FTSE 100 Index Flat-Lined On The Aftermath Of British PM Lizz Truss's Resignation

- FTSE 100 Index was down over 20 basis points on Friday to trade at the 6909.95 level

- U.K. Prime Minister Liz Truss resigned Thursday following a failed tax-cutting budget

- There is still plenty of caution toward the U.K. as an investment destination

- Fresnillo Plc and Polymetal International PLc stocks lead in the top gainer and top Loser category

UK 100 Index was flat-lined at 6909.93 in the aftermath of the latest news coming from the U.K. of Lizz Truss's resignation as the U.K. Prime Minister. That said, the index has been oscillating in a narrow range of 6888.31- 6955.83 levels since Wednesday as investors' fears of continuing the political turmoil in the U.K. would continue worsening.

U.K. Prime Minister Liz Truss resigned Thursday following a failed tax-cutting budget that rocked financial markets and led to a revolt within her own Conservative Party. Truss was in office for just 44 days, making her the shortest-serving prime minister in British history. For 10 days of her premiership, government business was paused following the death of Queen Elizabeth II. She said in a statement outside 10 Downing Street, "We set out a vision for a low-tax, high-growth economy that would take advantage of the freedoms of Brexit."

"I recognize though, given the situation, I cannot deliver the mandate on which I was elected by the Conservative Party. I have therefore spoken to His Majesty the King to announce that I am resigning as leader of the Conservative Party." The party is now due to complete a leadership election within the next week, much faster than this summer's two-month period. Graham Brady, the Conservative politician in charge of leadership votes and reshuffles, told reporters he was now looking at how the vote could include Conservative M.P.s and the wider party members. Following Truss's resignation, the pound was up 0.6% on the day against the dollar at 5:00 p.m U.K. Time., trading at $1.128. It remains at the level it was on Sept. 22, before Truss' market-moving budget. Gilt yields initially fell but were later flat on the day as speculation began over who would succeed Truss, with a new leader set to be in post in a week.

Market Moves

While markets initially greeted the news slightly positively, Joachim Klement at broker Liberum said, "what markets are looking for now are a stable government and competent leadership. "We think the developments put us on a path to remove the risk premium present in gilts since the mini-budget on Sept. 23."

Victoria Scholar, head of investment at Interactive Investor, said: "There is still plenty of caution towards the U.K. as an investment destination given the ongoing political uncertainty, the growing risk of recession, and Britain's persistent inflation problem with price levels hovering at 40-year highs. "Focus among investors now shifts to the leadership election, the Chancellor's medium-term fiscal plan on Oct. 31, and the Bank of England's rate decision in early November." The U.K.'s FTSE 100 closed 0.27% higher following Lizz Truss's resignation, with all major bourses in positive territory. Technology stocks led gains with a 2% rise, with oil and gas up 1.45%. As per the press time, Fresnillo PLc is the top gainer in the FTSE 100 index, registering a 3.96% /27.20 gain to trade 713.60, followed by Lloyds Banking Group PLc stock registering a 3.53%/1.43 gain to trade at 42.05. Closing the list of top gainers was Ocado Group PLc stock gaining 3.33%/15.90 to trade at 493.90.

On the other end of the stick was Polymetal International PLc stock leading the list of top losers, having shed 3.81%/-8.00 to trade at 202.00. Second on the list was Vodacom Group Plc stock which registered a 2.41%/-2.44 loss to trade at 98.72. Closing the list of top losers was Bunzl Plc stock which shed 2.09%/-58.0 to trade at 2720.0.

