USD/JPY Clings To PBOC's Rate Cut Decision, Weakens By 0.15% Ahead Of U.S. CPI Data And Fed Decision

📌USD/JPY drops by as much as 0.15%, weighed down by a combination of factors

📌PBOC trims its short-term lending rate, consequently weakening the Yen

📌Further U.S. Dollar uptick seems elusive amid Fed rate hike path uncertainty; this should cap the downside for the USD/JPY pair

📌Markets await the release of U.S. CPI data later today; the main focus remains on Fed's decision tomorrow

USD/JPY cross-met fresh supply during the mid-Asian session following an earlier uptick to the 139.668 - 139.638 region on Tuesday and seems to have snapped a two-day winning streak. This marks the third day of a gloomy day in the previous seven, and as of now, the shared currency looks set to maintain its bid tone heading into the European session.

The Japanese Yen weakened on Tuesday during the mid-Asian session in reaction to the People's Bank of China's decision to trim its short-term lending rate, its first such move in 10 months. The single currency particularly weakened by as much as 0.15% following the decision after tracking the rate-sensitive Chinese yuan, which dipped by as much as 0.2%, falling to an over six-month low. Further contributing to the sentiment around the yen were the dovish comments by Bank of Japan (BoJ) Deputy Governor Masazumi Wakatabe, who ruled out the possibility of any changes in the central bank's monetary policy stance later this week. Additionally, the Yen continues to be weighed down by weaker-than-expected PPI data, which showed producer prices in Japan rose 5.1% year-on-year in May 2023, slowing for the fifth straight month to their lowest level in nearly two years amid easing global inflationary pressures. May's figure also followed a revised 5.9% gain in April and came below a 5.5% growth expectation. Every month, producer prices dropped 0.7%, turning negative for the first time since February.

This, combined with a fresh leg-up in Treasury bond yields amid the risk-averse, further contributes to the sentiment around the USD/JPY. The rising yields could be attributed to the modest U.S. dollar rebound, a key factor that helped cap the upside for the USD/JPY pair. However, further U.S. dollar uptick seems elusive amid uncertainty concerning the Fed's rate hike path. The bets for a Fed pause in rate hikes have risen recently following a fresh batch of disappointing U.S. macro data that showed initial jobless claims reached their highest level since October 2021, indicating a potentially softening labor market that could stalk the Fed to skip hiking rates this week. Apart from this, the dovish rhetoric from several Fed officials in recent weeks has further reinforced bets that the Fed could pause its rate hiking cycle this week. That said, markets also seem convinced that the Fed will pause its rate hiking cycle this week, as CME's Fedwatch tool shows Fed fund futures traders have priced in a nearly 82% chance that the Fed will pause rate hikes this week and maintain its Fed fund target rate at 5.00%-5.25%.

As we advance, the Fed's policy outlook will influence U.S. dollar dynamics and provide a directional impetus for the USD/JPY pair. Apart from this, the BOJ monetary policy meeting on Thursday will influence the Yen's dynamics and help determine the next leg of a directional move for the USD/JPY pair. In the meantime, investors look forward to today's U.S. CPI data which is expected to show that U.S. inflation grew at a slower pace in May than the prior month and ultimately show that inflation pressures in the U.S. are gradually slowing down. But the reading is still expected to be twice as much as the Fed's annual target range of 2%.

