USD/JPY Rises Modestly Above 148.200 Mark As BoJ Retains Its Ultra-Loose Policy, BoJ Core CPI Data Eyed

Key Takeaways:

- The USD/JPY cross rose modestly above the 148.200 mark in reaction to BoJ's decision

- The Bank of Japan decided to hold its rates steady during the January MPM

- The divergence in monetary policy adoption between the Fed and BoJ is set to continue to undermine the Yen further

- A combination of factors continues to underpin the buck, which helps exert upward pressure on the USD/JPY cross

- Markets eye the release of the BoJ Core CPI data for further USD/JPY directional impetus

On Tuesday, the USD/JPY pair witnessed some buying during the mid-Asian session in a mild reaction to the Bank of Japan's latest monetary policy decision. Nevertheless, the pair has extended the modest bounce from the vicinity of the $147.639 level touched on Monday and is currently trading at 148.209, posting a 0.08% daily gain.

The Bank of Japan (BoJ) announced earlier today that it kept its key short-term policy interest rate unchanged at -0.1% and that of 10-year bond yields at around 0% in its meeting of 2024 by unanimous vote, as widely expected.

The accompanying monetary policy statement showed that the bank pledged to continue with quantitative and qualitative monetary easing (QQE) with yield curve control, aiming to achieve the price stability target as long as necessary to maintain that target stably.

The immediate market implications following the BoJ decision saw the yen slide by as much as 0.21% against the buck to trade at $148.544 before paring gains and moving lower to trade below the $148.300 mark as of press time. The 10-year Japanese Treasury bond yields declined slightly following the release before reducing losses and increasing to trade above 0.635%.

To a greater extent, the BoJ's monetary policy stance contrasts with the market expectations of the Federal Reserve, in which the Fed is expected to prolong its hawkish stance into the year's second quarter.

Markets seem convinced that the Fed will leave rates unchanged during the first two monetary policy meetings of the year (March and May) and start cutting rates during the third quarter of 2024.

This comes after markets saw influential FOMC members push back the idea of early rate cuts last week, warning that despite progress in tackling inflation, markets have gotten ahead of themselves regarding expectations for spring rate cuts.

Furthermore, a string of robust U.S. data released last week further helped push back the idea of early rate cuts and continue to act as a tailwind to the USD/JPY cross.

That said, the divergence in monetary policy adoption between the Federal Reserve (Fed) and the Bank of Japan (BoJ) continues to undermine the Yen and suggests the path of least resistance for the USD/JPY pair is to the upside.

As we advance, investors look forward to releasing the BoJ Core CPI data, which is expected to show that the annual inflation rate, excluding food and energy, rose slightly to 2.8% in January from 2.7% the previous month. The main focus, however, remains on the release of the U.S. quarter-four GDP data report and the Fed's preferred inflation gauge, popularly known as the core PCE price index data report, on Thursday and Friday, respectively.

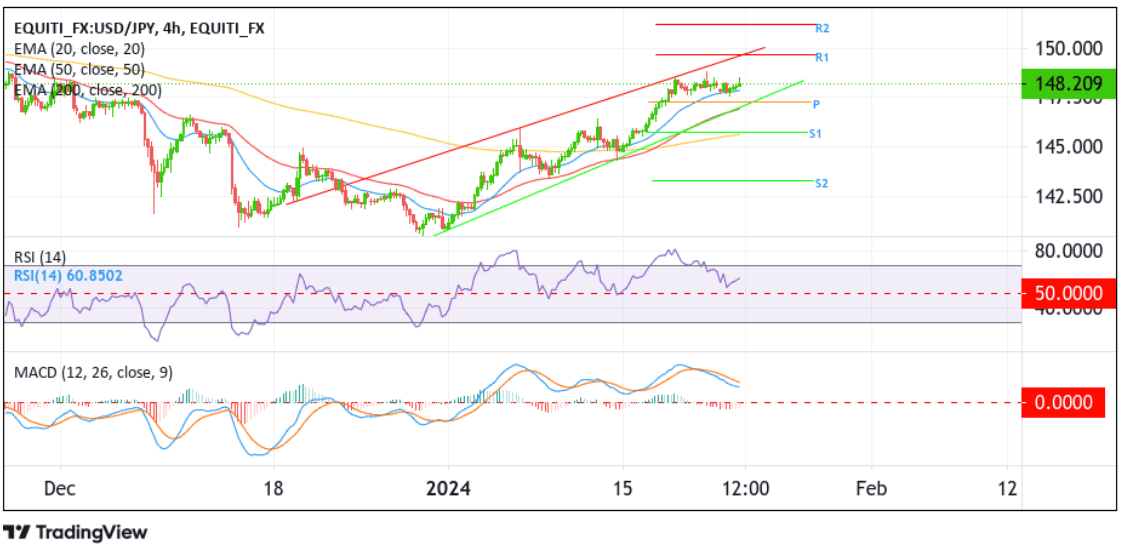

Technical Outlook: Four-Hour USD/JPY Price Chart

From a technical standpoint, looking at the broader picture, USD/JPY has been trading within a familiar territory for the last week or so with no clear sign of direction.

However, the 148.533 - 147.625 region has supported spot prices and should now be a pivotal point. Meanwhile, technical oscillators on the chart hold deep in bullish territory, suggesting continuing the bearish price action this week. Thus, the case for an eventual break above the 148.533 level is supported.

Sustained strength above the aforementioned level in the coming sessions would act as a fresh trigger for bulls to submit new bids and pave the way for a rise toward the key resistance level plotted by an ascending trendline extending from the mid-December 2023 swing to higher highs. A break above this level would reaffirm the bullish thesis and pave the way toward the 149.700 level (R1), followed by the 150.000 round mark.

On the flip side, immediate support is pegged at the 147.625 region. A decisive move below this level could see the pair drop towards the key pivot level (p) at 147.269. A convincing move below this level, followed by a break below the key support level plotted by an upward ascending trendline extending from the late-December 2023 swing lower lows, will pave the way for an accelerated decline toward the 145.736 level (S1), which sits directly above the technically strong 200-day (yellow) EMA level at 145.667. A convincing move below these barriers will turn the USD/JPY vulnerable to a further drop toward the 143.305 level (S2), and in extreme bearish cases, the USD/JPY could extend a leg down toward the 140.244 level.