technical selling around the pair. The downward trajectory could then accelerate toward the next relevant support (demand zone), ranging from 1.18292 - 1.18556 levels.