USD/JPY Flirts With 150.00 Psychological Mark, BOJ Intervention Overshadowed By Further FED Rate Hike Bets

- USD/JPY Cross attracts some buying on Thursday to extend the bullish trajectory and flirt with the 150.00 psychological mark

- Growing Concerns of a recession in the US trigger the Treasury bond yields to rise sharply, in turn leading to some USD deep buying

- FX analysts at Nordea Bank observe more upside potential on the pair

- Bank of Japan Announces Emergency Bond Buying Operations

- Us Initial Jobless Claims report and Existing Home Sales report to be released later today

USD/JPY pair prolonged its recent strong move over the past one and a half weeks and gained positive traction for the twelfth successive day on Thursday. Per the press, the shared currency is up over ten pips daily and trading at 149.924, just below the 150.00 psychological mark. The pair looks set to maintain its offered tone heading into the European session.

Elevated treasury bond yields and a softer risk tone supported the greenback as investors continued to weigh the prospect of larger rate hikes from the Federal Reserve at subsequent meetings. Additionally, hawkish remarks by several Top FED officials after hotter-than-expected inflation data turned out to be a critical factor that weighed on the USD/JPY pair and offered some support to the safe-haven greenback, which was up 0.05% to 113.04, after a nearly 1% surge overnight. This, in turn, was seen as another key factor that triggered treasury bond yields to rise on Wednesday. As such, The yield on the 10-year Treasury climbed to 4.127%, up by about 13 basis points after hovering just below the key 4% level for much of Tuesday. It rose as high as 4.136% during the session, its highest level since July 23, 2008. On the other hand, The policy-sensitive 2-year Treasury yield increased by 11 basis points to 4.55%. This resultant widening of the US-Japan rate differential continues to weigh on the Yen and offers support to the USD/JPY pair amid a more dovish stance adopted by the Bank of Japan. This, along with the prevalent risk-on mood, favors bullish traders.

FX analysts at Nordea Bank observe more upside potential on the pair and point out a potential 160.00 target: "With a continued worsening of rate differentials, we see USD/JPY trading as high as 160 at times, even with the intervention from the Japanese government." What will stop the weakening of the JPY is a shift in monetary policy from the Bank of Japan or a 180-degree shift from all other G10 central banks. That said, Concerns about a recession have been growing louder among investors after a slew of US economic data pointed to the difficult path the FED has to tread to bring inflation down, which remains at an all-time high. That said, CME's FED watch tool is now pricing a 95.9% probability of a 75bps -100bps rate hike during FED's next monetary policy meeting on November 2.

Lifting the USD was the firmer US Building permits data which showed the number of new building permits issued by the government last month had increased by 1.564 million compared to the previous month at 1.542 Million.

Bank of Japan Announces Emergency Bond Buying Operations

The Central Bank of Japan announced it would hold emergency bond-buying operations early on Thursday morning, offering to buy some $667 million in government debt, a move designed to put a floor under bond prices," Reuters. Following BOJ intervention, Japanese Prime Minister Fumio Kishida said on Thursday that the government would consider the downside risks of overseas economies in deciding on the size of spending in an upcoming stimulus package. "Overseas economic developments are likely to work against Japan's economy next year. We will take this into account in considering the size of the spending package," added Japan PM Kishida while speaking at the parliament. That said, The BOJ's Intervention and Kishida's remarks were overshadowed to a greater extent by the growing expectations of aggressive fed rate hike bets.

Going forward, The Yen has been hammered this year by the widening difference between the US and Japanese interest rates. Some investors have bet Japan will need to ditch its extended policy of 'yield curve control', or YCC, - where it buys massive amounts of bonds to keep the yield on 10-year debt at around 0%. The yield on the benchmark 10-year JGB briefly touched 0.255% for the second straight day, above the BOJ's policy ceiling, before retreating to 0.25%, within the band.

As we advance, investors will look for fresh cues from the release of the Initial Jobless Claims data, which is expected to show the number of people who filed for unemployment insurance for the first time during the past week to have increased by 230,000 up from 228,000 people a week earlier. Additionally, traders will look for further cues from the US Existing Home Sales data report, which is expected to show a decrease in the number of houses sold last month by 4.7 Million compared to an increase of 4.8 Million in August. Investors will further look for cues from the speech of US FOMC Member Michelle Bowman on future monetary policy decisions by the FED. His speech and the US bond yields will influence the USD price dynamics and provide some impetus to gold. Apart from this, traders will take cues from the broader market risk sentiment to grab short-term opportunities around the XAU/USD Pair.