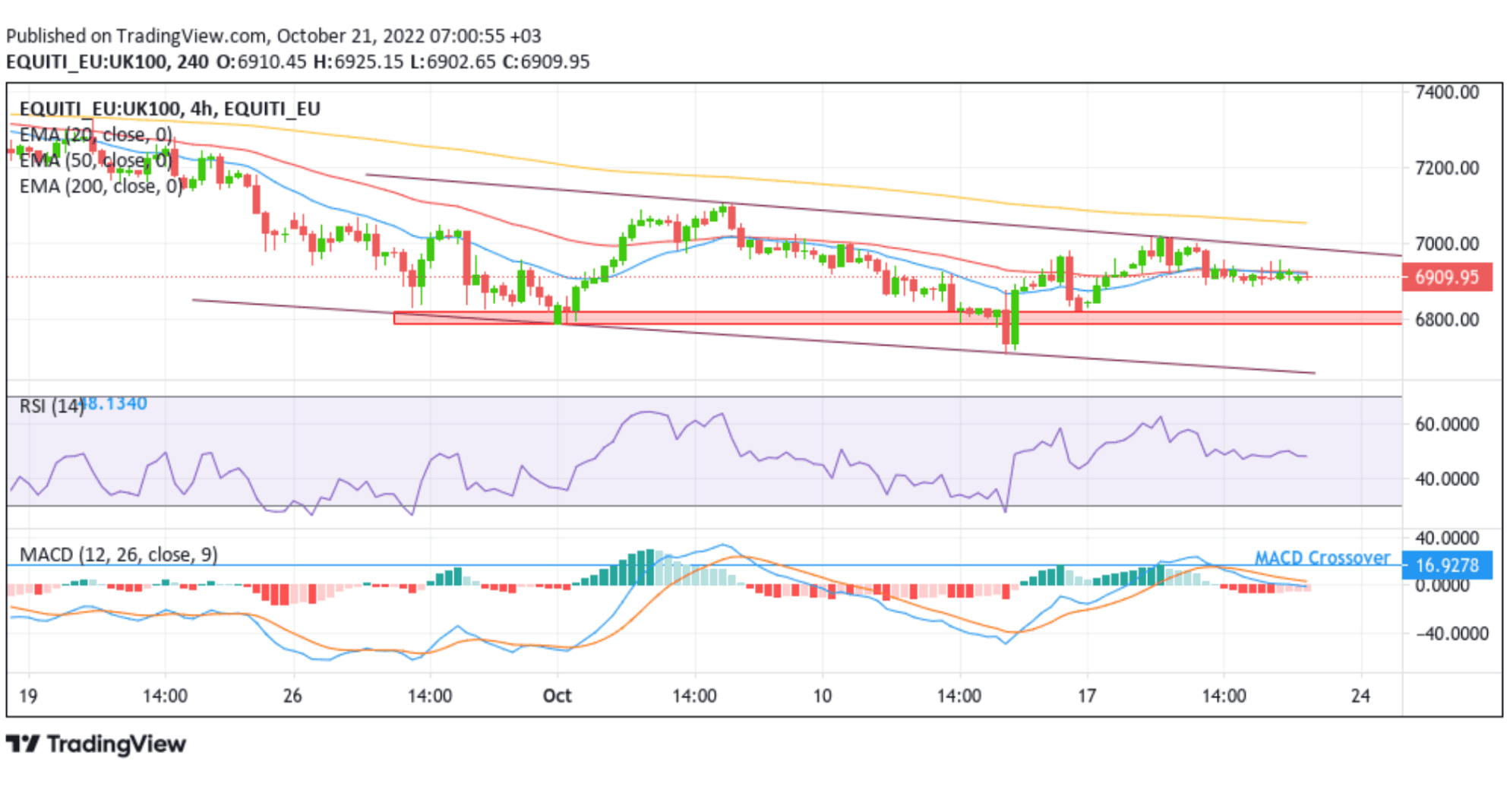

Technical Outlook: FTSE 100 INdex Four-Hour Price Chart

From a technical perspective, using a four-hour price chart, the price is confined to a narrow range of 1888.31- 6955.83 levels. If buyers break above the aforementioned range, the focus will shift toward the upper trendline of the descending channel pattern plotted from Oct. 6 2022, swing high. The key resistance level would act as a barricade against the pair on any further uptick however, a convincing break above this hurdle would negate any near-term bearish outlook and pave the way for aggressive technical buying.

All the technical oscillators are in negative territory. That said, the Relative Strength Index(RSI) has displayed a bearish range of 42.00 - 44.00 from the previous 51.25 - 46.81range. The Moving Average Convergence Divergence (MACD) crossover at 15.92 is on the verge of moving below the signal line, pointing to a bearish sign for price action this week. Additionally, The 20 and 50 Exponential Moving Average(EMA) crossover at the 6929.23 level adds credence to the downside bias.

On the flip side, any meaningful pullback now seems to find some resistance at the 6888.31 support level. That said, if sellers manage to break below this floor, it would negate any near-term bullish outlook and pave the way for technical selling. The attention would now turn toward the demand zone ranging from 6788.32 - 6820.59 levels. A convincing break above the aforementioned zone would pave the way for aggressive technical selling.