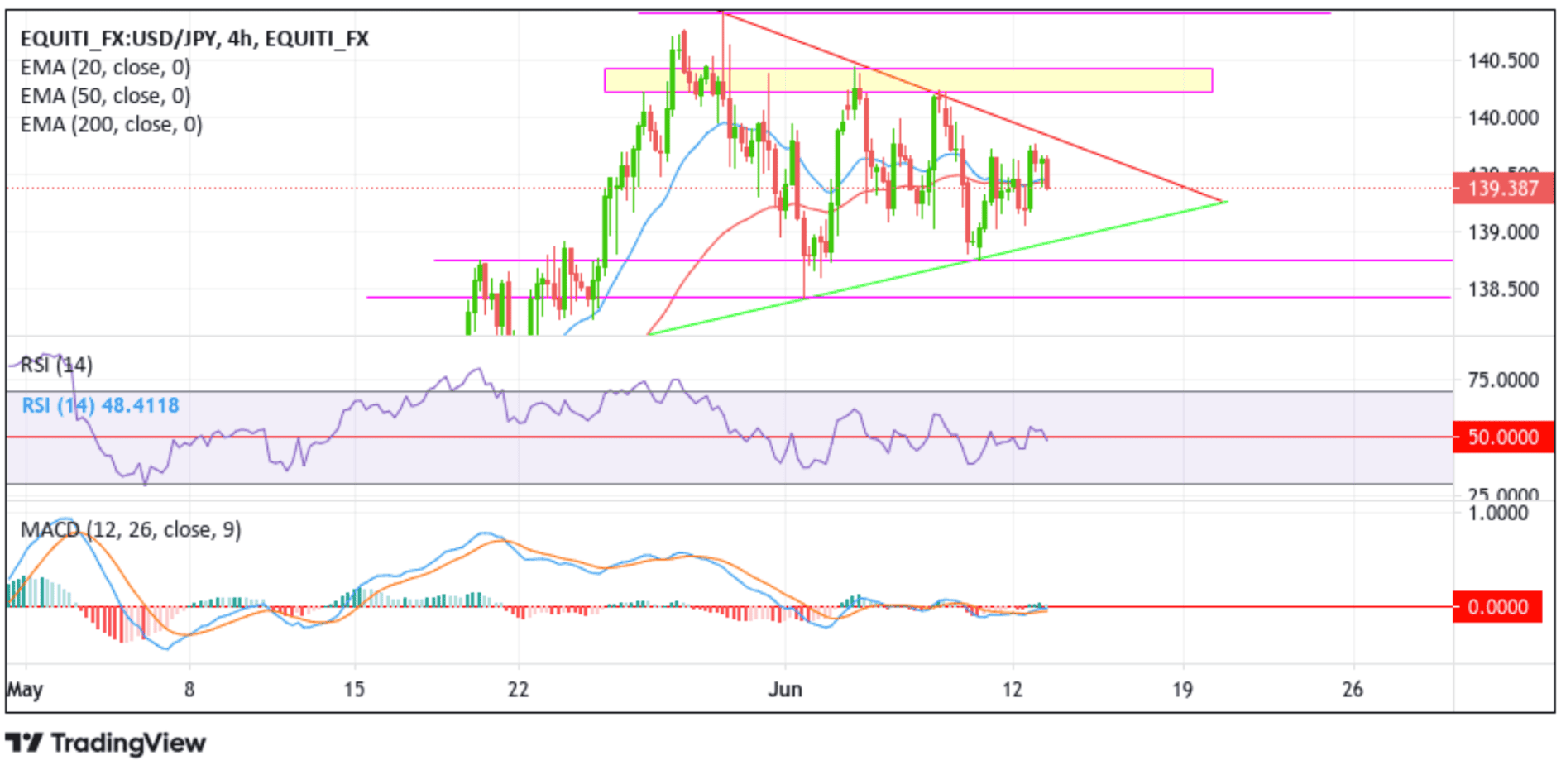

Technical Outlook: Four-Hour's USD/JPY Price Chart

From a technical perspective, the pair's earlier move in the session below the buyer congestion zone due to the 20 (blue) and 50 (red) days Exponential Moving Averages (EMA) at 139.465 and 139.432 levels, respectively, support the case for further downside moves. A subsequent downfall will cause the USD/JPY pair price to retest the lower limit of the bullish symmetrical triangle chart pattern. If sellers manage to breach this floor, downside pressure could accelerate, paving the way for a drop below the immediate support at 138.743 toward the 138.419 support level. A decisive flip of this support level into a resistance level could pave the way for a further decline toward the 138.000 psychological mark and, in highly bearish cases, confront the technically strong 200-day EMA at the 137.712 level.

On the flip side, the upper limit of the bullish symmetrical triangle chart pattern now acts as an immediate hurdle, above which a bout of short-covering has the potential to lift the pair towards the supply zone ranging from 140.434 - 140.219 levels. Sustained strength above this zone could see the USD/JPY accelerate its ascent toward May 2023 swings high at 140.915 level.