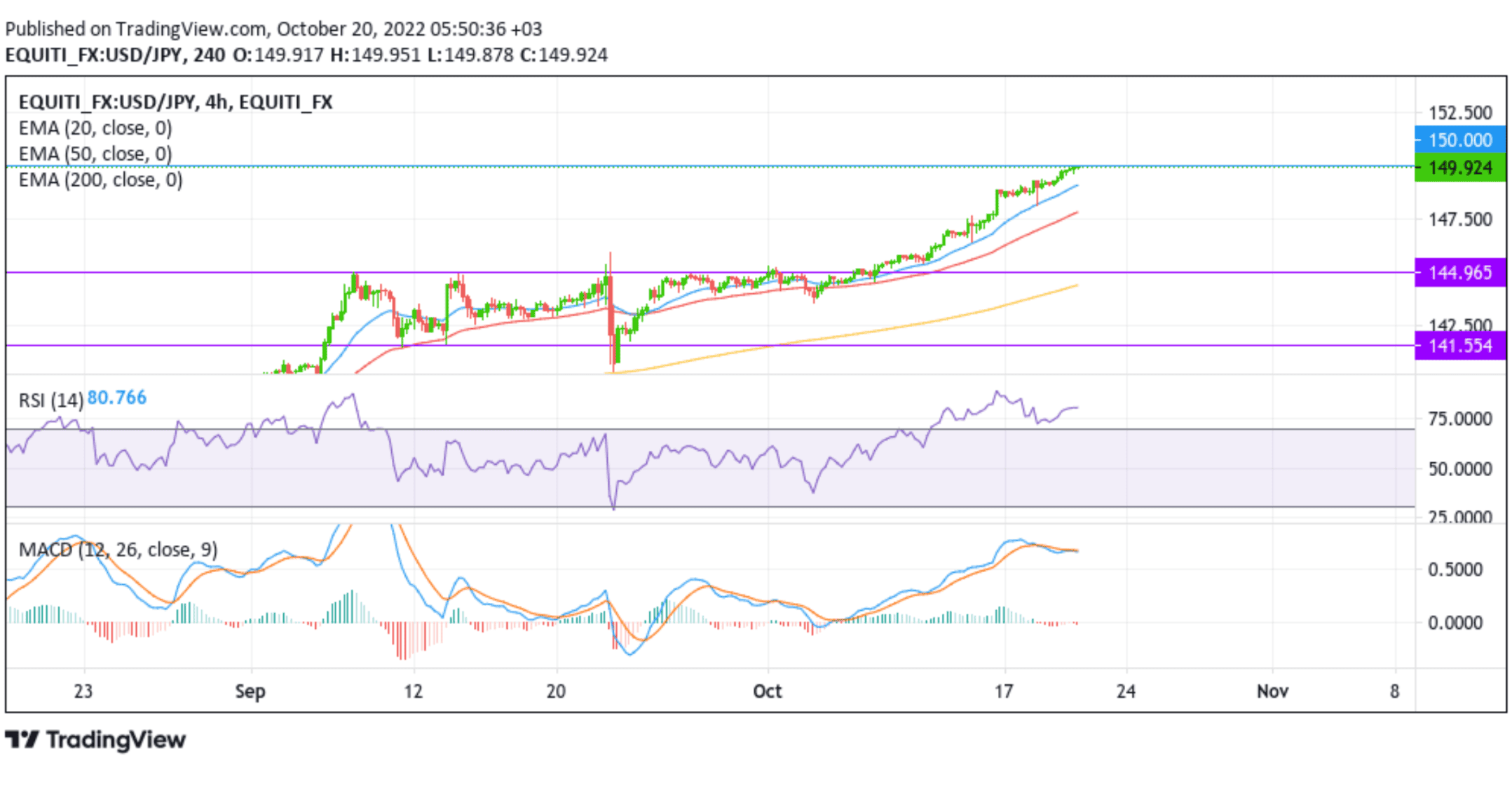

USD/JPY Technical Outlook: Four-Hour Price Chart

From a technical perspective, using a four-hour price chart, the price is treading near the 150.00 psychological mark, and a move beyond the aforementioned mark is just a matter of when than how but if the USD Bulls manage to break above this level, the subsequent uptick would expose the Yen to more tragic losses.

All the technical oscillators are in positive territory. That said, the Relative Strength Index(RSI) at 80.766 is in bullish territory and flashing extreme overbought conditions, warranting caution to traders against submitting aggressive bullish bets. The impending Moving Average Convergence Divergence (MACD) crossover is moving above the signal line, pointing to a bullish sign for price action this week. Additionally, The 20 and 50 Exponential Moving Average(EMA) crossover at the 143.58 level adds credence to the upside bias.